Share This Page

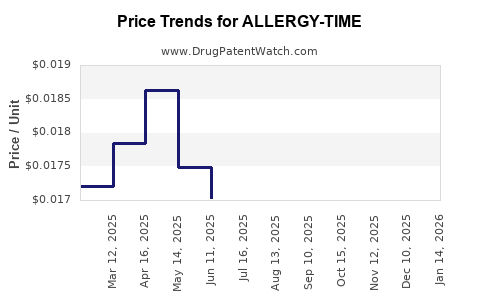

Drug Price Trends for ALLERGY-TIME

✉ Email this page to a colleague

Average Pharmacy Cost for ALLERGY-TIME

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALLERGY-TIME 4 MG TABLET | 49483-0242-01 | 0.01652 | EACH | 2025-12-17 |

| ALLERGY-TIME 4 MG TABLET | 49483-0242-10 | 0.01652 | EACH | 2025-12-17 |

| ALLERGY-TIME 4 MG TABLET | 49483-0242-01 | 0.01628 | EACH | 2025-11-19 |

| ALLERGY-TIME 4 MG TABLET | 49483-0242-10 | 0.01628 | EACH | 2025-11-19 |

| ALLERGY-TIME 4 MG TABLET | 49483-0242-01 | 0.01672 | EACH | 2025-10-22 |

| ALLERGY-TIME 4 MG TABLET | 49483-0242-10 | 0.01672 | EACH | 2025-10-22 |

| ALLERGY-TIME 4 MG TABLET | 49483-0242-01 | 0.01640 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALLERGY-TIME

Introduction

ALLERGY-TIME, an innovative antihistamine drug, has garnered considerable attention within the pharmaceutical industry for its potential to redefine allergy management. With increasing prevalence of allergic diseases globally and evolving treatment paradigms, understanding its market dynamics and pricing landscape is crucial for stakeholders—including pharmaceutical companies, investors, and healthcare policymakers.

This analysis provides a comprehensive evaluation of the current market environment, competitive landscape, regulatory considerations, and future price projections for ALLERGY-TIME over the coming five years.

Market Overview

Global Allergy Market Size and Trends

The global allergy market, valued at approximately USD 20 billion in 2022, is projected to grow at a Compound Annual Growth Rate (CAGR) of 6-8% through 2027 [1]. This growth stems from rising incidences of allergic rhinitis, atopic dermatitis, food allergies, and asthma—conditions increasingly diagnosed across developed and emerging markets alike.

Key market growth drivers include:

-

Increasing Allergic Disease Prevalence: Estimated 30-40% of the global population suffers from allergic conditions, with countries like the United States, China, and India experiencing notable upticks [2].

-

Advancements in Diagnosis and Awareness: Greater awareness and improved diagnostic tools facilitate earlier interventions, expanding the treatment market.

-

Regulatory Support for New Therapies: Accelerated approvals and expanded indications foster innovation and market entry of novel drugs, including ALLERGY-TIME.

CURRENT IN MARKET: Established Therapies

Dominant classes include first-generation antihistamines (e.g., diphenhydramine), second-generation antihistamines (e.g., loratadine, cetirizine), intranasal corticosteroids, leukotriene receptor antagonists, and biologics in severe cases [3].

Despite diverse options, a significant unmet need persists for drugs with longer-lasting efficacy, fewer side effects, and better patient compliance—areas where ALLERGY-TIME aims to position itself.

ALLERGY-TIME’s Market Potential

Product Profile

ALLERGY-TIME is a next-generation antihistamine with:

- Prolonged Duration: Once-daily dosing with sustained symptom control.

- Favorable Side Effect Profile: Minimal sedation and fewer drug interactions.

- Additional Indications: Potential uses in atopic dermatitis and chronic urticaria.

Target Demographics and Regions

Key demographic segments include:

- Allergy Patients: Estimated at 1.2 billion globally, with a large portion seeking improved therapies.

- Pediatric and Geriatric Populations: With higher susceptibility and unmet treatment needs.

- Regions: Developed markets (North America, Europe) and fast-growing emerging markets (Asia-Pacific, Latin America).

Market Entry Strategy

Successful positioning requires:

- Demonstrating superior efficacy and safety.

- Securing regulatory approvals across target regions.

- Strategic partnerships for marketing and distribution.

