Share This Page

Drug Price Trends for ALTACE

✉ Email this page to a colleague

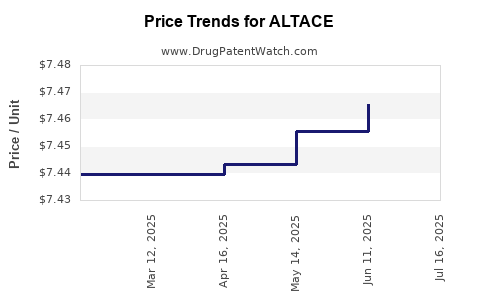

Average Pharmacy Cost for ALTACE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALTACE 10 MG CAPSULE | 61570-0120-01 | 7.46293 | EACH | 2025-07-23 |

| ALTACE 10 MG CAPSULE | 61570-0120-01 | 7.46543 | EACH | 2025-06-18 |

| ALTACE 10 MG CAPSULE | 61570-0120-01 | 7.45574 | EACH | 2025-05-21 |

| ALTACE 10 MG CAPSULE | 61570-0120-01 | 7.44350 | EACH | 2025-04-23 |

| ALTACE 10 MG CAPSULE | 61570-0120-01 | 7.43961 | EACH | 2025-03-19 |

| ALTACE 10 MG CAPSULE | 61570-0120-01 | 7.43961 | EACH | 2025-02-19 |

| ALTACE 10 MG CAPSULE | 61570-0120-01 | 7.43961 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALTACE (Ramipril)

Introduction

ALTACE, the brand name for Ramipril, is an angiotensin-converting enzyme (ACE) inhibitor primarily prescribed for hypertension, congestive heart failure, and the prevention of cardiovascular events. Since its FDA approval in 1989, ALTACE has established a significant foothold in the global cardiovascular therapeutic market. This analysis explores the current market dynamics, competitive landscape, regulatory considerations, and price projections for ALTACE over the next five years.

Market Overview and Dynamics

Global Market Size and Growth

The global hypertensive therapies market was valued at approximately $23.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of about 3.4% from 2023 to 2028 (Fortune Business Insights). Given ALTACE's positioning as a staple ACE inhibitor, it retains a substantial share within this market; however, patent expirations and generics influence its market trajectory.

Key Therapeutic Indications

- Hypertension management

- Heart failure treatment

- Post-myocardial infarction risk reduction

- Diabetic nephropathy prophylaxis

Market Drivers

- Increasing prevalence of hypertension and cardiovascular diseases globally

- Growing geriatric population with higher cardiovascular risk

- Positive clinical outcomes associated with ACE inhibitors

- Expanding healthcare infrastructure in emerging markets

Market Challenges

- Patent expiry driving generic competition, reducing brand-name drug sales

- Availability of newer, branded alternatives with improved tolerability

- Concerns regarding adverse effects, such as cough and hyperkalemia

- Pricing pressures from payers to reduce drug costs

Competitive Landscape

ALTACE faces intense competition, especially from generic formulations of Ramipril and other ACE inhibitors like Lisinopril, Enalapril, and Perindopril. Several pharmaceutical companies have entered the market to capitalize on the aging population's needs, leading to price wars and margin compression.

Notably, Novartis, the original patent holder, lost patent exclusivity for ALTACE/Ramipril in many jurisdictions by the early 2000s, leading to wide availability of generics that now dominate sales volumes [1].

Regulatory Environment

The entry of generics post-patent expiry has significantly lowered price barriers. However, regulatory scrutiny prevents potential price gouging and mandates transparency in pricing, especially in regions like the European Union and the United States.

The U.S. FDA classifies Ramipril as a generic drug, enabling multiple manufacturers to produce bioequivalent versions. International markets, such as India and China, have rapid approval processes for generics, further intensifying price competition globally.

Pricing Trends and Projections

Historical Price Trends

- Brand-name ALTACE (Ramipril): In the US, the average retail price per 30-day supply circa 2015 hovered around $350-$400.

