Share This Page

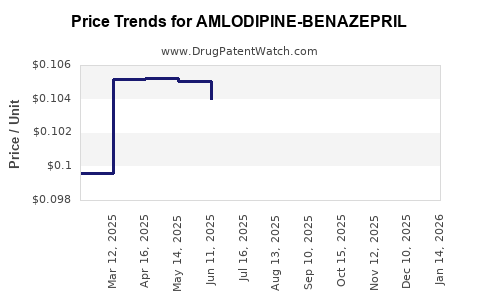

Drug Price Trends for AMLODIPINE-BENAZEPRIL

✉ Email this page to a colleague

Average Pharmacy Cost for AMLODIPINE-BENAZEPRIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMLODIPINE-BENAZEPRIL 10-20 MG | 57237-0146-01 | 0.11815 | EACH | 2025-12-17 |

| AMLODIPINE-BENAZEPRIL 10-20 MG | 55111-0341-05 | 0.11815 | EACH | 2025-12-17 |

| AMLODIPINE-BENAZEPRIL 5-40 MG | 68180-0463-01 | 0.14638 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amlodipine-Benazepril

Introduction

Amlodipine-Benazepril is a fixed-dose combination drug primarily prescribed for managing hypertension and certain cardiovascular conditions. Comprising amlodipine, a calcium channel blocker, and benazepril, an ACE inhibitor, this combination targets multiple pathways to lower blood pressure effectively. The product's market dynamics are influenced by the global prevalence of hypertension, evolving healthcare policies, generic competition, and therapeutic advancements.

This analysis provides a comprehensive overview of the current market landscape, forecasted trends, pricing trajectories, and strategic considerations pertinent to stakeholders in the pharmaceutical industry, healthcare providers, and investors.

Market Overview

Global Burden of Hypertension

Hypertension affects over 1.3 billion adults worldwide, accounting for approximately 7.5 million deaths annually [1]. The rising prevalence, especially in low- and middle-income countries, underscores the demand for effective, accessible antihypertensive therapies. Combination drugs like Amlodipine-Benazepril play a vital role in improving adherence and treatment outcomes by simplifying regimens.

Current Therapeutic Landscape

The antihypertensive market features numerous monotherapies and fixed-dose combinations (FDCs). Amlodipine-Benazepril is among the preferred options for initial therapy and maintenance, endorsed by guidelines like the JNC 8 and ESC/ESH. Its efficacy, tolerability, and once-daily dosing contribute to its widespread use.

Market Players and Product Availability

Key manufacturers include Pfizer, Mylan, Teva, and others, with some markets supplying both branded and generic formulations. Recent entry of generic equivalents has intensified price competition, particularly in mature markets like the U.S. and Europe.

Market Dynamics and Drivers

Growing Demand for Fixed-Dose Combinations

FDCs improve medication adherence by reducing pill burden, which is critical in chronic conditions such as hypertension. The increasing adoption of combination therapy aligns with evolving clinical guidelines recommending multi-drug regimens early in treatment.

Regulatory Environment

Regulatory agencies favor FDC approvals that demonstrate bioequivalence and safety, facilitating market entry for generics. The U.S. FDA, EMA, and other authorities have expedited pathways for approved generics, fostering price competition and improved access.

Healthcare Policy and Reimbursement

Government initiatives increasingly emphasize cost-effective treatments. Payers favor generic formulations, striving to curtail expenditures. Reimbursement policies significantly influence market share and pricing strategies.

Market Segmentation and Geographic Trends

Developed Markets

In North America and Europe, high purchasing power and mature regulatory frameworks facilitate widespread adoption of both brand-name and generic formulations. The expiration of patents for brand-name combinations has prompted a shift toward generics, leading to substantial price reductions.

Emerging Markets

Countries like India, China, and regions in Latin America experience growing demand driven by increased awareness, urbanization, and healthcare infrastructure expansion. Price sensitivity is higher, favoring affordable generic options.

Price Trends and Projections

Historical Pricing Dynamics

-

Brand-Name Formulations: Historically, the branded Amlodipine-Benazepril formulations have commanded premium pricing, with costs ranging from $50–$100 for a 30-day supply in developed markets [2].

