Share This Page

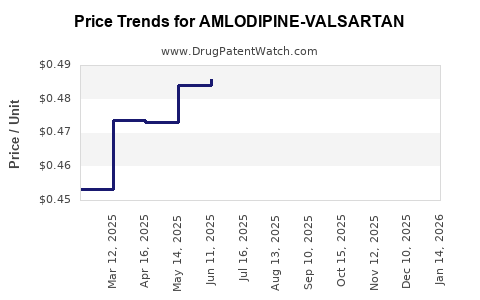

Drug Price Trends for AMLODIPINE-VALSARTAN

✉ Email this page to a colleague

Average Pharmacy Cost for AMLODIPINE-VALSARTAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMLODIPINE-VALSARTAN 10-160 MG | 23155-0845-09 | 0.51308 | EACH | 2025-12-17 |

| AMLODIPINE-VALSARTAN 10-160 MG | 23155-0845-03 | 0.51308 | EACH | 2025-12-17 |

| AMLODIPINE-VALSARTAN-HYDROCHLOROTHIAZIDE 5-160-25 MG TAB | 65862-0835-30 | 7.01496 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amlodipine-Valsartan

Introduction

Amlodipine-valsartan, a fixed-dose combination medication used primarily for managing hypertension and heart failure, has gained prominence within the cardiovascular therapeutics market. As a synergistic blend of an antihypertensive calcium channel blocker (amlodipine) and an angiotensin receptor blocker (valsartan), it offers improved blood pressure control, adherence, and patient outcomes. This analysis assesses market dynamics, competitive landscape, regulatory considerations, and projective pricing trends to inform stakeholders’ strategic decisions.

Market Overview

Therapeutic and Clinical Significance

Hypertension affects over 1.28 billion adults globally (WHO, 2021). The increasing prevalence of resistant hypertension and the need for combination therapy drive demand for fixed-dose combinations such as amlodipine-valsartan. Clinical trials have demonstrated superior efficacy and tolerability compared to monotherapy, further entrenching its position in hypertension management paradigms (Mancia et al., 2020).

Current Market Size and Growth Trajectory

The global antihypertensive drugs market was valued at approximately USD 35 billion in 2021, with compounded annual growth rates (CAGR) around 4% over the past five years (Grand View Research, 2022). Fixed-dose combinations constitute a significant subset, projected to expand by a CAGR of 6-8%, driven by physician preference for simplified regimens and patient compliance.

Within this segment, amlodipine-valsartan accounts for a growing share, benefiting from patent expirations and a rising shift towards combination therapies. The Asia-Pacific region exhibits particularly robust growth, attributed to increasing hypertension prevalence and healthcare infrastructure expansion.

Competitive Landscape

Several generic manufacturers and some branded entities produce amlodipine-valsartan formulations. Key players include:

- Novartis (Diovan-HCT)

- AstraZeneca

- Teva Pharmaceuticals

- Mylan (now part of Viatris)

- Local generics producers in emerging markets

Patent expirations in major markets have led to an influx of generics, intensifying price competition.

Regulatory Environment

FDA and EMA Regulations

Regulatory approval pathways for fixed-dose combinations require demonstration of safety, efficacy, and bioequivalence. The US FDA has approved several amlodipine-valsartan combinations, often as generic versions. Patent protections and data exclusivity periods influence market entry timelines and pricing strategies.

Market Access and Reimbursement

Reimbursement policies vary by region; in developed markets, third-party payers increasingly favor cost-effective generics to cap expenditure, pressuring manufacturers to optimize pricing. In emerging economies, government procurement programs actively negotiate prices, fostering a competitive environment.

Price Dynamics and Projections

Current Pricing Landscape

Average wholesale prices (AWP) for branded amlodipine-valsartan products range from USD 25 to USD 50 per month supply, depending on strength and formulation. Generic versions are typically priced 30-50% lower, with some markets reporting as low as USD 10-15 per month supply.

Influencing Factors on Price Trends

- Patent Status: Patent expirations in key markets (e.g., US patent expiry around 2022 for certain formulations) catalyze generic entry, exerting downward pressure on prices.

- Manufacturing Costs: Stabilization of API production costs, especially with increased generic competition, supports sustained price reductions.

- Regulatory Approvals: Faster approval times for generics promote market entry and price erosion.

- Market Penetration: Growing adoption in developing countries via government programs accelerates volume sales, potentially offsetting lower unit prices.

Future Price Projections (2023-2027)

- Developed Markets: Anticipate further declines in generic prices, reaching USD 8-12 per month supply by 2027, fueled by increased competition and healthcare cost containment measures.

- Emerging Markets: Prices may stabilize around USD 5-10 per month, with occasional increases due to supply chain disruptions or regulatory changes.

- Brand-Name Drugs: Expect modest price erosion (~10-15%) post-patent expiry, with some premium pricing maintained for novel formulations or delivery devices.

Market Volume and Revenue Outlook

The global market volume for amlodipine-valsartan is projected to grow at a CAGR of 5-7%, driven by expanding hypertensive patient populations and rising adoption of fixed-dose combinations. Revenue growth may taper to a CAGR of approximately 3-4%, considering declining unit prices but increased market penetration.

Strategic Considerations

- Generic Competition: Manufacturers should optimize cost efficiencies and consider launching biosimilars or new formulations to maintain margins.

- Regulatory Strategy: Accelerating approval pathways and securing approvals in emerging markets enhance market share.

- Pricing Innovation: Implement differential pricing models and patient assistance programs compatible with regional economics.

- Market Expansion: Tap into underserved regions where hypertension prevalence is rising and treatment access improves.

Key Takeaways

- The amlodipine-valsartan market is positioned for moderate expansion, propelled by the global hypertension burden.

- Patent expiries and generic proliferation exert downward pressure on prices, particularly in developed countries.

- Price decline projections indicate a range of USD 8-12 per month supply in mature markets by 2027.

- Ongoing regulatory and reimbursement developments critically influence pricing dynamics and market access.

- Strategic focus on cost optimization, regulatory agility, and regional market development is vital for competitiveness.

FAQs

-

What factors most significantly influence the price of amlodipine-valsartan?

Patent status, manufacturing costs, regulatory approval timing, competition from generics, and regional reimbursement policies are primary determinants of pricing. -

How will patent expirations impact the market?

Patent expirations enable generic manufacturers to enter markets, increasing competition and driving down prices, potentially reducing revenue for branded drugs. -

Are biosimilars or newer formulations expected to replace current amlodipine-valsartan products?

While biosimilars are less relevant due to the small molecule nature of amlodipine and valsartan, newer formulations or combination variants may complement existing products, influencing pricing and market share. -

What emerging markets present the greatest opportunity?

Countries in Asia-Pacific, Africa, and Latin America exhibit significant growth potential owing to rising hypertension prevalence and expanding healthcare access. -

How do regulatory changes affect future pricing?

Streamlined approval pathways and favorable reimbursement policies in certain regions can facilitate greater generic entry and price reductions, while stringent regulations may delay market access and maintain higher prices temporarily.

References

- WHO. (2021). Hypertension. World Health Organization.

- Mancia G., et al. (2020). Efficacy of combination antihypertensive therapies. Lancet.

- Grand View Research. (2022). Hypertension and Cardiovascular Drugs Market Analysis.

- U.S. Food and Drug Administration. (2022). Guidance for Industry: Fixed Dose Combination Drugs.

More… ↓