Last updated: August 1, 2025

Introduction

Allergy relief remains a significant segment within the global pharmaceutical industry, driven by rising prevalence of allergic conditions and growing consumer awareness. The landscape encompasses diverse categories, including antihistamines, corticosteroids, decongestants, and biologics. This analysis dissects current market dynamics, competitive positioning, regulatory influences, and future price projections essential for stakeholders aiming to navigate this lucrative sector effectively.

Market Overview

The global allergy treatment market was valued at approximately USD 20.8 billion in 2022, with expectations to reach USD 31.4 billion by 2030, expanding at a compounded annual growth rate (CAGR) of about 6.0% (2023-2030) [1]. Growth catalysts include increasing urbanization, pollution-induced allergies, and seasonal variations, alongside expanding pediatric and adult allergy diagnoses.

The segment identifies several dominant players: Pfizer's Claritin, Sanofi's Allegra, Merck's Zyrtec, along with newer entrants like biologics such as Dupilumab (Regeneron/Sanofi). Over-the-counter (OTC) formulations constitute a substantial share, driven by consumer preferences for non-prescription options.

Market Segmentation

- Drug Type: Antihistamines (first and second generation), corticosteroids, leukotriene receptor antagonists, biologics.

- Application: Seasonal allergic rhinitis, perennial allergic rhinitis, atopic dermatitis, conjunctivitis.

- Distribution Channels: OTC retail, hospital pharmacies, online platforms.

- Regional Distribution: North America (largest market), Europe, Asia-Pacific (fastest-growing), Latin America, Middle East & Africa.

Competitive Landscape

Large pharmaceutical firms dominate through diversified portfolios. Pfizer and Sanofi lead OTC antihistamines, while AstraZeneca and Regeneron advance biologic therapies for severe allergies. Price competition hinges on generic availability, brand positioning, formulation convenience, and regulatory factors.

Regulatory Influences

The U.S. Food and Drug Administration (FDA) plays a crucial role, often expediting approvals for novel therapies via breakthrough designations. Conversely, stringent patent protections and regulatory campaigns on OTC drug safety influence pricing strategies. In Europe, EMA approvals and health authority reimbursements also shape market access.

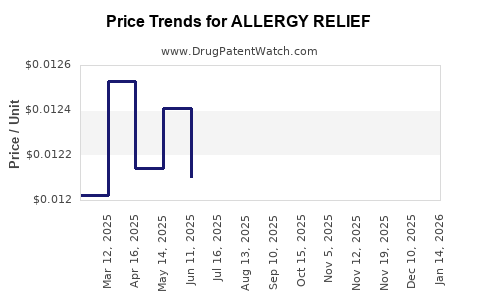

Price Dynamics and Factors Influencing Prices

- Brand vs. Generic: Branded allergy medications command premium prices, with generics offering 50-80% reductions.

- Formulation and Delivery Method: Novel delivery systems (e.g., nasal sprays, tablets) can fetch higher prices compared to older formulations.

- Regulatory Cost and R&D: High investment in clinical trials and regulatory compliance sustains elevated prices, especially for biologics.

- Market Competition: Price erosion occurs following patent expirations; for example, generics of Zyrtec and Allegra have significantly decreased prices.

- Insurance Coverage & Reimbursements: These factors can mitigate consumer costs, influencing retail prices.

Current Price Benchmarks

- OTC antihistamines: Generic loratadine (~USD 10-15 per month), branded counterparts (~USD 20-30).

- Prescription biologics: Dupilumab costs around USD 37,000 annually (~USD 3,083/month), reflecting high R&D and manufacturing costs.

- Nasal sprays and corticosteroids: Typically priced between USD 15-40 per bottle for OTC options.

Future Price Projections (2023-2030)

Considering the market trajectory and emerging therapies:

- OTC antihistamines: Expect minimal price fluctuations owing to high generic penetration. Prices may decline marginally due to increased competition, averaging around USD 8-12 per month for common drugs.

- Prescription drugs: Biologics like Dupilumab are projected to sustain high prices, albeit with slight declines driven by biosimilar competition. By 2030, average annual costs may balance around USD 30,000-35,000 for established biologics, while novel therapeutics could command premiums exceeding current benchmarks.

- Innovative therapies: Personalized allergy vaccines and biologics under advanced clinical trials could initially command premium pricing, with expected reductions post-market entry, assuming patent protections.

Market Trends Impacting Pricing Strategies

- Biosimilar proliferation will exert downward pressure on biologic prices.

- Digital health integration (e.g., telemedicine) may influence drug pricing through streamlined distribution and reduced overhead.

- Regulatory and reimbursement policies favoring cost-effective generics will shape price ceilings.

- Consumer preferences for OTC and natural remedies might limit premium pricing for new, high-cost biologics.

Conclusion

The allergy relief drug market is poised for sustainable growth, characterized by escalating demand for both OTC and prescription therapies. Price stability in OTC segments persists due to generics, while biologic therapies remain high-value due to R&D intensity and clinical efficacy. Future price movements suggest moderate declines in standard medications, with premium prices maintained for innovative and biologic treatments.

Key Takeaways

- The global allergy relief market is expanding at a CAGR of 6%, driven by increasing allergy prevalence.

- Generics will continue to suppress prices in OTC categories, maintaining affordability for consumers.

- Biologics will sustain high prices, with biosimilar entries potentially decreasing costs after regulatory approval.

- Regulatory dynamics and reimbursement policies significantly influence market pricing strategies.

- Innovation in delivery methods and personalized therapies will create premium pricing opportunities, albeit with eventual market-driven price adjustments.

FAQs

1. What are the primary drivers of price changes in allergy relief medications?

Market competition, patent expirations, regulatory policies, development costs, and consumer demand dictate price dynamics. Generics and biosimilars press prices downward, while innovative therapies and delivery methods sustain premium pricing.

2. How does patent protection influence allergy drug pricing?

Patent protection allows manufacturers to maintain monopolistic pricing, often resulting in higher prices. Once patents expire, generic alternatives reduce costs, benefiting consumers and healthcare systems.

3. Are biologic allergy therapies cost-effective?

Biologics demonstrate high clinical efficacy, especially for severe allergies, but their costs are substantial. Cost-effectiveness analyses depend on disease severity, patient population, and healthcare budgets, with ongoing debates about their long-term value.

4. What impact will the rise of online pharmacies have on allergy drug prices?

Online distribution channels increase competition, potentially lowering retail prices and improving accessibility. However, regulatory oversight on online sales influences pricing and product authenticity.

5. What future innovations could influence allergy relief drug prices?

Advancements in personalized medicine, nasal delivery technologies, and immune modulation therapies could command premium prices initially but may become more affordable as technologies mature and competition increases.

Sources

[1] MarketWatch, "Allergy Treatment Market Forecast," 2023.