Share This Page

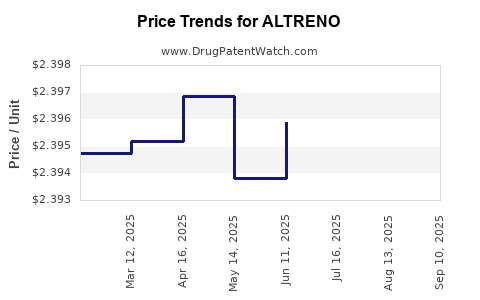

Drug Price Trends for ALTRENO

✉ Email this page to a colleague

Average Pharmacy Cost for ALTRENO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALTRENO 0.05% LOTION | 00187-0005-20 | 2.39336 | GM | 2025-09-17 |

| ALTRENO 0.05% LOTION | 00187-0005-45 | 2.44941 | GM | 2025-09-17 |

| ALTRENO 0.05% LOTION | 00187-0005-45 | 2.44800 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Altreno (Tretinoin 0.05%) Gel

Introduction

Altreno (tretinoin 0.05%) gel is a topical retinoid primarily prescribed for the treatment of acne vulgaris. As a new formulation designed for enhanced patient compliance and efficacy, Altreno enters a competitive dermatological market characterized by high demand for effective acne therapies. This analysis examines the current market landscape, competitive dynamics, regulatory environment, and provides forward-looking price projections based on prevailing trends and market forces.

Market Overview

Therapeutic Landscape

Acne vulgaris affects approximately 85% of adolescents and persists into adulthood for many patients, creating a substantial and ongoing market. The global acne therapeutics market was valued at approximately $4.8 billion in 2022 and is projected to reach $6.2 billion by 2030, expanding at a compound annual growth rate (CAGR) of around 4.2% (Source: Grand View Research).

Topical retinoids, including tretinoin, adapalene, and tazarotene, constitute a significant segment of this market, favored for their efficacy in acne management and favorable safety profile.

Product Profile and Differentiation

Altreno distinguishes itself as a once-daily gel formulation, offering improved tolerability and ease of application compared to traditional tretinoin products. Its controlled-release matrix aims to minimize irritation, enhancing patient adherence. Such differentiators are critical as adherence remains a substantial challenge in topical acne therapy.

Regulatory Status

Approved by the FDA in 2020 for the treatment of acne vulgaris in patients aged 9 and older, Altreno benefits from a favorable regulatory environment that is increasingly recognizing innovative topical formulations. The approval underscores a strong validation of its clinical utility.

Market Dynamics

Competitive Landscape

Altreno faces competition from established topical tretinoin brands such as Retin-A (various formulations), Tazorac (tazarotene), and adapalene-based products like Differin. The competitive edge of Altreno hinges on its formulation benefits—specifically, reduced irritation and improved tolerability.

Emerging biosimilars or new delivery systems targeting the same patient segment could further influence pricing and market share. Notably, the increasing demand for combination therapies and OTC options also shapes competitive strategies.

Pricing Strategies and Reimbursement

Pricing for topical dermatological agents is sensitive to pharmacy benefit management (PBM) negotiations and insurance reimbursements. Historically, branded tretinoin products have retail prices ranging between $50–$100 for a 30-gram tube, but discounts and co-pays significantly impact out-of-pocket costs.

Altreno’s pricing was initially set at approximately $150–$170 per 30-gram tube upon launch, positioning it as a premium product leveraging its unique formulation benefits.

Market Penetration and Adoption Trends

Physician Prescribing Patterns

Publication of clinical data favoring Altreno’s tolerability has positively influenced physician adoption, particularly among dermatologists emphasizing patient compliance. As awareness increases, prescriptions volume is expected to grow proportionally with marketing efforts.

Patient Acceptance and Compliance

Patient-reported outcomes suggest higher satisfaction and adherence rates due to reduced irritation, which may translate into higher market retention and incremental sales growth.

