Share This Page

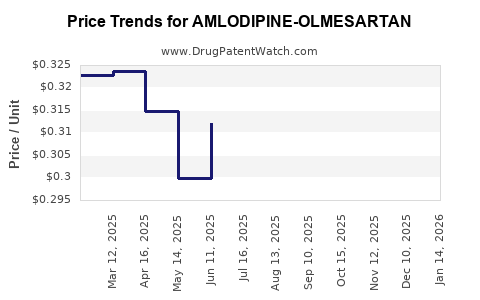

Drug Price Trends for AMLODIPINE-OLMESARTAN

✉ Email this page to a colleague

Average Pharmacy Cost for AMLODIPINE-OLMESARTAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMLODIPINE-OLMESARTAN 10-20 MG | 33342-0192-07 | 0.32115 | EACH | 2025-12-17 |

| AMLODIPINE-OLMESARTAN 10-20 MG | 33342-0192-10 | 0.32115 | EACH | 2025-12-17 |

| AMLODIPINE-OLMESARTAN 10-20 MG | 31722-0447-30 | 0.32115 | EACH | 2025-12-17 |

| AMLODIPINE-OLMESARTAN 10-20 MG | 42571-0236-30 | 0.32115 | EACH | 2025-12-17 |

| AMLODIPINE-OLMESARTAN 10-20 MG | 27241-0085-03 | 0.32115 | EACH | 2025-12-17 |

| AMLODIPINE-OLMESARTAN 5-40 MG | 69238-2676-01 | 0.31180 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amlodipine-Olmesartan

Introduction

Amlodipine-olmesartan, a fixed-dose combination (FDC) antihypertensive medication, offers a comprehensive solution for managing hypertension with improved drug adherence. This combination leverages the vasodilatory effects of amlodipine, a calcium channel blocker, alongside olmesartan, an angiotensin II receptor blocker (ARB). The growing prevalence of hypertension globally, alongside increasing awareness and therapeutic guidelines, positions amlodipine-olmesartan as a significant product in the cardiovascular pharmaceutical segment. Analyzing current market dynamics and projecting future prices are crucial for stakeholders—including pharmaceutical companies, investors, and healthcare policymakers—to make informed decisions.

Global Market Dynamics

Prevalence of Hypertension

The global hypertension market is driven by escalating prevalence rates, particularly in low- and middle-income countries, fueled by urbanization, sedentary lifestyles, and rising obesity rates.[1] According to the World Health Organization (WHO), approximately 1.13 billion people suffer from hypertension worldwide, with many remaining undiagnosed or untreated.[2]

Therapeutic Advances and Product Preference

Fixed-dose combinations like amlodipine-olmesartan are favored for their ability to improve patient compliance by reducing pill burden. Clinical guidelines recommend combination therapy for moderate to severe hypertension (≥ 20/10 mm Hg above goal), which enhances therapeutic efficacy.[3] As a result, the demand for such combinations has surged.

Market Competition

Multiple pharmaceutical companies manufacture amlodipine-olmesartan, both as branded and generic formulations. Key players include:

- AstraZeneca (Olmesartan-based products)

- Pfizer (Amlodipine-based products)

- Teva, Mylan, and Sandoz (Generics producers)

The competitive landscape is further tempered by patent expirations, sensorily increased generic penetration, and governmental price control policies in various markets.

Regional Market Insights

North America

The U.S. dominates the market, fueled by high hypertension prevalence, well-established healthcare infrastructure, and insurance coverage. The FDA's approval of generic formulations has significantly lowered prices, fostering increased adoption. According to IQVIA, the hypertension market in the US is projected to grow at a CAGR of approximately 4% over the next five years, with fixed-dose combinations comprising a growing segment.[4]

Europe

European markets show steady growth, with increasing patient awareness and adherence initiatives. Price regulations and healthcare spending austerity measures may suppress peak prices, moving market share toward generics.

Asia-Pacific

Rapid urbanization and increasing healthcare access propel growth. Major markets like China and India have seen a surge in generic manufacturing, driven by local regulatory policies favoring affordable medicines, which impacts overall pricing strategies.

Emerging Markets

Latin America and Africa exhibit rising hypertension-related healthcare demand. However, affordability remains paramount, emphasizing the importance of generics and tiered pricing.

Market Size and Growth Projections

Historical Market Size

In 2022, the global antihypertensive drug market was valued at approximately USD 17 billion.[4] Fixed-dose combination therapies, including amlodipine-olmesartan, represented an estimated 12-15% of this segment, translating to roughly USD 2–2.55 billion.

