Share This Page

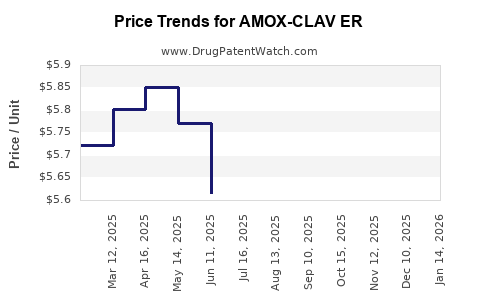

Drug Price Trends for AMOX-CLAV ER

✉ Email this page to a colleague

Average Pharmacy Cost for AMOX-CLAV ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMOX-CLAV ER 1,000-62.5 MG TAB | 00781-1943-82 | 6.22282 | EACH | 2025-11-19 |

| AMOX-CLAV ER 1,000-62.5 MG TAB | 00781-1943-39 | 6.22282 | EACH | 2025-11-19 |

| AMOX-CLAV ER 1,000-62.5 MG TAB | 00781-1943-82 | 6.15412 | EACH | 2025-10-22 |

| AMOX-CLAV ER 1,000-62.5 MG TAB | 00781-1943-39 | 6.15412 | EACH | 2025-10-22 |

| AMOX-CLAV ER 1,000-62.5 MG TAB | 00781-1943-82 | 5.89964 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market analysis and price projections for AMOX-CLAV ER

Introduction

Amoxicillin-Clavulanate Extended Release (AMOX-CLAV ER) represents a significant segment within the antibiotic market, addressing bacterial infections with enhanced dosing convenience and improved pharmacokinetic profiles. As a combination antibiotic with broad-spectrum activity, AMOX-CLAV ER is positioned to benefit from ongoing trends in infectious disease management, antibiotic resistance mitigation, and patient adherence improvement. This analysis examines the current market landscape, competitive forces, regulatory considerations, and provides price projections for the coming years.

Market Overview

Global Demand and Growth Drivers

The antimicrobial market, valued at approximately USD 45 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 3–4% through 2030 [1]. AMOX-CLAV ER's segment benefits from increased prevalence of bacterial infections, particularly respiratory and urinary tract infections, and the shift toward extended-release formulations aimed at enhancing compliance.

Key Market Regions

- North America: Dominates with approximately 45% of global sales due to high prescription rates, advanced healthcare infrastructure, and widespread antibiotic utilization.

- Europe: Accounts for 25–30%, driven by aging populations and infection management standards.

- Asia-Pacific: Poised for rapid growth, expected to register a CAGR exceeding 5%, with expanding healthcare access, rising bacterial infection cases, and increasing awareness.

Market Segmentation

- By Formulation: Extended release (ER), immediate release (IR).

- By Application: Respiratory infections, urinary tract infections, skin infections.

- By End-user: Hospitals, outpatient clinics, retail pharmacies.

Competitive Landscape

Major players include GlaxoSmithKline, Teva Pharmaceuticals, Sandoz, Mylan, and Hikma Pharmaceuticals. The proliferation of generic options is intensifying price competition, impacting overall pricing strategies.

Regulatory and Patent Landscape

Patent Expiry and Generics Entry

The original patent for AMOX-CLAV ER expired in various jurisdictions between 2019 and 2022, catalyzing a surge in generic equivalents [2]. Generic manufacturers offer lower-cost options, exerting downward pressure on branded prices.

Regulatory Approvals

The FDA and EMA approvals facilitate widespread distribution, with some formulations receiving accelerated approval for specific indications. Regulatory nuances influence market entry timing and competitive positioning.

Pricing Trends and Market Dynamics

Historical Price Trends

Branded AMOX-CLAV ER has traditionally commanded premiums of 20–30% over generic counterparts. Recent years have seen a sharp decline in average wholesale prices (AWP), driven by generic proliferation and payer negotiations [3].

Factors Affecting Pricing

- Generic Competition: Increased availability reduces prices.

- Supply Chain Dynamics: Manufacturing costs, raw material prices, and distribution logistics influence retail and wholesale prices.