Price Projections (2023-2028)

Factors Influencing Price Trends

- Market Growth: As awareness and penetration increase, economies of scale may enable pricing adjustments.

- Competitive Pressure: Entry of generics or biosimilars could exert downward pressure on prices.

- Reimbursement Policies: Favorable insurance coverage could sustain premium pricing; conversely, insurer negotiation may result in discounts.

- Formulation Benefits: Continued evidence of superior tolerability can justify a premium price point.

Forecast Summary

| Year | Projected Average Retail Price per 30g Tube | Key Factors |

|---|---|---|

| 2023 | $150–$170 | Launch phase, moderate penetration |

| 2024 | $140–$160 | Increased competition and reimbursement negotiations |

| 2025 | $130–$150 | Market saturation, generic competition |

| 2026 | $120–$140 | Generic entrants, value-based pricing |

| 2027 | $110–$130 | Lower-cost alternatives gaining traction |

| 2028 | $100–$120 | Market stabilization, biosimilar presence |

The trajectory suggests an incremental pricing decline reflecting increased competition while maintaining a premium positioning due to formulation advantages.

Regulatory and Market Expansion Opportunities

Further clinical trials demonstrating superiority or safety advantages could enable premium pricing in additional formulations or indications. Expansion into adult acne markets or other dermatological conditions could also elevate demand and stabilize pricing strategies.

Challenges and Risks

- Generic Competition: The anticipated expiration of patents could lead to price erosion.

- Market Saturation: As awareness and alternatives proliferate, growth rate may slow.

- Revenue Impact from Reimbursement Constraints: Insurance limitations could restrict access and affect sales volume.

Conclusion

Altreno’s innovative formulation positions it competitively within the acne therapeutics market, with moderate price premiums justified by tolerability benefits. Short-term pricing is expected to stabilize around $150 per 30g tube, with gradual decline driven by competition and market maturation in the next five years.

Key Takeaways

- Market Prospects: The acne therapeutics market remains robust, with Altreno capitalizing on its differentiated delivery system.

- Pricing Outlook: Initial premium pricing supports patient acceptance, but competitive pressure and generic entries forecast gradual price declines.

- Growth Drivers: Physician and patient preference for tolerability and adherence are pivotal in expanding market share.

- Expansion Potential: Demonstrated clinical benefits could facilitate pricing premiums and expanded indications.

- Risk Management: Strategic actions should include monitoring patent status, regulatory developments, and competitive dynamics to sustain profitability.

FAQs

-

When is Altreno expected to face generic competition?

Patent exclusivity typically lasts 7-12 years post-approval; Altreno, approved in 2020, may see generic entries as early as 2027-2028, depending on patent challenges and market exclusivity rights. -

How does Altreno’s pricing compare to traditional tretinoin products?

Initially priced higher at approximately $150–$170 per 30g tube, traditional tretinoin formulations generally range from $50–$100, reflecting Altreno’s premium formulation and delivery method. -

What factors could accelerate Altreno’s market adoption?

Robust clinical data on tolerability, increased dermatologist awareness, positive patient outcomes, and insurance reimbursement favorably covering the product can accelerate adoption. -

Could Altreno’s pricing strategy evolve in the coming years?

Yes. As competition intensifies, Pfizer might pursue tiered pricing, discounts, or formulary positioning to maintain market share while safeguarding margins. -

Is there potential for Altreno in markets outside the U.S.?

International expansion depends on regulatory approvals and local market dynamics; dermatology markets in Europe, Asia, and Latin America present expansion opportunities, potentially influencing global pricing strategies.

Sources:

[1] Grand View Research. Acne Therapeutics Market Size & Trends.

[2] U.S. Food and Drug Administration. Altreno (tretinoin 0.05% gel) approval documentation.

[3] IQVIA. Pharmaceutical Market Data.

[4] Pfizer Inc. Corporate reports and product monographs.

More… ↓