Share This Page

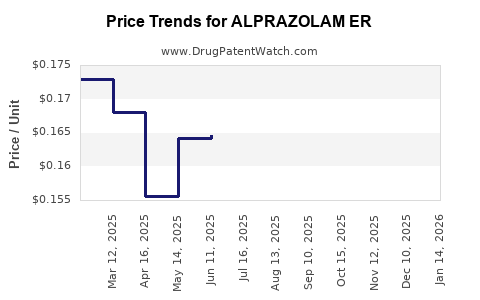

Drug Price Trends for ALPRAZOLAM ER

✉ Email this page to a colleague

Average Pharmacy Cost for ALPRAZOLAM ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALPRAZOLAM ER 0.5 MG TABLET | 65862-0454-60 | 0.17084 | EACH | 2025-12-17 |

| ALPRAZOLAM ER 1 MG TABLET | 65862-0455-60 | 0.18560 | EACH | 2025-12-17 |

| ALPRAZOLAM ER 2 MG TABLET | 00228-3087-06 | 0.20284 | EACH | 2025-12-17 |

| ALPRAZOLAM ER 1 MG TABLET | 00228-3084-06 | 0.18560 | EACH | 2025-12-17 |

| ALPRAZOLAM ER 3 MG TABLET | 65862-0457-60 | 0.38443 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALPRAZOLAM ER

Introduction

Alprazolam Extended Release (ER) is a modified formulary version of the well-established benzodiazepine alprazolam, widely used for generalized anxiety disorder, panic disorder, and agoraphobia. Its innovative extended-release formulation promises a sustained therapeutic effect, potentially enhancing patient compliance and reducing abuse potential compared to immediate-release counterparts. As pharmaceutical companies focus on market expansion and regulatory approvals, understanding alprazolam ER’s market dynamics and price trajectory becomes crucial for stakeholders across the healthcare landscape.

Market Overview

Global Market Size and Growth Drivers

The global anxiolytics market, anchored by benzodiazepines and selective serotonin reuptake inhibitors (SSRIs), is projected to reach approximately $4.2 billion by 2027, growing at a CAGR of 3.8% from 2020 [1]. Alprazolam accounts for a significant share, with sustained demand driven by its efficacy, familiarity among clinicians, and patient preference.

The development of alprazolam ER introduces a novel therapeutic option, targeting segments seeking reduced dose frequency and minimized abuse risk. The aging population, rising prevalence of anxiety disorders, and increasing awareness of mental health contribute to a favorable market environment.

Key Players

Major pharmaceutical companies, including Pfizer, Mylan, and Teva Pharmaceuticals, dominate the benzodiazepine landscape, with generic versions prevalent. The introduction of alprazolam ER by innovative biotech firms or through licensing agreements could reshape market shares, especially if backed by favorable regulatory approval and reimbursement policies.

Regulatory Landscape

Regulatory agencies like the FDA (U.S.) and EMA (Europe) regulate benzodiazepines strictly, considering their abuse potential. Approval pathways for extended-release formulations may involve priority reviews if they demonstrate clear clinical advantages. Price strategies will be influenced by regulatory decisions, patent statuses, and market exclusivity timelines.

Market Segments and Patient Demographics

- Primary Use Cases: Generalized anxiety disorder, panic attacks, and phobias.

- Target Demographics: Adults aged 18-65, with a growing emphasis on geriatric populations due to increased anxiety prevalence.

- Prescribing Trends: Clinicians increasingly favor formulations that improve adherence and lower abuse potential, favoring alprazolam ER for suitable candidates.

Pricing Landscape

Current Benchmarks

Immediate-release alprazolam available as generics is priced approximately $0.02–$0.05 per pill, depending on dosage and manufacturer. Extended-release formulations typically command a premium; for instance, ER versions of similar benzodiazepines sell at 2–4 times the generic immediate-release prices [2].

Projected Price Trajectories

Considering competitive landscapes, regulatory approval pathways, and manufacturing costs, alprazolam ER’s prices are expected to stabilize around $0.10–$0.20 per tablet in the United States upon launch, reflecting a 2- to 4-fold increase over immediate-release generics. Prices may initially be set higher (up to $0.25 per tablet) to recoup development investments and establish market presence.