-

Generic Competition: Once patents expired, generic versions entered the market, reducing costs by 40–70%. For example, generic prices in the U.S. dropped to approximately $10–$20 per month, depending on the manufacturer.

Future Price Trajectories

Given ongoing patent expirations, market saturation of generics, and increasing market penetration, prices are expected to continue declining:

-

Short-Term (1-2 years): Marginal prices reductions as existing generics consolidate market share. Price stabilizes around $8–$15 per 30-day supply in mature markets.

-

Medium to Long-Term (3-5 years): Further price decreases as competition intensifies, new entrants emerge, and manufacturing efficiencies improve. Prices could reach as low as $5–$10 in high-volume regions.

-

Premium Markets and Branded Drugs: Branded formulations may retain a 15–25% premium due to perception of quality and branding, although this gap narrows.

Impact of Biosimilars and Emerging Technologies

While biosimilars are not directly applicable to small-molecule drugs like Amlodipine-Benazepril, technological innovations such as digital health tools and improved generics manufacturing are expected to enhance accessibility and affordability further.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies: Continued innovation and diversification of formulations could sustain premium pricing, especially with extended-release or combination variants. Investment in emerging markets offers growth potential amid price pressures elsewhere.

-

Healthcare Providers and Payers: Emphasizing cost-effective generics while maintaining quality standards can improve therapeutic adherence and reduce overall healthcare spending.

-

Investors: The declining trend in prices due to generic competition suggests narrowing profit margins for branded products, emphasizing the importance of strategic patent management and pipeline diversification.

Regulatory and Market Entry Considerations

-

Patent Expirations: Monitoring patent statuses and regulatory filings is crucial for timing market entry, particularly in key jurisdictions where generics can impact pricing dynamics.

-

Quality Standards: Competition driven by bioequivalence and manufacturing standards ensures market stability and consumer confidence.

-

Pricing Regulations: Price control policies in countries like India, Brazil, and South Africa influence wholesale and retail pricing strategies.

Key Market Trends

- A gradual decline in average prices driven by increases in generic competition.

- Growing preference for fixed-dose combinations to improve compliance.

- Expansion into emerging markets, leveraging affordability and increasing hypertension awareness.

- Regulatory facilitation of generics and biosimilar entry to enhance market competition.

Key Takeaways

- The global Amlodipine-Benazepril market is characterized by expanding demand owing to the rising hypertension burden.

- Patent expirations are catalyzing a shift toward generic formulations, significantly reducing prices.

- Price projections indicate continued downward trends, particularly in mature markets, with prices potentially falling below $10 for a 30-day supply within the next few years.

- Strategic focus on emerging markets presents growth opportunities amid intensifying price competition.

- Stakeholders should monitor patent landscapes, regulatory changes, and manufacturing innovations to optimize market positioning.

FAQs

1. What factors most influence the price of Amlodipine-Benazepril?

Market competition, patent status, regulatory approval, manufacturing costs, and healthcare reimbursement policies are primary determinants of drug pricing.

2. How rapidly are prices expected to decline globally?

Prices in mature markets are projected to decline gradually over the next 3-5 years, with generic versions significantly reducing costs. Developing markets may experience more rapid declines due to high price sensitivity.

3. What is the impact of generic entry on market share?

Generic competition often results in substantial market share gains for low-cost alternatives, reducing the sales volume of branded formulations and exerting downward pressure on prices.

4. Are there upcoming patent expirations for Amlodipine-Benazepril?

Most patents for branded formulations have expired globally, enabling widespread generic manufacturing. Stakeholders should monitor jurisdiction-specific patent statuses for precise timing.

5. How can stakeholders differentiate in a highly competitive market?

Focusing on quality, manufacturing efficiency, strategic partnerships in emerging markets, and innovation in formulation (e.g., extended-release) can provide competitive advantages.

References

[1] World Health Organization. (2021). Hypertension.

[2] Goodrx. (2022). Amlodipine prices and market analysis.

More… ↓