Share This Page

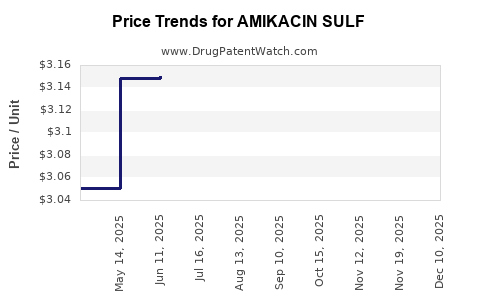

Drug Price Trends for AMIKACIN SULF

✉ Email this page to a colleague

Average Pharmacy Cost for AMIKACIN SULF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMIKACIN SULF 500 MG/2 ML VIAL | 25021-0173-02 | 2.72275 | ML | 2025-12-17 |

| AMIKACIN SULF 500 MG/2 ML VIAL | 23155-0785-41 | 2.72275 | ML | 2025-12-17 |

| AMIKACIN SULF 500 MG/2 ML VIAL | 00641-6167-10 | 2.72275 | ML | 2025-12-17 |

| AMIKACIN SULF 500 MG/2 ML VIAL | 23155-0290-41 | 2.72275 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amikacin Sulfate

Introduction

Amikacin sulfate is a potent aminoglycoside antibiotic primarily utilized to treat severe bacterial infections, including tuberculosis, septicemia, bone infections, and complicated urinary tract infections. Its efficacy against multidrug-resistant (MDR) bacteria has positioned it as a critical component in the antibiotic arsenal. As global antimicrobial resistance (AMR) escalates, the demand for amikacin sulfate is expected to rise, influencing market dynamics and pricing strategies.

This analysis explores current market conditions, competitive landscape, regulatory environment, pricing trends, and future projections for amikacin sulfate, equipping stakeholders with insights to make informed strategic decisions.

Market Overview

Global Market Size and Growth

The global aminoglycoside antibiotics market, with amikacin sulfate as a significant segment, is projected to reach USD 600 million by 2028, expanding at a compounded annual growth rate (CAGR) of approximately 6.2% over the next five years (2023-2028)[1]. The rise of MDR bacteria, particularly in hospital settings, propels the demand for efficacious antibiotics such as amikacin sulfate.

Key Market Drivers

- Escalating antimicrobial resistance: Growing resistance to conventional antibiotics necessitates alternative therapies like amikacin, especially against resistant strains such as Klebsiella pneumoniae and Acinetobacter baumannii.

- Expanding hospital-acquired infections (HAIs): An increasing prevalence of HAIs enhances the need for potent antibiotics.

- Emerging regions' healthcare investments: Asia-Pacific and Latin America exhibit rapid healthcare infrastructure development, expanding access and demand.

Regional Market Trends

- North America: Dominates owing to high healthcare spending, advanced infrastructure, and stringent regulatory pathways. The U.S. accounts for roughly 35% of the market share.

- Europe: Steady growth driven by antimicrobial stewardship programs and research initiatives.

- Asia-Pacific: The fastest-growing segment, projecting a CAGR of approximately 8%, driven by increasing infection rates and expanding healthcare access.

Competitive Dynamics

Major Manufacturers

- Hospira (Pfizer): Historically leading with a broad portfolio of injectable antibiotics.

- Sagent Pharmaceuticals: Focused on generic sterile injectables, including amikacin sulfate.

- Eurofarma, Zydus Cadila, and Biocon: Prominent regional players expanding presence in emerging markets.

Market Entry Barriers

- Regulatory hurdles: Stringent approval processes in developed markets (FDA, EMA).

- Manufacturing complexity: Ensuring sterile, high-quality production compliant with Good Manufacturing Practices (GMP).

- Pricing pressures: Increasing emphasis on generic markets and price-sensitive regions.

Regulatory and Patent Landscape

Amikacin sulfate is generally classified as a generic drug, with many formulations approved in both developed and developing countries. While no active patents substantially restrict production, certain formulations or delivery systems might be under regional patent protections or exclusivities, influencing market entry and pricing strategies.