- Generics: Post-patent expiration, prices declined sharply, often reaching $10-$30 per month (GoodRx, 2022 data).

Current Market Prices

- United States: Generic Ramipril available at approximately $10-$20 per month (depending on the pharmacy and dosage).

- Europe and other markets: Prices vary widely but generally follow similar trends with lower costs due to regional pricing regulations.

Future Price Projections (2023-2028)

Given the entrenched presence of generics, further significant price reductions for ALTACE are unlikely. Instead, pricing will stabilize or experience modest declines driven by:

- Increased market saturation

- Competitive pressure from multiple generic manufacturers

- Price negotiations by healthcare systems and payers

Projected average monthly cost for generic Ramipril in mature markets is expected to remain in the $10-$15 range through 2028, with minimal variability.

The brand-name ALTACE may retain a premium in select markets or hospitals, but with declining sales volumes, its price is projected to decline gradually or maintain premium status only in niche segments.

Market Opportunities and Strategic Considerations

-

Emerging Markets: Rising income levels and the expansion of health insurance schemes can drive growth for ALTACE’s generics, although intense pricing competition is expected.

-

Combination Therapies: There is a rising trend toward fixed-dose combinations involving ACE inhibitors, which could influence future formulations and pricing strategies.

-

Biosimilars and Innovator Alternatives: While biosimilars are less relevant for small-molecule drugs like Ramipril, patent and exclusivity periods for new formulations (e.g., sustained-release variants) may create niche pricing windows.

Risk Factors and Market Limitations

- Regulatory hurdles in different jurisdictions can delay market entry or impact pricing.

- Pricing regulations in countries like Canada, the UK, and Australia, where government-controlled prices are common, could pressurize margins.

- Emergence of novel antihypertensive agents with superior side-effect profiles may cannibalize Altace’s market share.

Key Takeaways

- ALTACE/Ramipril remains a cornerstone therapy for cardiovascular risk management but faces a shrinking market share due to generic competition.

- Prices for generic Ramipril are anticipated to stabilize around $10-$15 per month across major markets through 2028.

- The overall market for ACE inhibitors will grow modestly driven by aging populations, but price erosion will continue for older drugs like ALTACE.

- Manufacturers and healthcare providers should focus on cost-effective prescribing, optimizing the value of generic formulations to stay competitive.

- Strategic investments into combination therapies and novel formulations may offer differentiation and opportunities amid declining traditional sales.

FAQs

1. Will ALTACE’s price increase in the next five years?

No, due to widespread generic availability and market saturation, ALTACE’s prices are expected to remain stable or decline slightly, with no significant price increases forecasted.

2. How does patent expiry affect ALTACE pricing?

Patent expiry in the early 2000s opened the market to numerous generic manufacturers, drastically reducing prices and eroding brand-name ALTACE’s market share.

3. Are there regulatory barriers impacting ALTACE’s price projections?

Most regions have regulatory frameworks favoring generic competition, which constrains pricing. Regulatory approval of biosimilars is less relevant for small molecules like Ramipril.

4. What emerging markets offer growth opportunities for ALTACE?

Countries with expanding healthcare infrastructure such as India, China, and Brazil present growth opportunities, although price competition remains intense.

5. Could new formulations or combination drugs revive ALTACE’s market?

Potentially. Fixed-dose combinations or sustained-release versions might offer niche advantages, but these are less likely to impact pricing significantly unless they address unmet clinical needs.

References

- Fortune Business Insights. "Hypertensive Therapies Market Size, Share & Industry Analysis, 2023-2028."

- GoodRx. "Ramipril Prices and Medications."

- U.S. Food and Drug Administration (FDA). "Approved Drug Products with Therapeutic Equivalence Evaluations."

- Market Research Future. "ACE Inhibitors Market Analysis."

- IQVIA. "Pharmaceutical Market Data and Trends."

In conclusion, ALTACE’s market landscape is characterized by mature generic markets with stable yet declining prices. Stakeholders should focus on cost containment and innovation strategies to maintain competitiveness amid ongoing generics proliferation.

More… ↓