Last updated: July 27, 2025

Introduction

Alprazolam, marketed principally under the brand name Xanax, is a benzodiazepine widely prescribed for anxiety and panic disorders. Its high clinical demand, patent expirations, and regulatory developments significantly influence its market trajectory. This analysis examines the current landscape, competitive factors, regulatory environment, and generates price projections for Alprazolam over the next five years.

Market Overview

Global Market Size and Growth

The global anxiolytic market, within which Alprazolam figures prominently, was valued at approximately USD 5.2 billion in 2021, with projections estimating a compound annual growth rate (CAGR) of around 3.5% until 2028 [[1]]. Alprazolam remains one of the top prescribed benzodiazepines, especially in North America and parts of Europe, driven by rising mental health awareness, an aging population, and increased stress-related disorders.

Key Geographic Markets

- North America: Dominant market due to high prescription rates, advanced healthcare infrastructure, and regulatory acceptance.

- Europe: Steady growth with regulatory rigor, but constrained by medication restrictions.

- Asia-Pacific: Rapid expansion, driven by increased mental health awareness and growing pharmaceutical manufacturing capabilities.

Market Drivers

- Rising prevalence of anxiety disorders.

- Greater acceptance of benzodiazepines for short-term relief.

- Increased healthcare investments.

- Patent expirations of branded Alprazolam formulations, fostering generic market entry.

Market Challenges

- Regulatory restrictions: Stringent controls on benzodiazepine prescribing, especially amid concerns over addiction.

- Safety concerns: Side effects such as dependency and overdose risks.

- Shift toward non-benzodiazepine therapies: Increasing preference for SSRIs and novel anxiolytics.

Competitive Landscape

Patent and Market Exclusivity

Alprazolam’s original patent expired in many jurisdictions during the early 2010s, enabling a surge in generic formulations. The generic market is presently highly competitive, with multiple producers offering bioequivalent products at lower prices.

Generic Competition

The proliferation of generics has contributed to a significant decline in the price of Alprazolam in developed markets. Key manufacturers include Teva Pharmaceuticals, Mylan, and Sandoz, which collectively dominate distribution.

Brand vs. Generic Pricing

While brand-name Xanax commands premium prices (USD 5–10 per pill), generic versions typically sell for USD 1–3 per pill, depending on dosage and market.

Regulatory Environment and Trends

- U.S. FDA: Recognizes benzodiazepines as schedule IV controlled substances, leading to restrictions on prescription quantities.

- European Medicines Agency (EMA): Similar classifications with strict prescribing guidelines.

- Global regulatory tightening post the opioid crisis has increased oversight, potentially affecting prescribing behaviors and market volume.

Emerging trends include Enhanced Prescription Monitoring Programs (PDMPs), which impose stricter checks, possibly curtailing overprescription.

Price Projections (2023–2028)

Factors Influencing Prices

- Patent and Formulation Approvals: Introduction of controlled-release formulations and combination therapies.

- Regulatory Stringency: Stricter controls may reduce prescription volume but could underpin premium pricing for specialized formulations.

- Market Saturation and Generic Competition: Intense competition predicted to exert downward pressure on prices.

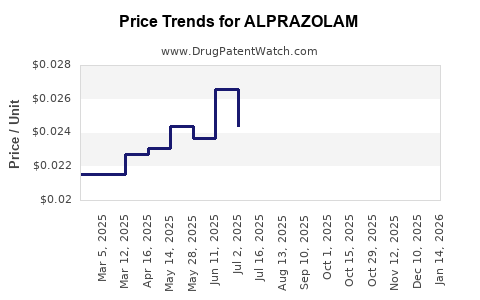

Projected Price Trends

- North America and Europe: Due to mature markets and high generic penetration, average per-unit prices are expected to decline by approximately 10–15% annually over the next five years.

- Emerging Markets: Potential for stable or slightly increasing prices, driven by low market penetration and regulatory variability.

Most Likely Scenario

A steady decline in unit price by 12% annually in developed regions, stabilizing at approximately USD 0.80–1.00 per pill for generic formulations by 2028. Market volume may plateau or decline due to regulatory restrictions and consumer shift toward alternative therapies.

Implications for Stakeholders

- Manufacturers: Need to innovate formulation delivery or explore new indications to sustain revenues.

- Investors: Market entry for generics remains attractive but with diminishing returns; portfolio diversification is advisable.

- Healthcare Providers: Must balance clinical efficacy with regulatory compliance and safety considerations.

Conclusion

The Alprazolam market is characterized by an evolving competitive environment, regulatory constraints, and declining prices driven by generic proliferation. While current demand remains high, the trajectory suggests a gradual price decline and market maturation over the next five years, emphasizing the importance of strategic positioning in both manufacturing and clinical deployment.

Key Takeaways

- The global Alprazolam market is mature with high generic competition, leading to persistent price erosion.

- Regulatory frameworks worldwide increasingly restrict benzodiazepine prescriptions, potentially limiting market volume.

- Generic formulations dominate, with prices expected to decline approximately 12% annually in developed regions.

- Innovation in formulation, indication expansion, or derivative development presents growth opportunities.

- Emerging markets offer opportunities for growth amid regulatory variability and lower initial market penetration.

FAQs

1. How will patent expirations impact Alprazolam prices in the next five years?

Patent expirations have facilitated widespread generic entry, substantially reducing prices in developed markets. This trend is expected to continue, with generic prices declining by around 12% annually, though some regional variations may occur.

2. Are there new formulations of Alprazolam in development?

Yes. Regulatory agencies are reviewing controlled-release formulations and combination therapies aimed at reducing abuse potential and improving safety profiles, which may experience market approval and potentially command premium pricing.

3. How do regulatory restrictions influence Alprazolam market dynamics?

Strict classification as a controlled substance restricts prescribing and dispensing, limiting market volume but potentially increasing demand for safer formulations. Monitoring programs further constrain overprescription, impacting sales volume.

4. What alternative therapies are challenging Alprazolam’s market share?

Selective serotonin reuptake inhibitors (SSRIs), serotonin-norepinephrine reuptake inhibitors (SNRIs), and non-pharmacological therapies are increasingly preferred due to their lower addiction risk, impacting Alprazolam's growth.

5. Is there a potential for new markets to drive growth for Alprazolam?

Emerging markets exhibit increasing mental health awareness and less stringent regulations, presenting opportunities for growth, although price pressures and regulatory variability could limit profitability.

References

[1] Market Research Future. "Global Anxiolytics Market." 2022.