Regulatory agencies like the FDA approve generic versions based on bioequivalence, facilitating market penetration. However, evolving antimicrobial stewardship policies and safety profiles influence formulations’ approval timelines and market stability.

Pricing Trends and Dynamics

Current Pricing Landscape

- Generic availability: Costs vary significantly across regions, with wholesale prices ranging from USD 0.20 to USD 1.00 per vial depending on the formulation and manufacturer.

- Brand vs. generic: Branded formulations often command 20-30% premium over generics, though the trend is shifting towards commoditized pricing.

Influencing Factors

- Manufacturing costs: Raw material prices and quality compliance significantly impact pricing.

- Market competition: Increased generics lead to downward pressure on prices.

- Procurement policies: Government hospitals and insurance plans often negotiate prices, influencing supply chain dynamics.

- Regulatory costs: Costs associated with approvals and compliance can add to the final pricing, especially in high-regulation markets.

Price Projection Outlook (2023-2028)

Based on current trends and anticipated demand surge, the following projections emerge:

-

Short term (1-2 years): Prices for standard generic amikacin sulfate vials are expected to remain relatively stable, averaging USD 0.20 – USD 0.35 per vial in Western markets, with slight fluctuations due to supply chain variables and raw material costs.

-

Mid to long term (3-5 years): Prices may experience a moderate decline of 5-10% driven by increased generic competition and further market penetration in emerging regions. However, supply chain constraints, such as raw material shortages, could temporarily stabilize or increase prices.

-

Influence of new formulations: Introduction of liposomal or IV infusion-ready formulations may command premium pricing, potentially ranging USD 1.50 – USD 3.00 per dose, adjusting for convenience and enhanced safety profiles.

Impact of Market Shifts

- Antimicrobial stewardship initiatives could exert downward pressure on prices by reducing unnecessary use.

- Emergence of resistance patterns may increase demand temporarily, supporting stable or higher prices.

- Biotechnology advancements and patenting of novel delivery systems could sustain higher price points for specialized formulations.

Strategic Considerations for Stakeholders

- Manufacturers should focus on cost optimization, pipeline diversification, and regional regulatory navigation to capitalize on growth.

- Investors must monitor regional healthcare investments and resistance trends to identify lucrative markets.

- Distributors and healthcare providers benefit from understanding regional pricing variations and supply chain risks to optimize procurement strategies.

Key Takeaways

- The amikacin sulfate market is poised for steady expansion, driven by rising antimicrobial resistance and global healthcare needs.

- Generic formulations dominate pricing, with stable current costs and potential slight declines due to competitive pressures.

- Emerging markets represent significant growth opportunities, though regulatory complexities and supply chain considerations remain barriers.

- Innovations in formulation and delivery methods could create premium price segments, balancing volume-driven revenues.

- Close monitoring of resistance patterns and stewardship policies is essential for adjusting pricing and marketing strategies.

FAQs

Q1: What are the primary factors influencing the price of amikacin sulfate?

Raw material costs, manufacturing expenses, regional regulations, competition among generics, and supply-demand dynamics significantly influence pricing.

Q2: How will antimicrobial resistance trends impact the market for amikacin sulfate?

Rising MDR bacteria increase demand, potentially stabilizing or raising prices temporarily, while stewardship efforts can reduce unnecessary usage, applying downward pressure.

Q3: Are there patent restrictions on amikacin sulfate?

Most amikacin sulfate formulations are off-patent, allowing multiple generic manufacturers to produce competing products, which typically reduces prices.

Q4: Which regions are expected to experience the fastest growth in amikacin sulfate demand?

The Asia-Pacific region is projected to see the most rapid expansion due to increased healthcare infrastructure and infection rates.

Q5: What future innovations could influence amikacin sulfate pricing?

Development of liposomal or targeted delivery systems, combination therapies, and formulations with improved safety profiles could command higher prices.

References

[1] Market Research Future, "Aminoglycoside Antibiotics Market Overview," 2022.

More… ↓