Share This Page

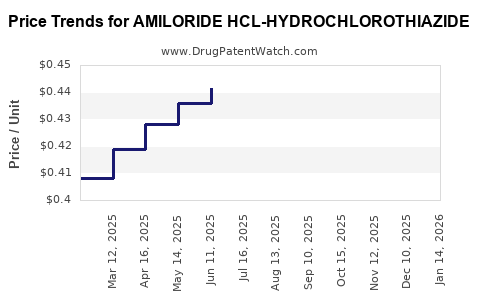

Drug Price Trends for AMILORIDE HCL-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for AMILORIDE HCL-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMILORIDE HCL-HYDROCHLOROTHIAZIDE 5-50 MG TAB | 00555-0483-05 | 0.44754 | EACH | 2025-12-17 |

| AMILORIDE HCL-HYDROCHLOROTHIAZIDE 5-50 MG TAB | 00555-0483-02 | 0.44754 | EACH | 2025-12-17 |

| AMILORIDE HCL-HYDROCHLOROTHIAZIDE 5-50 MG TAB | 00555-0483-05 | 0.44866 | EACH | 2025-11-19 |

| AMILORIDE HCL-HYDROCHLOROTHIAZIDE 5-50 MG TAB | 00555-0483-02 | 0.44866 | EACH | 2025-11-19 |

| AMILORIDE HCL-HYDROCHLOROTHIAZIDE 5-50 MG TAB | 00555-0483-05 | 0.44994 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amiloride HCl-Hydrochlorothiazide

Introduction

Amiloride HCl-Hydrochlorothiazide (AMILORIDE HCL-HYDROCHLOROTHIAZIDE) is a fixed-dose combination diuretic used primarily for managing hypertension and edema. As interest in combination therapies for cardiovascular conditions increases, understanding the market landscape and price evolution of Amiloride HCl-Hydrochlorothiazide becomes crucial for pharmaceutical stakeholders, investors, and healthcare providers. This analysis explores current market dynamics, competitive positioning, regulatory trends, and future pricing forecasts.

Market Overview

Therapeutic Use and Demand Drivers

Amiloride HCl-Hydrochlorothiazide addresses hypertension and fluid retention, conditions prevalent globally, especially in aging populations. The drug’s dual mechanism—Amiloride as a potassium-sparing diuretic and Hydrochlorothiazide as a thiazide diuretic—offers synergistic benefits, leading to widespread adoption among clinicians seeking to optimize blood pressure control while minimizing hypokalemia risks.

The global hypertension drugs market was valued at approximately USD 34 billion in 2022, with a compound annual growth rate (CAGR) of around 3.7% through 2030 [1]. Diuretics represent a significant subset, with Hydrochlorothiazide being one of the most widely prescribed agents. Fixed-dose combinations like Amiloride HCl-Hydrochlorothiazide contribute to adherence and simplified regimens, further fueling demand.

Market Segmentation and Geography

North America dominates the market, driven by high hypertension prevalence and healthcare spending. The United States alone accounts for over 40% of global pharmaceutical sales, with a notable shift towards combination therapies. Europe follows closely, with mature healthcare systems and high disease awareness. Emerging markets in Asia-Pacific and Latin America show promising growth, propelled by increasing chronic disease burden and expanding healthcare infrastructure.

Competitive Landscape

Key Players and Product Availability

While Amiloride HCl-Hydrochlorothiazide is available as generic formulations globally, branded equivalents are limited. Several multinational companies have developed and marketed generics, including Teva, Mylan (now part of Viatris), and Sandoz. The dominance of generics leads to highly competitive pricing environments and constrains premium pricing power.

Regulatory Status

The drug is generally approved in major markets, including the US (FDA), Europe (EMA), and other regulatory agencies supporting generic approvals. An increasing trend of biosimilar and generic availability has bolstered access but exerts downward pressure on prices.

Pricing Trends and Market Forces

Current Pricing Landscape

Generic Amiloride HCl-Hydrochlorothiazide formulations are typically priced significantly lower than branded equivalents. In the US, average retail prices for a 30-day supply range from USD 10 to USD 25, depending on strength, formulation, and pharmacy discounts [2]. European prices tend to mirror this trend, with variations based on healthcare reimbursement policies.

