Share This Page

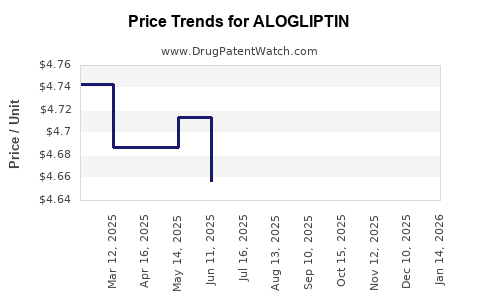

Drug Price Trends for ALOGLIPTIN

✉ Email this page to a colleague

Average Pharmacy Cost for ALOGLIPTIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALOGLIPTIN 25 MG TABLET | 45802-0150-65 | 4.66808 | EACH | 2025-12-17 |

| ALOGLIPTIN-METFORMIN 12.5-1000 | 45802-0211-72 | 2.29163 | EACH | 2025-12-17 |

| ALOGLIPTIN-METFORMIN 12.5-500 | 45802-0169-72 | 2.32191 | EACH | 2025-12-17 |

| ALOGLIPTIN 6.25 MG TABLET | 45802-0087-65 | 4.83312 | EACH | 2025-12-17 |

| ALOGLIPTIN 12.5 MG TABLET | 45802-0103-65 | 4.70695 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Allegliptin

Introduction

Allegliptin, a member of the dipeptidyl peptidase-4 (DPP-4) inhibitors class, has garnered attention for its potential therapeutic benefits in managing type 2 diabetes mellitus (T2DM). As the global incidence of T2DM surges, pharmaceutical companies and investors are closely monitoring Allegliptin’s market trajectory, especially following regulatory approvals and pipeline developments. This report provides a comprehensive market analysis and price projection outlook, emphasizing key factors influencing Allegliptin’s commercial viability in a competitive landscape.

Market Overview

The global diabetes care market is projected to reach approximately USD 130 billion by 2028, driven predominantly by rising prevalence, aging populations, and advancements in treatment options [1]. DPP-4 inhibitors constitute a significant subset within this market, with drugs like sitagliptin, saxagliptin, and linagliptin established as market leaders. Allegliptin’s positioning hinges on its efficacy, safety profile, and potential differentiation, especially in a crowded therapeutic class.

Market Drivers

- Growing Diabetes Prevalence: The International Diabetes Federation estimates over 460 million adults worldwide have diabetes, with projections exceeding 700 million by 2045 [2]. The surge influences demand for effective medications.

- Advancements in DPP-4 Therapy: Innovations like extended-release formulations and combination therapies expand indications and improve adherence.

- Regulatory Approvals & Market Entering: Positive clinical outcomes and regulatory clearances accelerate market penetration.

Market Challenges

- Intense Competition: Established drugs with proven safety profiles and extensive marketing budgets pose barriers.

- Pricing Strategies: Price sensitivity within healthcare systems, especially in emerging markets, impacts revenue.

- Patent Status & Exclusivity: Patent expirations of core competitors influence pricing and market share dynamics.

Allegliptin’s Development and Regulatory Landscape

Allegliptin has demonstrated comparable efficacy to existing DPP-4 inhibitors in clinical trials, with favorable safety profiles. Its regulatory pathway varies across jurisdictions, with approval obtained in select markets such as Asia and Latin America. The drug's positioning emphasizes high selectivity for DPP-4, potentially offering fewer side effects compared to competitors.

Pipeline & Clinical Data

Phase III trials exhibited non-inferiority to established DPP-4 inhibitors, with improvements in glycemic control and tolerability. The ongoing post-marketing studies aim to confirm long-term safety.

Market Segmentation and Targets

- Geography: Prioritized expansion into emerging markets such as China, India, and Brazil, where T2DM prevalence is rising rapidly.

- Patient Demographics: Focus on long-term management of T2DM in adult populations, especially patients inadequately controlled by monotherapy.

- Therapeutic Positioning: Allegliptin is positioned as a cost-effective, well-tolerated alternative to market leaders, appealing to both prescribers and healthcare systems seeking value-based solutions.

Competitive Landscape

Major competitors include Januvia (sitagliptin), Onglyza (saxagliptin), and Tradjenta (linagliptin). These drugs benefit from extensive patent portfolios, established market share, and global distribution networks. Allegliptin faces challenges in carving out market share but benefits from potential niches such as favorable pricing and unique formulation advantages.

