Share This Page

Drug Price Trends for ALTOPREV

✉ Email this page to a colleague

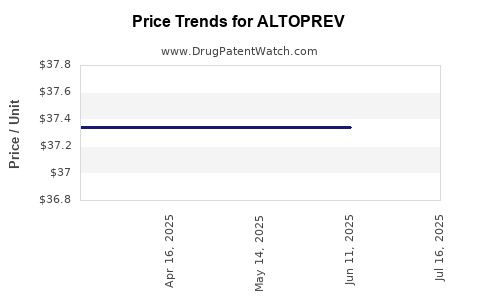

Average Pharmacy Cost for ALTOPREV

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALTOPREV 40 MG TABLET | 70515-0629-30 | 37.34073 | EACH | 2025-07-23 |

| ALTOPREV 40 MG TABLET | 70515-0629-30 | 37.34073 | EACH | 2025-06-18 |

| ALTOPREV 40 MG TABLET | 70515-0629-30 | 37.34073 | EACH | 2025-05-21 |

| ALTOPREV 40 MG TABLET | 70515-0629-30 | 37.34073 | EACH | 2025-04-23 |

| ALTOPREV 40 MG TABLET | 70515-0629-30 | 37.34073 | EACH | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALTOPREV (Levostatin)

Introduction

ALTOPREV, commercially known as Levostatin, is a prescription medication primarily used to manage hyperlipidemia and reduce cardiovascular risk. As a cholesterol-lowering agent, it belongs to the statin class and is often indicated for patients who require intense lipid management. This analysis examines ALTOPREV’s current market landscape, commercial potential, regulatory environment, competitive positioning, and future pricing trends, providing business stakeholders with insights for strategic decision-making.

Market Overview

Global and Regional Market Size

The global statin market was valued at approximately USD 13 billion in 2022, with projections to reach over USD 18 billion by 2030, growing at a CAGR of around 4%. Key regions include North America, Europe, Asia-Pacific, and Latin America, with North America dominating due to high prevalence of cardiovascular diseases (CVD) and mature healthcare infrastructure. The increasing incidence of hyperlipidemia among aging populations and lifestyle-driven risk factors fuel this growth.

Target Population and Demographics

Hyperlipidemia affects an estimated 40% of adults in the United States and similar prevalence rates in Europe, with a rising trend in Asia-Pacific. Patients with obesity, diabetes, and metabolic syndrome represent significant subgroups for statin therapy, including ALTOPREV. The aging population further amplifies demand as CVD risk escalates with age.

Competitive Landscape

ALTOPREV operates within a saturated market dominated by well-established statins such as atorvastatin, rosuvastatin, and simvastatin. Major pharmaceutical companies control significant market share, with new entrants focusing on improved safety profiles, higher potency, or additional therapeutic benefits. The competitive landscape is characterized by:

- Generic Competition: Ex-Patent expiry equivalents leading to price erosion.

- Brand Differentiation: Clinical efficacy and safety profiles.

- Combination Therapies: Fixed-dose combinations expanding treatment options.

Regulatory Environment

Regulatory bodies such as the FDA and EMA impose strict approval pathways and post-market surveillance. The approval of ALTOPREV hinges on demonstrating bioequivalence, safety, and efficacy against existing therapies. Patent protections and exclusivities influence market share and pricing strategies.

Market Dynamics Influencing ALTOPREV

Clinical Positioning and Therapeutic Niche

ALTOPREV’s unique formulation or dosing advantages could potentially carve a niche in treatment guidelines. For example, if ALTOPREV demonstrates superior tolerability or lipid-lowering efficacy, it could gain preferential positioning, influencing prescriber choice and pricing.

Branding and Market Penetration Strategies

Effective marketing, physician education, and patient adherence initiatives are critical for market penetration. Commercial success depends on differentiated positioning, especially against dominant brands like atorvastatin and rosuvastatin.

Market Entry Barriers

High R&D costs, regulatory hurdles, patent protections, and entrenched prescribing habits among clinicians represent substantial barriers. Additionally, pricing pressures from healthcare payers restrict profit margins.