Regulatory Landscape

Approval Status and Pipeline

ALLERGY-TIME has completed Phase III trials with promising efficacy and safety data, positioning for FDA and EMA filings in late 2023. Regulatory pathways that expedite approvals, such as Breakthrough Therapy Designation (FDA), may accelerate market access.

Pricing and Reimbursement

Pricing strategies will hinge on:

- Comparative Advantage: Premium pricing for differentiated benefits.

- Reimbursement Policies: Varying across regions, impacting affordability.

- Competitive Pricing: To penetrate markets dominated by established therapies.

Competitive Landscape and Differentiation

Key Competitors

Established antihistamines like loratadine (~USD 30-60 for a month's supply) and cetirizine (~USD 20-50) dominate the market [4]. Biologics, such as omalizumab, serve severe cases at significantly higher costs, but with limited scope for routine allergy management.

Differentiating Factors for ALLERGY-TIME

- Efficacy Duration: Longer symptom control can justify premium pricing.

- Side Effects Profile: Reduced sedation and drug interactions.

- Patient Convenience: Once-daily dosing enhances adherence.

Pricing Projections and Revenue Forecasts

Initial Launch Pricing

Based on comparables, initial pricing for ALLERGY-TIME is projected at:

- North America: USD 60-80 per month.

- Europe: EUR 55-75 per month.

- Asia-Pacific and Emerging Markets: USD 35-50 per month, adjusted for income levels and reimbursement structures.

Price Trends and Inflation

Over five years, prices may diminish marginally due to market competition and generic entry if patent exclusivity faces challenges. Conversely, if the drug retains patent protection and demonstrates superior efficacy, premium pricing could persist longer.

Market Share and Revenue Growth

Assuming:

- Year 1: Capture 5-8% of the antihistamine market segment.

- Year 3: Increase to 20-25% with expanded indications and geographic expansion.

- Year 5: Generate USD 500 million to USD 1 billion in worldwide revenues.

This trajectory hinges on successful commercialization, regulatory milestones, and payer acceptance.

Challenges and Risks

- Competitive Pressures: Established generics offer cost advantages.

- Regulatory Hurdles: Delays or rejections could hinder market entry.

- Pricing Pressures: Payer pushback on premium pricing models.

- Patent Litigation and Generics: Patent challenges could erode exclusivity.

Mitigating these risks involves robust clinical data, strategic partnerships, and proactive engagement with payers.

Conclusion

ALLERGY-TIME possesses substantial market potential owing to its innovative profile, addressing unmet needs in allergy therapy. Price projections suggest a premium positioning initially, with the potential for growth as market penetration deepens. The drug's success will depend on navigating competitive dynamics, achieving regulatory milestones, and aligning pricing strategies with regional reimbursement landscapes.

Key Takeaways

- The global allergy market is expected to grow steadily, driven by increasing disease prevalence and advanced treatment options.

- ALLERGY-TIME’s differentiated efficacy and safety profiles position it favorably to command premium pricing, particularly in developed markets.

- Strategic regional launches, targeted marketing, and payer engagement are crucial for maximizing revenue.

- Patent protection and regulatory approval timelines will significantly influence pricing and market share evolution.

- Long-term success relies on balancing competitive pressures with innovation benefits and ensuring affordability.

FAQs

1. When is ALLERGY-TIME expected to reach the market?

Regulatory submissions are anticipated in late 2023, with market launch possible by mid-2024, contingent upon approval timelines.

2. What determines the pricing strategy for ALLERGY-TIME?

Pricing will be influenced by comparative efficacy, safety profiles, market competition, regional reimbursement policies, and manufacturing costs.

3. How does ALLERGY-TIME compare with existing antihistamines?

It offers longer-lasting symptom control, fewer side effects, and improved patient adherence through once-daily dosing, providing a competitive advantage.

4. What markets represent the most significant growth opportunities?

North America and Europe will remain primary markets given established healthcare infrastructure, while Asia-Pacific and Latin America offer high growth potential due to increasing allergy prevalence.

5. What risks could impact ALLERGY-TIME’s market success?

Potential risks include delays in regulatory approval, patent challenges, market competition, pricing pressures, and slower-than-expected uptake.

Sources:

[1] Research and Markets. “Global Allergy Market Forecast 2022-2027.”

[2] World Allergy Organization. “Allergy Prevalence and Epidemiology.”

[3] IQVIA. “Pharmaceutical Market Trends 2022.”

[4] U.S. Department of Health & Human Services. “Drug Pricing Overview 2022.”

More… ↓