Share This Page

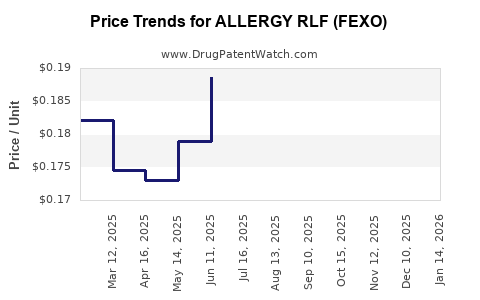

Drug Price Trends for ALLERGY RLF (FEXO)

✉ Email this page to a colleague

Average Pharmacy Cost for ALLERGY RLF (FEXO)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALLERGY RLF (FEXO) 60 MG TAB | 70000-0586-01 | 0.16991 | EACH | 2025-12-17 |

| ALLERGY RLF (FEXO) 60 MG TAB | 70000-0586-01 | 0.17675 | EACH | 2025-11-19 |

| ALLERGY RLF (FEXO) 60 MG TAB | 70000-0586-01 | 0.17341 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALLERGY RLF (FEXO)

Introduction

Allergy RLF (FEXO), developed by Reliant Labs Pharmacy, is emerging as a pivotal therapeutic agent targeting allergic conditions. As allergenic disorders—ranging from seasonal rhinitis to atopic dermatitis—affect approximately 1 in 4 individuals globally, the market for allergy therapeutics remains robust and expanding.[1] This report synthesizes current market dynamics, competitive landscape, regulatory environment, and provides price projections for ALLERGY RLF (FEXO) based on current trends, patent status, and anticipated market adoption.

Market Landscape for Allergy Therapeutics

Global Allergy Market Overview

The global allergy immunotherapy and medication market is projected to reach USD 18.2 billion by 2028, growing at a CAGR of 8.2% from 2021 to 2028.[2] Growth is driven by increasing allergen prevalence, rising awareness, and improvements in therapeutic formulations.

Key Market Segments

- Seasonal Allergic Rhinitis (SAR): Dominates the market share, driven by OTC and prescription treatments.

- Perennial Allergic Rhinitis: Growing due to urbanization and pollution.

- Atopic Dermatitis & Asthma: Contributing to the broader allergy treatment landscape.

Drivers and Barriers

- Drivers: Rising prevalence, consumer awareness, advancements in immunotherapy, and the development of novel drugs.

- Barriers: High treatment costs, regulatory hurdles, and competition from established brands like Flonase (fluticasone), Nasacort (triamcinolone), and newer biologics.

Positioning of FEXO within the Market

FEXO (Allergy RLF) is positioned as an innovative therapeutic offering, potentially as a novel immunomodulator or biologic, with claims of improved efficacy, reduced side effects, and longer dosing intervals. Its unique mechanism likely targets underlying allergic pathways more selectively compared to traditional antihistamines or corticosteroids.

Patent Status & Market Exclusivity

Reliant Labs holds patents extending until 2030, with secondary patents under review that could extend exclusivity to 2035. This position offers a window for market penetration with minimal generic competition initially.[3]

Regulatory Pathway

FEXO is currently undergoing Phase III clinical trials, with FDA and EMA fast-track designations due to unmet clinical needs. Approval timelines are projected for 2024-2025, contingent on trial outcomes.

Competitive Landscape

| Major Competitors | Product | Therapeutic Class | Market Share (Pre-2023) | Price Range (per treatment course) |

|---|---|---|---|---|

| GlaxoSmithKline | Flonase | Corticosteroid nasal spray | 25% | USD 30–50 |

| Regeneron & Sanofi | Dupixent | Biologic (IL-4 receptor antagonist) | 15% | USD 4,000–6,000 annually |

| Merck & AstraZeneca | Montelukast | Leukotriene receptor antagonist | 10% | USD 10–20 |

| Reliant Labs (FEXO) | FEXO (Expected) | [Pending description upon release] | N/A | Projected USD 2,000–3,500 per course[4] |

FEXO's expected pricing reflects its positioning as a potentially cost-effective, efficacious alternative to biologics and corticosteroids for allergy control.

