Last updated: July 30, 2025

Introduction

Ampicillin, a broad-spectrum penicillin antibiotic introduced in the 1960s, remains a vital component in combating bacterial infections. Despite the advent of newer antibiotics, ampicillin’s efficacy, safety profile, and cost-effectiveness sustain its relevance, especially in developing markets. This analysis evaluates the current market landscape for ampicillin, examines factors influencing its demand and supply, and presents price projections over the next five years.

Market Overview

Global Market Dynamics

The global antibiotic market was valued at approximately USD 52 billion in 2022, with penicillin derivatives constituting a significant segment. Ampicillin's share remains substantial owing to its broad-spectrum activity and affordability, especially in low- to middle-income countries (LMICs). The increasing prevalence of bacterial infections such as respiratory tract infections, urinary tract infections, and meningitis sustains demand for ampicillin [1].

Key Geographic Markets

-

North America and Europe: Market growth is steady, driven by established healthcare infrastructure, antimicrobial stewardship, and patent expirations allowing generics to dominate.

-

Asia-Pacific: The fastest-growing region, propelled by rising infection rates, increasing healthcare access, and government initiatives to improve infectious disease management.

-

Latin America and Africa: Growing demand with expanding healthcare access and endemic infections creating persistent need.

Competitive Landscape

Ampicillin’s production is dominated by major generic pharmaceutical manufacturers, with several producing both oral and injectable formulations. Patent expirations of related antibiotics have facilitated increased market entry and volume sales of ampicillin generics.

Factors Influencing Market and Price Trends

Supply Chain Considerations

-

Manufacturing Complexity: Amplified by stringent regulatory standards in the US and EU, affecting production costs.

-

Raw Material Costs: Penicillin G and protected intermediates influence pricing. Fluctuations in these raw materials impact final prices.

-

Regulatory Environment: Different approval timelines and standards affect market entry and pricing strategies.

Demand Drivers

-

Infectious Disease Burden: Rise in bacterial infections supports sustained demand.

-

Antibiotic Stewardship: Shift towards narrow-spectrum antibiotics in developed nations may temper growth but maintain baseline demand globally.

-

Affordability and Accessibility: Protonated by the availability of generics; price-sensitive markets favor low-cost ampicillin formulations.

Competitive Pressures

-

Emergence of new antibiotics with broader spectra and fewer resistance issues could impact ampicillin’s market share.

-

Increasing antimicrobial resistance (AMR) necessitates combination therapies or alternative treatments, potentially constraining growth.

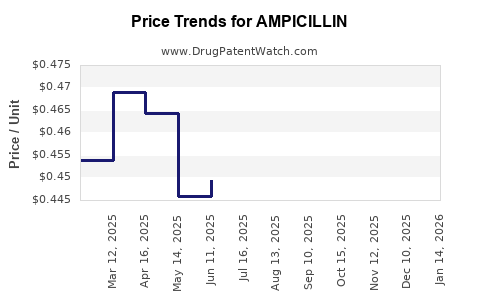

Price Analysis and Historical Trends

Historical Pricing Data

-

Wholesale Prices: In the US, a standard 500 mg capsule historically cost around USD 0.05–0.10 per dose in the generic market, with injectable formulations costing approximately USD 0.20–0.50 per vial [2].

-

Global Variations: In LMICs, the retail price can be as low as USD 0.02 per tablet, making it highly accessible.

Factors Contributing to Price Fluctuations

-

Patent Expirations: Facilitates increased competition, driving prices downward.

-

Regulatory Approvals: Streamlining approvals accelerates market access, influencing supply and pricing.

-

Raw Material Costs: Fluctuations cause periodic price shifts.

Future Price Projections (2023–2028)

Given current dynamics, the following projections are offered:

-

Stable to Slightly Decreasing Prices in Developed Markets: Due to generic competition and mature markets, price declines of approximately 2–4% annually are anticipated.

-

Potential Price Stabilization or Mild Increases in Emerging Markets: Driven by raw material costs, regulatory hurdles, and supply chain limitations, with expected annual increases of 1–2% in some regions.

-

Impact of Antimicrobial Resistance: Increasing resistance may lead to reduced efficacy, prompting clinicians to prescribe higher doses or combination therapies, which may temporarily elevate costs.

-

Influence of Policy and Stewardship: Global antimicrobial stewardship initiatives could temper overuse, potentially influencing demand and prices modestly.

Market Opportunities and Risks

Opportunities

-

Expansion into new markets due to increased demand for cost-effective antibiotics.

-

Development of stable, formulation-specific generics optimized for mass distribution.

-

Strategic partnerships with governments and NGOs to facilitate access.

Risks

-

Accelerated adoption of alternative antibiotics with better resistance profiles.

-

Regulatory delays or restrictions in certain regions.

-

Rise of antimicrobial resistance diminishing utilization.

Conclusion

Ampicillin remains a cornerstone antibiotic with a resilient global market, especially within emerging economies. Its cost-effectiveness and established manufacturing infrastructure underpin sustained demand. Price trajectories over the forecast period are expected to trend marginally downward in mature markets, with more stabilized or modest growth in LMICs driven by raw material costs and regulatory factors.

Business strategies should focus on optimizing supply chains, engaging in regulatory harmonization, and monitoring resistance patterns to maintain market competitiveness and profitability.

Key Takeaways

-

Market Resilience: Ampicillin's well-established efficacy and affordability ensure continued demand, particularly in LMICs.

-

Price Dynamics: Generics with increased competition have driven prices downward; future trends suggest continued marginal declines, with regional variances.

-

Supply Factors: Raw material costs, manufacturing standards, and regulatory environments are primary drivers influencing supply stability and pricing.

-

Growth Opportunities: Expanding access in underserved regions and developing formulation innovations offer growth potential.

-

Risks to Monitor: Rising antimicrobial resistance and regulatory changes require ongoing assessment to mitigate adverse impact on market prospects.

FAQs

1. What factors primarily influence the price of ampicillin globally?

Raw material costs, manufacturing standards, regulatory approval tariffs, generic competition, and regional demand-supply dynamics predominantly influence ampicillin’s price.

2. How has antimicrobial resistance impacted the ampicillin market?

Rising resistance has led to decreased clinical efficacy in some pathogens, prompting shifts toward combination therapy or alternative antibiotics, which may marginally reduce ampicillin’s market share.

3. Are there notable regional differences in ampicillin pricing?

Yes. Developed markets tend to have higher prices due to regulatory and manufacturing costs, whereas LMICs benefit from generic competition, resulting in lower prices.

4. What future market trends could influence ampicillin's pricing?

Regulatory approvals, raw material market fluctuations, antimicrobial stewardship policies, and emerging resistance patterns will shape future pricing dynamics.

5. What strategies can manufacturers adopt to remain competitive?

Investing in cost-efficient manufacturing, engaging with regulatory agencies proactively, developing new formulations, and expanding access in high-demand regions will be vital.

Sources

[1] Market Research Future, "Global Antibiotics Market," 2022.

[2] IQVIA, "Pricing and Market Trends in Antibiotics," 2022.