Last updated: July 27, 2025

Introduction

AMBIEN (zolpidem tartrate) stands as a leading prescription medication for insomnia, fabricated by distinct pharmaceutical companies, predominantly by Takeda Pharmaceuticals. Its market robustness stems from the persistent demand for effective sleep aids amidst increasing global insomnia prevalence. This analysis evaluates current market dynamics, competitive landscape, regulatory factors, and future pricing trajectories for AMBIEN, aligning insights to inform strategic decision-making within the pharmaceutical and healthcare sectors.

Market Landscape of AMBIEN

Global Incidence of Insomnia and Market Demand

Insomnia remains a widespread health issue globally, with estimates suggesting that approximately 10-30% of adults suffer from sleep disturbances annually, with a significant subset requiring pharmacological intervention [1]. The surge in insomnia cases spurred by lifestyle stressors, aging populations, and comorbid conditions fuels sustained demand for sleep aids like AMBIEN.

Market Segmentation and Key Geographic Regions

- North America: Dominates the global sleep aid market, accounting for roughly 40% of total revenue, driven by high prescription rates and insurance coverage.

- Europe: A mature market with steady growth, influenced by regulatory approvals and aging demographics.

- Asia-Pacific: Exhibits rapid growth potential due to rising awareness and expanding healthcare infrastructure.

Competitive Landscape

AMBIEN's primary competitors include other sedative-hypnotics such as zolpidem formulations (e.g., Ambien extended-release), eszopiclone, zaleplon, and non-benzodiazepine compounds like suvorexant. Generic versions of zolpidem have entered the market, exerting downward pressure on prices [2].

Regulatory Environment

AMBIEN’s patent exclusivity has historically supported premium pricing. However, patent expirations have led to increased generic manufacturing, challenging market share and pricing strategies. Regulatory obstacles mainly involve ensuring safety and abuse potential mitigation, especially considering concerns about dependence and sleep-related behaviors [3].

Current Pricing Dynamics

Brand vs. Generic Pricing

- Brand AMBIEN: In the U.S., a typical 30-count, 10 mg prescription costs approximately $250–$350 without insurance [4].

- Generic Zolpidem: Significantly cheaper, often around $10–$30 for similar quantities, catalyzing substitution and eroding brand revenue.

- Insurance and Formularies: Tend to favor generics, limiting brand drug market penetration unless prescribed under strict clinical indications.

Factors Influencing Price Stabilization

- Supply Chain Costs: Raw material availability influences prices, particularly amid pandemic-related disruptions.

- Regulatory Constraints: Stricter controls and label updates impact production costs.

- Market Penetration Strategies: Patent litigation defenses or reformulations aim to sustain premium pricing.

Future Price Projections

Impact of Patent Expiry and Generics

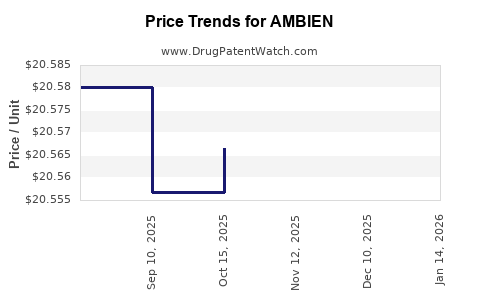

The last key patent for AMBIEN in the US expired around 2017, leading to an influx of generic zolpidem products. Consequently, the price of brand AMBIEN is expected to decline further, stabilizing at lower levels over the next five years. Market forecasts suggest:

- Brand AMBIEN: Anticipated to decline by approximately 10–15% annually, stabilizing at around $150–$200 for a 30-count, 10 mg supply.

- Generic Versions: Will likely dominate the market, with prices decreasing to $5–$10 per prescription set.

Potential for Reformulation and New Indications

Pharmaceutical companies may explore reformulations, combination therapies, or extended-release variants to command higher prices. Regulatory approval of new indications (e.g., bipolar disorder sleep management) could also temporarily bolster pricing.

Market Factors Driving Price Trends

- Consumer Awareness: Increased awareness of dependence risks may influence prescriber preferences.

- Reimbursement Policies: Shifts favoring cost-effective generics will suppress brand pricing.

- Emergence of Novel Sleep Therapeutics: Rise of non-benzodiazepine agents with better safety profiles could reduce AMBIEN's market share and price.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Must adapt to declining brand prices by innovating or shifting focus to niche formulations.

- Healthcare Providers: Need to balance efficacy, safety, and cost when prescribing sleep medications.

- Policymakers and Insurers: Should promote equitable access to affordable sleep aids while mitigating abuse potential.

Key Trends and Predictions

- Price erosion for AMBIEN will persist, with the brand’s value diminishing as generics dominate.

- Market share will align increasingly with non-brand formulations, emphasizing the importance of formulation differentiation.

- Emerging therapeutic categories—like orexin antagonists—may further influence AMBIEN's market position, leading to a gradual price decline.

- Reformulation and indication expansion could temporarily arrest price erosion but are unlikely to restore initial premium levels.

- Policy shifts towards prescription monitoring could further limit abuse, impacting demand dynamics and pricing.

Conclusion

AMBIEN's current market holds a mature profile characterized by declining premium pricing due to patent expirations and the proliferation of generics. Future pricing will predominantly be dictated by generic competition, regulatory influences, and evolving consumer preferences. Stakeholders should strategically leverage differentiation, innovation, and market diversification to sustain profitability amid these dynamics.

Key Takeaways

- The global insomnia market sustains high demand but exerts downward pressure on AMBIEN’s brand pricing owing to generics.

- Patent expirations catalyzed a sharp decline in AMBIEN’s average selling prices, a trend projected to continue.

- Price stabilization will occur at significantly lower levels, emphasizing the necessity for innovation and market differentiation.

- Regulatory trends prioritizing safety and abuse mitigation influence market access and pricing strategies.

- Emerging sleep therapeutics and reformulation options may temporarily enhance pricing, but long-term outlook favors generic dominance.

FAQs

1. What factors primarily influence AMBIEN’s market price?

Market price is mainly affected by patent status, generic competition, manufacturing costs, regulatory constraints, and prescription volume trends.

2. How has patent expiration impacted AMBIEN’s pricing?

Patent expiry led to increased generic availability, causing a significant decline in brand pricing and market share erosion.

3. Are there regional differences in AMBIEN pricing?

Yes. North American markets tend to maintain higher prices due to stronger brand recognition and insurance coverage, whereas Europe and Asia-Pacific experience more competitive, lower prices.

4. What future developments could influence AMBIEN’s market prices?

Introduction of reformulated versions, new indications, or alternative sleep aids can alter competitive dynamics, impacting prices.

5. How should stakeholders prepare for the evolving sleep aid market?

Focus on innovation, diversify portfolio offerings, monitor regulatory changes, and consider strategic pricing adjustments aligned with generics’ proliferation.

References

[1] National Sleep Foundation. (2022). Sleep Health Index.

[2] IQVIA. (2022). Market Share and Pricing Reports.

[3] U.S. Food and Drug Administration. (2020). Regulatory Guidance on Sedative-Hypnotics.

[4] GoodRx. (2022). Zolpidem (Ambien) Price Comparisons.