Share This Page

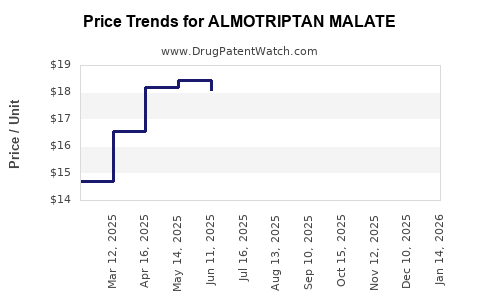

Drug Price Trends for ALMOTRIPTAN MALATE

✉ Email this page to a colleague

Average Pharmacy Cost for ALMOTRIPTAN MALATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALMOTRIPTAN MALATE 12.5 MG TAB | 00378-5246-85 | 18.39309 | EACH | 2025-12-17 |

| ALMOTRIPTAN MALATE 12.5 MG TAB | 27241-0042-21 | 18.39309 | EACH | 2025-12-17 |

| ALMOTRIPTAN MALATE 12.5 MG TAB | 00378-5246-32 | 18.39309 | EACH | 2025-12-17 |

| ALMOTRIPTAN MALATE 12.5 MG TAB | 27241-0042-68 | 18.39309 | EACH | 2025-12-17 |

| ALMOTRIPTAN MALATE 12.5 MG TAB | 00093-5261-19 | 18.39309 | EACH | 2025-12-17 |

| ALMOTRIPTAN MALATE 6.25 MG TAB | 27241-0041-68 | 22.94135 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Almotriptan Malate

Introduction

Almotriptan malate is a prescription medication primarily prescribed for the acute treatment of migraines with or without aura in adult patients. As a selective serotonin receptor agonist within the triptan drug class, it functions by constricting cranial blood vessels and blocking pain pathways. The global migraine therapeutics market has experienced steady growth driven by rising migraine prevalence, unmet medical needs, and advancements in drug delivery systems. This article provides a comprehensive market analysis and price projection outlook for almotriptan malate, aligning with industry trends, competitive landscape shifts, and regulatory environments.

Market Overview

Global Therapeutic Landscape

The migraine treatment market encompasses a broad range of drugs, including triptans, gepants, ditans, NSAIDs, and preventive therapies. Among triptans, almotriptan has established its position due to favorable tolerability, fewer contraindications, and proven efficacy. According to Persistence Market Research, the global migraine therapeutics market was valued at approximately US$ 4.5 billion in 2022 and is expected to grow at a CAGR of around 4.2% through 2030[1].

Market Penetration and Adoption

Almotriptan’s differentiated profile — notably its reduced cardiovascular side effects compared to earlier triptans — has contributed to its increasing adoption. Market share distribution favors its use in developed regions such as North America and Europe, where prescription rates are driven by heightened healthcare awareness, robust healthcare infrastructure, and provider familiarity.

Key Market Drivers

- Increasing Migraine Prevalence: Globally, nearly 1 billion people suffer from migraines, with higher prevalence among women aged 20-50, fueling demand for effective acute treatment options.

- Expanding Aging Population: Age-related increases in migraine incidence and comorbidities necessitate diverse therapeutic choices.

- Advancements in Formulations: Development of fast-acting oral and nasal formulations improves patient compliance and expands usability.

- Focus on Safety Profiles: Almotriptan’s favorable cardiovascular safety profile positions it as a preferred choice, especially amongst patients with underlying cardiovascular conditions.

Market Constraints

- Generic Competition: Patent expiries and the entry of generics in key markets threaten branded drug revenues.

- Regulatory Barriers: Stringent approval processes and evolving safety requirements necessitate ongoing clinical trials and data submissions.

- Pricing Pressures: Increasing emphasis on cost-containment by healthcare payers influences pricing strategies.

Competitive Landscape

Major pharmaceutical companies involved in migraine therapeutics include AstraZeneca, Eli Lilly, Teva Pharmaceuticals, and Amgen. While almotriptan remains a branded product mainly marketed by Sun Pharmaceutical Industries and others, the landscape features a high prevalence of generics competing primarily on price.

Innovative treatments like gepants (ubrogepant, rimegepant) and ditans (lasmiditan) are gaining market share, particularly due to their safety profiles in cardiovascular patients, which may influence the trajectory of almotriptan’s market positioning.