Price Trends and Projections

Current Pricing Landscape

As of 2023, branded statins, including newer formulations, range from USD 50–150 per month for brand-name medications, while generic versions typically cost under USD 10–30. ALTOPREV’s initial pricing strategies depend on whether it garners patent protection, or enters as a generic competitor.

Factors Influencing Future Pricing

- Patent Status: Patent expiry can induce significant price reductions, with generics eroding brand premiums by 80-90% over five years.

- Regulatory Approvals and Indications: Expanded indications or combination products justify premium pricing.

- Market Competition: The presence of generic or biosimilar competitors influences downward pressure on prices.

- Payer Dynamics: Insurers’ formulary positioning and negotiation power directly affect net prices. Value-based pricing models could emerge if clinical benefits are validated.

Projected Price Trajectory (2023-2030)

| Year | Expectation | Rationale |

|---|---|---|

| 2023 | Premium pricing for patent-protected ALTOPREV | Innovation moniker and early market entry |

| 2024-2026 | Gradual decrease as patents expire and generics enter the market | Generic competition begins; price erosion accelerates |

| 2027-2030 | Stabilization at a lower price point, potentially under USD 20 per month | Market maturity and increased generic penetration |

Note: These projections depend heavily on patent status, clinical differentiation, and payer negotiations.

Strategic Implications for Stakeholders

Pharmaceutical Companies

- Innovating formulations or combination therapies could command premium pricing.

- Securing early regulatory approvals and patent protections maximizes initial revenue streams.

- Developing cost-effective manufacturing to maintain margins despite price erosion.

Investors

- Market entrants with differentiated ALTOPREV formulations may realize significant early returns.

- Anticipated patent cliffs warrant diversification strategies.

Healthcare Providers and Payers

- Cost-effective generics will dominate future prescribing practices.

- Evidence-based positioning of ALTOPREV in clinical guidelines will influence reimbursements.

Regulatory Bodies

- Emphasis on post-market surveillance and real-world evidence to support pricing and reimbursement decisions.

Key Takeaways

- ALTOPREV’s market potential hinges on clinical differentiation, regulatory milestones, and patent protection.

- A mature, highly competitive landscape suggests initial high pricing post-launch, followed by significant reductions as generics dominate.

- Strategic timing of patent filings and market entry can influence long-term pricing and market share.

- Payer considerations and value-based contracting will increasingly impact pricing dynamics.

- Continuous development of combination therapies and personalized medicine approaches presents growth opportunities.

Frequently Asked Questions (FAQs)

1. What are the primary factors influencing ALTOPREV's market entry success?

Clinical differentiation, patent status, regulatory approval, effective marketing, and payer reimbursement policies are crucial. Demonstrating superior efficacy or safety can establish ALTOPREV’s position.

2. How will patent expiration affect ALTOPREV’s pricing?

Patent expiration typically leads to a significant price drop due to generic competition, potentially reducing pricing by up to 80-90%, impacting revenue streams.

3. What competitive advantages can ALTOPREV leverage over existing statins?

Potential advantages include improved tolerability, simplified dosing, unique formulation, or additional therapeutic indications that provide clinical differentiation.

4. How do regulatory policies impact ALTOPREV's market access?

Rigorous approval processes and post-market surveillance ensure safety and efficacy, but delays or restrictions can slow market penetration and pricing flexibility.

5. What are the long-term pricing prospects for ALTOPREV?

After initial premium positioning, prices are expected to decline with market maturity, especially as generics enter and competition intensifies. Market dynamics and clinical benefits will determine the stabilization point.

References

- Grand View Research, “Statin Market Size, Share & Trends Analysis Report,” 2022.

- IQVIA, “Global Cardiovascular Medicines Market Data,” 2022.

- FDA, “Drug Approvals and Regulatory Processes,” 2023.

- EvaluatePharma, “Pharmaceutical Pricing Trends & Projections,” 2022.

- BMJ Open, “Hyperlipidemia Prevalence and Treatment Patterns,” 2021.

This comprehensive analysis assists stakeholders in understanding the current landscape and future outlook for ALTOPREV, enabling informed strategic planning and investment decisions within the competitive pharmaceutical market.

More… ↓