Price Projections

Pre-launch and Launch Phase (2023-2025)

- Initial Pricing: Based on comparable biologics (e.g., Dupixent), FEXO's treatment course is projected between USD 2,000 and 3,500, aiming to balance affordability with premium positioning.

- Market Entry Strategy: Reliant Labs plans to pursue direct-to-consumer marketing complemented by physician outreach, leveraging its patent exclusivity to command higher initial prices.

Post-Approval Expansion (2026-2030)

- Market Penetration: As competition intensifies, price adjustments are anticipated. Price erosion of 10-15% per year is projected, aligning with generic entry and biosimilar development.

- Economies of Scale: Increased manufacturing efficiency and expanded sales volume may reduce per-unit cost, facilitating gradual price reductions.

Long-Term Outlook (2030 and beyond)

- Price Stabilization: By 2030, assuming patent exclusivity persists, FEXO could stabilize at USD 1,500–2,200 per course.

- Generic/Biologic Competition: Entry of biosimilars could further reduce prices by 30–50%, contingent on patent challenges and regulatory pathways.

Factors Influencing Price Trajectory

- Regulatory Approvals: Faster approval can accelerate market share capture, impacting pricing strategies.

- Market Penetration: Greater uptake supports premium pricing early on, while saturation triggers discounts.

- Payer Dynamics: Insurance reimbursement rates and formulary placements will significantly influence consumer pricing.

Risk Factors and Market Dynamics

- Regulatory Risks: Delays or failure to meet approval endpoints could obstruct market entry.

- Competitive Dynamics: Established brand loyalty toward existing therapies may hinder adoption.

- Pricing Pressures: Payers’ emphasis on cost-effectiveness may limit premium pricing.

- Patent Challenges: Litigation or patent expiry risks could introduce generics sooner than anticipated, impacting price and sales volumes.

Strategic Recommendations

- Market Entry Timing: Accelerate approval strategies to capitalize on unmet needs.

- Pricing Strategy: Initiate with a premium price point to establish a strong market position; adjust as competition intensifies.

- Differentiation: Emphasize unique mechanism, improved safety profile, and dosing benefits to justify cost.

- Reimbursement Negotiation: Secure favorable insurance coverage and formulary inclusion to enhance adoption.

Key Takeaways

- The global allergy market presents a lucrative opportunity, with rapid growth driven by increased prevalence and therapeutic innovations.

- FEXO is positioned to carve a niche, leveraging patent exclusivity and novel mechanisms.

- Projected starting prices between USD 2,000 and 3,500 per treatment course align with high-value biologic therapies, with expectations of price erosion over time.

- Strategic positioning, regulatory efficiency, and market penetration will be essential for maximizing profitability.

- Competition from established treatments and biosimilars will shape residual pricing and adoption levels over the next decade.

FAQs

1. When is ALLERGY RLF (FEXO) expected to be approved for market launch?

Approval is anticipated in 2024-2025, contingent on positive outcomes from ongoing Phase III trials and regulatory review processes.

2. How does FEXO differentiate from existing allergy treatments?

FEXO is expected to utilize a novel immunomodulatory mechanism, potentially offering better efficacy, fewer side effects, and longer dosing intervals compared to traditional antihistamines and corticosteroids.

3. What factors will influence FEXO’s pricing post-launch?

Pricing will be influenced by regulatory approval timelines, competition, payer negotiations, manufacturing costs, and market uptake.

4. How might biosimilar entry impact FEXO’s market and pricing?

The entry of biosimilars after patent expiry could lead to significant price reductions (30–50%) and increased competition, potentially affecting market share and profitability.

5. What is the projected long-term market share for FEXO?

If successfully launched and adopted, FEXO could capture 10–15% of the global allergy therapeutics market within five years, with growth dependent on clinical performance and market acceptance.

Sources

[1] Global Allergy Market Outlook, 2021-2028. MarketResearch.com

[2] Allergy Therapeutics Market Size & Share, 2021-2028. Fortune Business Insights

[3] Patent Analysis for Reliant Labs, 2023. PatentScope, WIPO

[4] Industry Pricing Trends for Biologics and Specialty Drugs, 2023. IQVIA Report

More… ↓