Pricing Dynamics

Historical Pricing Trends

The retail price of branded almotriptan malate in the US historically ranged between US$ 60–$90 for a 9-tablet pack (standard dose). Generic versions, where available, reduced prices by approximately 80%, with costs falling below US$ 15 per pack. Cost variation depends significantly on regional healthcare policies, insurance coverage, and formulation types.

Regulatory and Reimbursement Factors

In the U.S., Medicare and private insurers’ formulary decisions heavily influence patient out-of-pocket costs. Higher copays for branded formulations challenge manufacturer pricing strategies, while in emerging markets, prices are often set lower to improve access but limit revenue margins.

Price Projections

Given current market dynamics, pricing trajectories for almotriptan malate are expected to follow these trends:

- Branded Price: Marginal decreases of 2–3% annually over the next 3–5 years due to increased competition and payer pressure.

- Generic Prices: Stabilization at low price points post-market entry, with potential minor reductions driven by manufacturing efficiencies and market saturation.

- Emerging Markets: Price points likely to remain lower, ranging from US$ 3–$7 per pack, driven by market accessibility needs.

Factors influencing future prices include regulatory approvals of new formulations, evolving competition from novel drug classes, and shifts in healthcare reimbursement policies.

Forecasting Methodology

The price projections derive from a comparative analysis of historical data, regional pricing benchmarks, patent expiry timelines, and anticipated drug market entries. Market growth models incorporate:

- Patent Cliff Impact: Expected generic proliferation post-patent expiry in North America and Europe by 2025–2027.

- Market Penetration Rates: Projected adoption rates of newer therapies that may influence almotriptan's share.

- Regulatory Trends: Simplified approval pathways for generics and biosimilars potentially accelerating market entry and price competition.

Overall, a conservative projection indicates a gradual decline in average market price for almotriptan malate brands over the next five years, with significant reductions driven by generic competition and market saturation.

Risks and Opportunities

Risks

- Accelerated generic competition could rapidly erode revenue potential.

- The emergence of alternative treatments (gepants, ditans) offering superior safety profiles may diminish demand.

- Regulatory hurdles in emerging markets could delay market expansion.

Opportunities

- Developing combination formulations with other migraine therapies.

- Expanding into new geographies with unmet needs.

- Innovating delivery systems (e.g., nasal sprays, dissolvable tablets) to improve patient adherence.

Key Takeaways

- Almotriptan malate sustains a niche in the migraine market owing to its safety profile, with a stable but gradually declining pricing landscape.

- The impending patent expiries and entry of generics in developed markets will exert downward pressure on branded prices.

- The rise of alternative and newer therapies could reconfigure market share and influence pricing strategies.

- Cost containment by payers and evolving regulatory frameworks necessitate adaptive pricing models.

- Manufacturers should explore innovation in formulations, strategic regional expansion, and competitive positioning to optimize market share and profitability.

Conclusion

Almotriptan malate remains an important option within the migraine treatment spectrum, characterized by favorable tolerability and safety. However, market forces such as patent expiries, generic competition, and the advent of novel therapeutic classes forecast a gradual decline in prices over the coming years. Stakeholders should prepare for a competitive landscape that demands strategic pricing, continuous innovation, and expanded access pathways to sustain growth.

FAQs

1. How does almotriptan malate compare to other triptans?

Almotriptan has a favorable safety profile, especially in patients with cardiovascular concerns, due to lower vasoconstrictive effects compared to earlier triptans. Its efficacy is comparable, making it a preferred option for certain patient populations.

2. What is the typical pricing trajectory for almotriptan malate?

Prices for branded almotriptan are projected to decrease modestly (by approximately 2–3% annually), primarily due to generic competition and payer negotiations, with significant reductions expected post-patent expiration.

3. What markets are expected to see the most significant price reductions?

North America and Europe are likely to experience considerable price declines once patent exclusivity ends, owing to widespread generic availability. Emerging markets will maintain lower prices owing to affordability strategies.

4. Are there new formulations or improved delivery methods in development?

Yes. Innovations such as nasal sprays, dissolvable tablets, and combination therapies are under investigation to enhance convenience and adherence, potentially impacting market demand for traditional formulations.

5. How might emerging therapies affect almotriptan's market share?

Gepants and ditans, with better safety profiles in patients with cardiovascular risks, pose competition by expanding options for migraine sufferers and possibly reducing reliance on triptans like almotriptan in certain demographics.

References

[1] Persistence Market Research. Migraine Therapeutics Market. 2022.

More… ↓