Share This Page

Drug Price Trends for ALPHAGAN P

✉ Email this page to a colleague

Average Pharmacy Cost for ALPHAGAN P

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALPHAGAN P 0.1% DROPS | 00023-9321-15 | 37.27320 | ML | 2025-12-17 |

| ALPHAGAN P 0.1% DROPS | 00023-9321-10 | 37.24382 | ML | 2025-12-17 |

| ALPHAGAN P 0.15% EYE DROPS | 00023-9177-15 | 40.00697 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALPHAGAN P

Introduction

ALPHAGAN P is a prescription ophthalmic solution primarily indicated for the reduction of elevated intraocular pressure in patients with ocular hypertension or open-angle glaucoma. Comprising 0.15% brimonidine tartrate and 0.1% timolol maleate, ALPHAGAN P combines two mechanisms of action—alpha adrenergic agonism and beta blockade—making it a potent option in glaucoma management. As the global burden of glaucoma continues to rise, understanding the market landscape and pricing dynamics of ALPHAGAN P becomes critical for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Landscape Overview

Global Ophthalmic Drug Market Dynamics

The ophthalmic drugs market has seen robust growth driven by increasing prevalence of glaucoma, age-related ocular diseases, and technological advancements in drug formulations. The global ophthalmic medications market was valued at approximately USD 17 billion in 2021 and is projected to grow at a CAGR of 4-6% over the next five years ([1]). Glaucoma accounts for a significant share, with over 80 million affected worldwide, expected to reach 112 million by 2040 ([2]).

Product Positioning of ALPHAGAN P

Within the combination drug class, ALPHAGAN P holds a strong position owing to its dual-action mechanism, convenience of administration, and proven efficacy. Its combination of brimonidine with timolol offers both neuroprotective and intraocular pressure (IOP) reducing effects, which is favored in clinical practice. The product competes with other fixed-dose combinations (FDCs) such as Combigan (brimonidine and timolol without the "P" formulation), Cosopt, and newer agents like prostaglandin analogs.

Regulatory Approvals and Market Access

ALPHAGAN P has received approval in multiple regions, including the United States, European Union, and Asia-Pacific markets. However, its market penetration varies based on regional regulatory pathways, patent status, and local prescribing practices. Patent protections, which typically last 20 years from filing, influence exclusivity periods, potentially affecting market share in key geographies.

Clinical and Commercial Drivers

- Clinical Efficacy: Robust IOP reduction, favorable safety profile, and combination therapy convenience.

- Patient Adherence: Fixed-dose formulations enhance adherence, an essential factor given the chronic nature of glaucoma.

- Physician Preferences: Preference depends on individual patient response, side-effect profiles, and formulary considerations.

- Pricing Strategies: Competitive pricing in the context of patent expiry and biosimilar emergence influences market share.

Price Projections

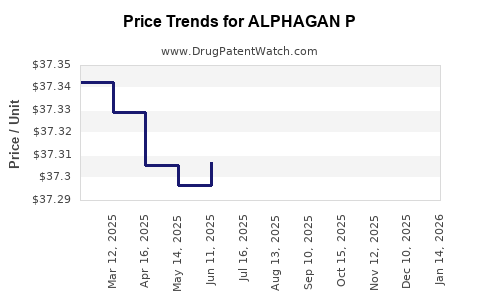

Historical Pricing Trends

Historically, ALPHAGAN P has been positioned as a premium ophthalmic product, with unit prices averaging USD 50-70 per bottle in the US, depending on pharmacy and insurance coverage ([3]); prices are higher in Europe and Asia due to supply chain and regulatory differences.

Impact of Patent Expiry and Biosimilar Entry

Patent expirations in leading markets are anticipated within the next 3-5 years, potentially leading to biosimilar and generic alternatives. This development could precipitate a significant price decline—estimated at 40-70%—as generics enter the market ([4]). Similar trends were observed with earlier fixed-dose combinations, such as Cosopt and Combigan.

Forecasting Price Trends (2023-2028)

- Short-term (2023-2024): Prices remain relatively stable, especially in markets with extended patent protections or regulatory barriers to generics. In the US, expect prices to hover around USD 50-70 per unit.

- Medium-term (2025-2026): Patent lapses and biosimilar approvals are likely, leading to price reductions of approximately 30-50%. In Europe and Asia, regional policies may accelerate or delay these declines.