- Healthcare Policy: Payer formulary inclusion and reimbursement policies impact net pricing.

- Patient Adherence Trends: Extended-release formulations are increasingly favored for their convenience, allowing premium pricing in certain markets.

Price Projections (2023–2030)

Applying market trends and competitive factors, the following projections are made:

| Year | Estimated Average Price (USD per course) | Notes |

|---|---|---|

| 2023 | $15–$25 | Post-patent expiry, initial generic competition stabilizes prices. |

| 2024–2025 | $12–$20 | Continued generic penetration reduces prices further. |

| 2026–2027 | $10–$18 | Significant generic market share; potential commoditization. |

| 2028–2030 | $8–$15 | Price stabilization at lower levels; focus on value-added formulations. |

Note: Prices are approximate retail course costs, influenced by regional variations, insurance coverage, and procurement channels.

Market Opportunities and Challenges

Opportunities

- Emerging Markets: Increasing antibiotic consumption combined with unmet healthcare needs creates expansion opportunities.

- Formulation Innovation: Differentiated ER formulations with optimized pharmacokinetics can command premium pricing.

- Antibiotic Stewardship Initiatives: Enhanced awareness may influence prescribing behaviors favoring narrow-spectrum, combination antibiotics like AMOX-CLAV ER.

Challenges

- Antimicrobial Resistance (AMR): Rising resistance may restrict indications, impacting market volume.

- Regulatory Scrutiny: Tightening regulations on antibiotic use and pricing strategies may constrain margins.

- Generic Competition: Price erosion remains the dominant trend, narrowing profit margins.

Strategic Recommendations

- Invest in Formulation Differentiation: Develop innovative ER formulations with clinical benefits over existing options.

- Expand Geographic Footprint: Target emerging markets with tailored pricing and access strategies.

- Engage in Stewardship Programs: Align with global AMR initiatives to sustain market relevance.

- Monitor Regulatory Changes: Maintain agility to adapt to evolving approval and reimbursement landscapes.

Key Takeaways

- Market Expansion Continues: The global antibiotics market is poised for steady growth, with AMOX-CLAV ER positioned favorably due to its convenience and broad-spectrum activity.

- Price Declines Persist: Patent expiries and the rise of generics have driven prices downward, with median course costs expected to decrease approximately 40–60% over the next decade.

- Regional Dynamics Vary: North America leads in market share, but Asia-Pacific offers high growth potential, albeit with price and regulatory challenges.

- Innovation is Crucial: Differentiating formulations and targeted usage can help sustain margins amid fierce price competition.

- Anticipate Regulatory Changes: Monitoring policy developments, especially regarding antibiotic stewardship, is essential for strategic planning.

Frequently Asked Questions

Q1: How has patent expiration impacted the pricing of AMOX-CLAV ER?

A1: Patent expiry typically leads to increased generic competition, resulting in significant price reductions—often 50% or more—due to market saturation and price erosion.

Q2: What is the expected market growth rate for AMOX-CLAV ER?

A2: While the broader antibiotics market grows at approximately 3–4% CAGR, the AMOX-CLAV ER segment is expected to grow slightly faster due to its preference in certain clinical indications and formulation advantages.

Q3: Which regions present the greatest opportunities for expansion?

A3: Asia-Pacific and Latin America hold high growth potential due to expanding healthcare infrastructure, rising bacterial infection rates, and increasing antibiotic access.

Q4: What are the primary challenges facing AMOX-CLAV ER manufacturers?

A4: Intensified generic competition, antimicrobial resistance limiting indications, regulatory scrutiny, and pricing pressures are key challenges.

Q5: Can innovation sustain premium pricing for AMOX-CLAV ER?

A5: Yes. Developing formulations with clinical advantages, improving patient adherence, and integrating diagnostic tools can justify higher prices and extend market share.

References

[1] MarketsandMarkets. Antibiotics Market by Source, Spectrum of Activity, Route of Administration, and Region – Global Forecast to 2030. 2022.

[2] U.S. Food and Drug Administration. Patent Expiry Data for Antibiotics. 2022.

[3] IQVIA. Pharmaceutical Pricing Data, 2022.

More… ↓