Price Reduction Drivers

- Generic Competition: The entrance of multiple generics has intensified price competition, leading to price erosion.

- Regulatory Approvals: Streamlined approval processes for generics lower development costs, fostering price declines.

- Healthcare Policy: Payers' emphasis on cost-effective treatments encourages formulary switches to generics.

- Market Saturation: Saturation of the treatment landscape limits premium pricing opportunities.

Future Price Projections

Factors Influencing Price Trends

- Patent Expirations: Although the original branded product’s patent status varies by jurisdiction, patent cliffs generally facilitate generic proliferation, continuing downward pressure.

- Market Penetration and Adoption: Increased utilization in emerging economies might slightly mitigate price declines due to volume effects.

- Regulatory Changes: Greater transparency and reforms aimed at reducing drug prices are expected to further influence pricing.

Projected Price Trajectory (2023–2030)

Given the current competitive environment, the following trends are anticipated:

- Stabilization at Low Price Points: Prices for generic Amiloride HCl-Hydrochlorothiazide are unlikely to decline below USD 3–5 per month per patient in major markets.

- Gradual Decline: Over the next five years, average prices may decrease by approximately 10–15%, driven by increased generic market saturation.

- Emerging Markets: Prices could stabilize or slightly increase due to rising demand and limited regulatory price controls.

In 2030, average retail prices are projected to hover around USD 2–4 per month per patient in the US and Europe, assuming continued generic competition and healthcare policy trends favoring cost containment.

Market Opportunities and Risks

Opportunities

- Expanding Use in Developing Countries: The cost-effective nature of generics makes Amiloride HCl-Hydrochlorothiazide attractive for expanding healthcare access.

- Formulation Innovations: Fixed-dose combinations with improved bioavailability or novel formulations could command premium pricing.

- Legislative Initiatives: Policy reforms promoting biosimilars and generics could stabilize or reduce prices further.

Risks

- Regulatory Scrutiny: Policies aimed at price controls may cap price growth or induce reductions.

- Market Saturation: High penetration rates limit revenue growth potential.

- Intensified Competition: Entry of authorized generics or biosimilars could precipitate price wars.

Conclusion

The current market for Amiloride HCl-Hydrochlorothiazide is characterized by intense generic competition, leading to low and stable pricing, especially in mature markets. While future price declines are anticipated, they will likely stabilize around USD 2–4 per month, driven by continued generics proliferation, healthcare policy shifts, and market saturation. Investment and strategic development efforts should focus on expanding access in emerging markets and innovating formulations to maintain profitability amidst structural pricing pressures.

Key Takeaways

- Dominance of Generics: The market is primarily driven by generic formulations, which exert downward pressure on prices.

- Stable Price Range: Expect prices to stabilize around USD 2–4 per month per patient in major markets by 2030.

- Growth Opportunities: Expanding use in emerging markets and formulation innovations are key growth vectors.

- Regulatory Impact: Policy reforms and patent expirations will continue to influence pricing dynamics.

- Market Saturation Risks: High penetration rates limit revenue growth potential in developed economies.

FAQs

1. What factors influence the pricing of Amiloride HCl-Hydrochlorothiazide?

Market competition, regulatory approvals, healthcare policies, and demand in both developed and emerging markets are primary drivers influencing drug prices.

2. How does generic competition impact the pricing of this drug?

Generic competition significantly reduces prices by increasing supply and decreasing monopolistic pricing, leading to more affordable options for patients and payers.

3. Are branded versions of Amiloride HCl-Hydrochlorothiazide still available?

Branded versions are limited; most markets rely on generics due to patent expirations and cost considerations.

4. What is the outlook for pricing in the next five years?

Prices are expected to decrease slightly but stabilize around USD 2–4 per month per patient in major markets due to sustained competition.

5. How might regulatory changes influence future pricing?

Policy initiatives promoting drug affordability and generic biosimilars could further compress prices, while reforms favoring innovation might support premium formulations.

References

[1] MarketWatch. "Hypertension Drugs Market Size, Share & Trends Analysis." 2022.

[2] GoodRx. "Price comparison for Amiloride Hydrochlorothiazide." 2023.

More… ↓