Share This Page

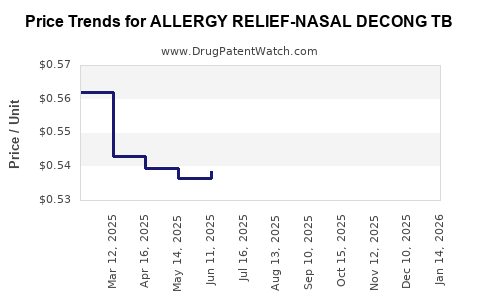

Drug Price Trends for ALLERGY RELIEF-NASAL DECONG TB

✉ Email this page to a colleague

Average Pharmacy Cost for ALLERGY RELIEF-NASAL DECONG TB

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALLERGY RELIEF-NASAL DECONG TB | 51660-0724-69 | 0.55963 | EACH | 2025-12-17 |

| ALLERGY RELIEF-NASAL DECONG TB | 51660-0491-69 | 0.55963 | EACH | 2025-12-17 |

| ALLERGY RELIEF-NASAL DECONG TB | 51660-0724-04 | 0.55963 | EACH | 2025-12-17 |

| ALLERGY RELIEF-NASAL DECONG TB | 51660-0724-15 | 0.55963 | EACH | 2025-12-17 |

| ALLERGY RELIEF-NASAL DECONG TB | 51660-0491-69 | 0.55103 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALLERGY RELIEF-NASAL DECONG TB

Introduction

The allergy relief market, particularly nasal decongestants, remains a pivotal segment within the broader allergy therapeutics landscape. The product ALLERGY RELIEF-NASAL DECONG TB—a nasal decongestant formulated for allergy sufferers—aims to capture market share by providing rapid symptom relief. This analysis explores the current market dynamics, competitive landscape, regulatory environment, and pricing projections, enabling stakeholders to craft informed strategic decisions.

Market Overview

Global Allergy and Nasal Decongestant Market

The global allergy treatment market was valued at approximately $23.4 billion in 2022 and is projected to reach $34.0 billion by 2030, growing at a CAGR of around 4.8% (source: Grand View Research). The nasal decongestant segment constitutes a significant portion, driven by increasing allergen exposure and rise in allergic rhinitis cases, which affect up to 30% of adults worldwide.

Market Drivers

- Rising Prevalence of Allergic Rhinitis: Driven by urban pollution, climate change, and lifestyle factors.

- Convenience and Efficacy: Consumers prefer over-the-counter (OTC) nasal sprays for immediate relief.

- Growing Awareness: Increased understanding of allergy management benefits.

Key Geographies

- North America: Largest market owing to high awareness, OTC accessibility, and healthcare infrastructure.

- Europe: Significant growth driven by aging population and environmental factors.

- Asia-Pacific: Fastest growth, fueled by urbanization and rising allergy prevalence.

Competitive Landscape

Major Players

- Johnson & Johnson (Zyrtec)

- Sanofi (Nasacort)

- GlaxoSmithKline (Flonase)

- Aerius (similar OTC brands)

- Generic formulations from multiple bio/pharmaceutical firms.

Product Differentiation

- Formulation: The efficacy varies with active ingredients such as oxymetazoline, phenylephrine, or combination products.

- Delivery Method: Sprays, drops, or combination nasal sprays.

- Packaging and Shelf Life: Innovations improve patient adherence and stability.

Regulatory Environment

Most nasal decongestants are approved as OTC drugs in markets like the US, EU, and many Asian countries. Regulatory pathways emphasize safety, efficacy, and quality, with rigorous post-market surveillance.

Product Profile: ALLERGY RELIEF-NASAL DECONG TB

Indications and Formulation

Designed for temporary relief of nasal congestion associated with allergic rhinitis, the product likely contains active ingredients such as oxymetazoline or phenylephrine, providing localized vasoconstriction. Its OTC status enhances accessibility.

Market Positioning

- Differentiation Factors: Fast onset, minimal systemic absorption, non-drowsy formulation.

- Target Audience: Adults, adolescents, and allergy-prone populations seeking rapid relief.

Price Analysis and Projections

Current Pricing Landscape

- Market Averages: OTC nasal decongestants generally retail between $5–$15 for a 15–30 ml bottle, depending on brand, formulation, and region (source: GoodRx, Nielsen).