Projected Market Growth

Forecasts suggest a compound annual growth rate (CAGR) of approximately 6-8% through 2030 for the antihypertensive market, driven chiefly by the increasing adoption of fixed-dose combination therapies. Factoring this, the amlodipine-olmesartan segment could surpass USD 4 billion globally by 2030, with front-running markets such as North America and Asia-Pacific leading growth.

Pricing Trends and Projections

Current Pricing Landscape

- Branded formulations in developed markets typically command retail prices from USD 4 to USD 12 per tablet, depending on dosage and packaging.

- Generic versions have driven prices down to USD 1 to USD 4 per tablet.

For instance, in the U.S., the average wholesale price (AWP) for brand-name amlodipine-olmesartan ranges from USD 8 to USD 12 per tablet, whereas generic forms are often available at approximately USD 1 to USD 3 per tablet.

Factors Influencing Price Fluctuations

- Patent statuses: Patent expirations significantly lower prices via generic entry.

- Regulatory environment: Stringent price controls or negotiations, especially in Europe and emerging markets, suppress retail prices.

- Manufacturing costs: Increases in raw material prices, such as calcium channel blockers and ARBs, affect overall pricing.

- Market competition: An influx of generic manufacturers intensifies price competition, driving prices downward.

Future Price Projections (2023-2030)

Considering current trends, the following projections are feasible:

- Developed Markets: Prices for fixed-dose combinations are expected to decrease progressively, reaching around USD 0.5 to USD 2 per tablet by 2030, driven by generic competition and cost containment efforts.

- Emerging Markets: Prices will largely remain stable or slightly decrease due to intensive generic penetration. Fixed-dose combinations will likely range from USD 0.3 to USD 1 per tablet.

Advanced market dynamics suggest a broader trend toward reduced per-unit prices, favoring wider access and adherence, but profit margins for manufacturers may diminish accordingly.

Regulatory and Commercial Considerations

Regulatory Approvals

Stringent regulatory approvals, especially in the U.S. and Europe, require robust bioequivalence and clinical trial data. The entry of generic rivals post-patent expiration accelerates price declines.

Market Entry Strategy

Successful market penetration entails competitive pricing, differentiated formulations (e.g., pediatric or combination dosages), and strategic partnerships with healthcare providers to foster prescribing patterns.

Key Drivers and Barriers

| Drivers | Barriers |

|---|---|

| Increasing global hypertension prevalence | Patent exclusivity periods delaying generic entry |

| Patient preference for fixed-dose combinations | Regulatory hurdles in certain jurisdictions |

| Cost-effective healthcare initiatives | Market saturation in mature markets |

| Pharmacoeconomic assessments favoring combination therapy | Limited awareness among healthcare providers |

Conclusion

The amlodipine-olmesartan market presents robust growth prospects, buoyed by the rising global burden of hypertension and a shift toward fixed-dose combination therapies to enhance adherence. Price trends are expected to decline, especially in markets with high generic competition, improving accessibility but squeezing profit margins for brand manufacturers. Stakeholders should focus on strategic pricing, biosimilar development, and expansion into emerging markets to maximize returns.

Key Takeaways

- The global amlodipine-olmesartan market is projected to grow at an 6-8% CAGR through 2030, surpassing USD 4 billion.

- Price per tablet in developed markets is expected to decrease from USD 4–12 to approximately USD 0.5–2 by 2030, driven by generics and price competition.

- Emerging markets will continue to favor affordable formulations, with prices remaining below USD 1 per tablet.

- Patent expirations and regulatory pathways are pivotal in shaping future pricing and market dynamics.

- Companies must innovate through biosimilars, combination formulations, and strategic market entry to sustain profitability.

FAQs

-

What factors primarily influence the pricing of amlodipine-olmesartan?

Dominant factors include patent status, generic market entry, manufacturing costs, regulatory policies, and regional price controls. -

How does patent expiration impact the market and pricing?

Patent expiration opens markets to generics, increasing competition and significantly reducing prices. -

What regions are expected to see the highest growth in amlodipine-olmesartan sales?

Asia-Pacific and Latin America are poised for rapid growth due to rising hypertension prevalence and increased healthcare access. -

Will the price decrease affect pharmaceutical companies' profits?

Yes, especially in markets with high generic penetration. Companies may need to diversify portfolios or innovate with new formulations. -

Are biosimilars or alternative combinations expected to replace amlodipine-olmesartan?

While biosimilars primarily target biologics, similar competition may emerge through new fixed-dose combinations or improved formulations, maintaining a dynamic market environment.

Sources:

[1] WHO. "Hypertension Fact Sheet." 2022.

[2] WHO. “Global Health Observatory Data.” 2021.

[3] American Heart Association. "Guidelines for Hypertension Management." 2021.

[4] IQVIA. “Global Cardiovascular Market Report.” 2022.

More… ↓