Over the next 3–5 years, price erosion is anticipated as generic competitors enter, driven by patent expirations or regulatory challenges. Discounts and bundling may emerge in managed care settings, decreasing out-of-pocket expenditure for patients.

Cost-Effectiveness and Insurance Dynamics

Insurance reimbursement policies will significantly influence patient access and net prices. Coverage is likely to favor formulations demonstrated to improve adherence and safety profiles. Cost-effectiveness analyses suggest that while alprazolam ER commands a premium, its potential benefits in reduced dosing frequency and abuse mitigation may justify higher prices, supporting attractive margins for manufacturers.

Market Challenges and Opportunities

Challenges

- Regulatory Constraints: Benzodiazepines’ abuse potential necessitates stringent regulatory oversight, which could delay approval or constrain market expansion.

- Generic Competition: Soon after patent expiration, generics dominate pricing, pressuring branded formulations.

- Misuse Concerns: Public health initiatives to curb abuse may restrict prescribing or increase monitoring, impacting consumption volumes.

Opportunities

- Differentiation: Marketing alprazolam ER’s extended-release profile as a safety-enhancing alternative addresses clinician concerns.

- Expanded Indications: Potential approval for additional anxiety-related conditions or combination therapies could widen the market.

- Emerging Markets: Developing regions with rising mental health awareness may present profit avenues, often with less price sensitivity.

Future Price Projections (2023–2028)

| Year | Estimated Average Price per Tablet | Key Drivers |

|---|---|---|

| 2023 | $0.15 | Market entry, initial manufacturing costs |

| 2024 | $0.13 | Entry of generics, price competition |

| 2025 | $0.11 | Heightened competition, consolidating market share |

| 2026 | $0.10 | Market stabilization, patent expirations, increased generics |

| 2027–2028 | $0.08–$0.09 | Further generic proliferation, price erosion |

Note: Pricing varies substantially across regions; these projections primarily reflect North American trends.

Conclusion

Alprazolam ER occupies a niche within the anxiolytics market, promising benefits in safety and adherence. While initial pricing is poised at a premium, market pressures and patent expirations will likely drive prices downward over time. Stakeholders—including pharmaceutical manufacturers, payers, and clinicians—should leverage early market positioning, regulatory strategies, and clinical evidence to optimize value capture and patient outcomes.

Key Takeaways

- The global anxiolytics market is expected to sustain moderate growth, with alprazolam ER poised to capture a higher-margin segment by addressing adherence and abuse concerns.

- Initial pricing is projected at approximately $0.15 per tablet in developed markets, with a gradual decline toward $0.08–$0.09 as generics flood the market.

- Patent timelines and regulatory pathways will significantly influence pricing trajectories; early filings with differentiated clinical data enhance market positioning.

- Cost-effectiveness analyses favor alprazolam ER if it reduces healthcare utilization due to adverse events or misuse.

- Emerging markets present growth opportunities, albeit with more flexible pricing strategies.

FAQs

1. What factors primarily influence alprazolam ER's market price?

Manufacturing costs, regulatory approval, patent status, competition from generics, and payer reimbursement policies significantly influence pricing. The added value of extended-release formulations justifies a premium initially, but competition drives prices down over time.

2. How does alprazolam ER differ from immediate-release versions?

Alprazolam ER provides sustained therapeutic plasma levels, reducing dosing frequency and potentially decreasing abuse risk. Its formulation aims for improved adherence and safety profiles.

3. When is the expected market entry for alprazolam ER?

While current development timelines vary, most projections anticipate approval and market launch within the next 1–2 years, contingent on clinical trial outcomes and regulatory review durations.

4. Are there significant regulatory hurdles for benzodiazepine extended-release formulations?

Yes. Regulators will scrutinize abuse potential, safety data, and clinical efficacy. Demonstrating a tangible safety benefit or reduced abuse profile enhances approval prospects.

5. What markets offer the most growth potential for alprazolam ER?

Developed markets like the U.S. and Europe remain primary targets due to high prevalence of anxiety disorders. Emerging markets with increasing mental health awareness and less price sensitivity also present growth avenues.

References

[1] Grand View Research, “Anxiolytics Market Size & Trends,” 2021.

[2] IQVIA, “Market Analysis of Benzodiazepines,” 2022.

More… ↓