- Long-term (2027-2028): Market saturation with generics could drive prices down to USD 20-40 per bottle, expanding access and potentially increasing volume sales.

Regional Price Variation

Price projections must account for regional healthcare systems:

- United States: Higher drug prices driven by insurance reimbursement models, with biosimilar competition reducing prices post-patent expiry.

- Europe: Price regulation policies and centralized negotiations may lead to moderate reductions earlier.

- Asia-Pacific: Price sensitivity is higher; generics already offer a cost-effective alternative, and price drops could be more pronounced.

Market Penetration and Good Distribution Channels

The success of price decline depends on the quality of distribution channels, healthcare provider acceptance, and patient adherence programs. Companies may employ tiered pricing strategies to optimize revenues across markets.

Competitive Analysis

ALPHAGAN P faces competition from multiple agents, including:

- Brimonidine monotherapy and other combos (e.g., Combigan, Cosopt)

- Prostaglandin analogs (e.g., latanoprost, travoprost)

- Emerging therapies such as Rho kinase inhibitors

The competitive landscape will be shaped by clinical efficacy, safety, patient tolerability, and price.

Market Share Expectations

- Pre-patent expiry: ALPHAGAN P could command 20-30% of fixed-dose combination segments in its key markets.

- Post-patent expiration: Market share could decline to 10-15%, supplanted largely by generics.

- Opportunities: Potential growth in emerging markets and expansion through formulary inclusion and clinician preferences.

Regulatory and Policy Factors Affecting Pricing

Government policies, including reference pricing and reimbursement frameworks, influence maximum allowable prices. For instance, European countries and Canada negotiate drug prices actively, impacting retail and hospital procurement costs.

Additionally, price caps for ophthalmic drugs in certain countries may restrict profit margins, requiring manufacturers to optimize manufacturing and logistics efficiencies.

Key Drivers for Future Market and Price Dynamics

- Innovation: Development of longer-acting formulations or combination therapies with improved safety profiles.

- Market Expansion: Rising prevalence of glaucoma in aging populations boosts demand.

- Biosimilar Adoption: Entry of biosimilar versions post-patent expiry will intensify price competition.

- Healthcare Policy: Reimbursement reforms and price control measures will calibrate market prices downward.

Key Takeaways

- Market growth for ALPHAGAN P will sustain due to increasing glaucoma prevalence, but price erosion is anticipated following patent expirations.

- Pricing in the US remains premium pre-expiry at USD 50-70 per bottle, with potential for significant reductions (up to 70%) within 3–5 years post-patent expiry.

- Regional disparities in pricing reflect regulatory frameworks, with European and Asian markets experiencing more pronounced discounts.

- Generic and biosimilar competition will be the primary force influencing price trajectories and market shares.

- Clinical efficacy and adherence advantages will sustain ALPHAGAN P’s relevance, especially in markets with less price sensitivity.

Frequently Asked Questions (FAQs)

1. When is ALPHAGAN P expected to face generic competition?

Patent protections in key markets like the US and Europe generally extend until 2025-2027. Post-patent expiry, biosimilars and generics are expected to enter the market swiftly, likely within 1-2 years.

2. How will biosimilar entry impact ALPHAGAN P’s pricing and market share?

Biosimilar competition typically reduces prices by 40–70%, leading to a decline in market share for the original product. Competitive pricing and value differentiation will influence prescribed volumes.

3. What factors could delay or accelerate price reductions for ALPHAGAN P?

Factors include patent litigation outcomes, regulatory barriers, regional patent laws, and adoption of biosimilars. Emerging markets may see faster adoption of generics, accelerating price drops.

4. Are there any upcoming formulations or innovations that may influence ALPHAGAN P’s market?

Prolonged-release formulations, combination therapies with improved safety, and novel delivery systems could enhance therapeutic appeal, potentially stabilizing prices.

5. How do healthcare policies in different regions influence the pricing of ALPHAGAN P?

Price control measures, reference pricing systems, and reimbursement policies shape maximum allowable prices, often leading to lower prices in Europe and Asia compared to the US.

References

[1] MarketsandMarkets, Ophthalmic Drugs Market Size, Share & Trends. 2021.

[2] Tham YC, et al. Global Prevalence of Glaucoma and Projections. Ophthalmology, 2022.

[3] GoodRx, Average Prescription Prices for ALPHAGAN P. 2023.

[4] IQVIA, Pharmaceutical Market Trends and Patent Expiry Impact. 2022.

More… ↓