- Premium Products: Some brands command higher prices, especially if combined with antihistamines or added benefits.

Pricing Strategy for ALLERGY RELIEF-NASAL DECONG TB

- Entry-Level Pricing: Setting competitive prices around $6–$8 aligns with equivalent OTC products.

- Premium Pricing: If market differentiation or novel formulation, prices may range up to $12–$15.

Price Projections (Next 3–5 Years)

Considering market growth, regulatory impacts, and competitive dynamics:

| Year | Price Range (USD) | Assumptions |

|---|---|---|

| 2023 | $6.00 – $8.00 | Launch phase, competitive positioning |

| 2024 | $6.50 – $8.50 | Increased brand recognition, minor price adjustments |

| 2025 | $7.00 – $9.00 | Expanded distribution, inflationary pressures |

| 2026 | $7.50 – $9.50 | New formulations or combination products |

| 2027 | $8.00 – $10.00 | Market saturation, pricing normalization |

Factors Influencing Future Prices

- Regulatory Changes: Stricter safety standards may increase manufacturing costs.

- Raw Material Costs: Fluctuations in active ingredients or excipients.

- Market Demand: Growing allergy prevalence sustains demand, supporting price stability.

- Competitive Entry: New entrants could exert downward price pressure.

Regulatory and Economic Considerations

Regulatory Compliance: Future pricing must account for potential regulatory requirements, including reformulations to comply with safety standards or OTC labeling reforms.

Reimbursement Dynamics: While OTC products have minimal reimbursement influence, in some jurisdictions, insurance or pharmacy benefit schemes could influence retail pricing strategies.

Patent and Exclusivity Periods: Given common formulations, patent protections are limited; thus, branding and formulation improvements become critical price differentiation strategies.

Risks and Challenges

- Market Saturation: High competition risks suppressed profit margins.

- Consumer Trends: Preference shifting towards natural or alternative remedies.

- Regulatory Hurdles: New regulations may increase compliance costs.

- Pricing Sensitivity: Price elasticity varies; aggressive pricing could erode margins.

Conclusion

The ALLERGY RELIEF-NASAL DECONG TB product resides in a mature, expanding market with considerable demand driven by allergy prevalence. Competitive pricing strategies should balance affordability and premium positioning, with projections indicating a gradual price increase aligning with inflation, innovation, and market expansion. Strategic positioning, including patent protections or formulation innovations, can further enhance profitability and market penetration.

Key Takeaways

- The global allergy and nasal decongestant market is projected to grow at approximately 4.8% CAGR, with OTC nasal decongestants representing a significant segment.

- Current retail prices for nasal decongestant products range from $5–$15, with potential for ALLERGY RELIEF-NASAL DECONG TB to be priced competitively at $6–$8 initially.

- Price projections indicate a steady increase over the next five years, influenced by market growth, technological innovation, and regulatory factors.

- Market entry or expansion strategies should focus on balancing affordability with differentiation through formulation or delivery mechanisms.

- Ongoing regulatory compliance and competitive pressures will be key determinants of future pricing and market viability.

FAQs

1. What are the primary active ingredients in nasal decongestants like ALLERGY RELIEF-NASAL DECONG TB?

Typically, active ingredients include vasoconstrictors such as oxymetazoline or phenylephrine, which provide quick relief from nasal congestion.

2. How does OTC status influence pricing strategies?

OTC products benefit from widespread accessibility, allowing competitive pricing without the need for reimbursement negotiations, but also limit premium pricing potential due to price sensitivity.

3. What regulatory hurdles could affect the pricing or formulation of this nasal decongestant?

Regulatory agencies may require safety, efficacy, and quality demonstrations, potentially leading to reformulation costs, labeling updates, or new approval delays impacting pricing.

4. How does market competition impact the pricing of ALLERGY RELIEF-NASAL DECONG TB?

High competition from established brands and generics exerts downward pressure on prices, necessitating strategic differentiation to command premium pricing.

5. What are potential growth opportunities for this product?

Expanding into emerging markets, developing combination formulations (e.g., antihistamines), or leveraging digital marketing can facilitate growth and justify price premium positioning.

Sources:

[1] Grand View Research, "Allergy Treatment Market Size & Share," 2022.

[2] GoodRx, OTC Nasal Decongestant Price List, 2023.

[3] Nielsen Reports, Consumer Health Market Trends, 2022.

More… ↓