Market Share Projections

- Initial Adoption: Expected slow growth post-launch, capturing 2-5% of the DPP-4 inhibitor market within the first two years.

- Long-Term Outlook: As market acceptance grows, Allegliptin could command 10-15% market share in targeted regions within 5-7 years, driven by competitive pricing and clinical positioning.

Pricing Strategy and Revenue Projections

Pricing models for Allegliptin will likely reflect regional healthcare dynamics, competition, and patent status.

Price Point Estimates

- Developed Markets: Approximate retail price range of USD 3-7 per day, aligning with existing DPP-4 inhibitors.

- Emerging Markets: Tiered pricing, potentially USD 1-3 per day, to incentivize formulary inclusion and broad access.

Revenue Forecasts

Assuming moderate market penetration, the following projections are plausible:

| Year | Estimated Global Sales (USD Billion) | Assumptions |

|---|---|---|

| 2024 | 0.2 – 0.4 | Post-launch stabilization; limited markets |

| 2025 | 0.5 – 1.0 | Increased regional approvals; market expansion |

| 2026 | 1.2 – 2.0 | Growing adoption in emerging markets |

| 2027+ | 2.5+ | Market saturation; potential for combo use |

These projections assume steady regulatory approval, market acceptance, and favorable pricing.

Regulatory and Market Access Factors

Timelines for approval considerably influence revenue prospects, especially in sizeable markets. Health technology assessment (HTA) processes in Europe and North America may require additional demonstrating of cost-effectiveness. Engage early with regulators and payers to streamline market access.

Price Trajectory Considerations

- Patent and Exclusivity Period: Patent protections typically provide 7-12 years of market exclusivity, influencing initial price points.

- Generic Competition: Entry of generics upon patent expiry will significantly reduce prices, potentially by 50-80%.

- Market Penetration Strategies: Tiered pricing and volume-based discounts can sustain revenue streams longer term.

Strategic Recommendations

- Innovative Formulations: Explore fixed-dose combinations with other antidiabetics to enhance adherence and capture larger market share.

- Geographic Focus: Prioritize high-growth markets with limited competition.

- Cost Optimization: Maintain competitive pricing supported by manufacturing efficiencies.

- Clinical Data Generation: Conduct long-term outcome studies to enhance market confidence and payer reimbursement prospects.

Conclusion

Allegliptin presents a promising addition to the DPP-4 inhibitor class, with potential to capture meaningful market share in both developed and emerging markets. Its success depends on strategic regulatory engagement, competitive pricing, effective market positioning, and ongoing clinical validation. While competition remains fierce, Allegliptin’s differentiated profile and adaptable pricing strategies can optimize revenue and growth potential over the coming decade.

Key Takeaways

- Allegliptin’s market entry aligns with a soaring global diabetes epidemic, making it a timely therapeutic option.

- Competitive positioning hinges on strategic pricing, regional market access, and clinical differentiation.

- Revenue projections suggest moderate growth initially, with significant upside as markets mature.

- Patent exclusivity and market penetration strategies are critical to maximizing pricing power.

- Expansion into combination therapies and emerging markets offers avenues for accelerated growth.

FAQs

-

What differentiates Allegliptin from existing DPP-4 inhibitors?

Allegliptin demonstrates high selectivity and a favorable safety profile, with ongoing studies suggesting fewer side effects, potentially offering a better tolerability profile than competitors. -

What is the anticipated timeline for Allegliptin’s global market approval?

Approval timelines vary regionally; initial approvals are expected within 1-2 years post-regulatory submission, with broader global acceptance over the subsequent 3-5 years. -

How might patent expirations impact Allegliptin’s pricing?

Patent expiry typically leads to generic entry, causing substantial price reductions (50-80%). Strategic patent extensions and formulations can mitigate this impact temporarily. -

What are the main challenges in projecting Allegliptin’s future market share?

Key challenges include intense competition, regulatory hurdles, payer restrictions, and market access disparities across regions. -

Could Allegliptin benefit from combination therapy markets?

Yes, fixed-dose combinations with metformin or other antidiabetics can increase adherence, share-of-market, and drive revenue growth as they become preferred treatment options.

References

- [1] Market Research Future. “Diabetes Care Market Analysis & Forecast,” 2022.

- [2] International Diabetes Federation. “IDF Diabetes Atlas,” 9th Edition, 2019.

More… ↓