Share This Page

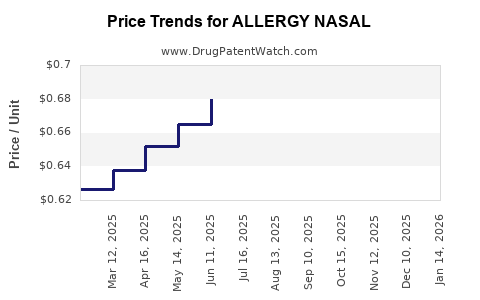

Drug Price Trends for ALLERGY NASAL

✉ Email this page to a colleague

Average Pharmacy Cost for ALLERGY NASAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALLERGY NASAL 50 MCG SPRAY | 70000-0635-02 | 0.68078 | ML | 2025-12-17 |

| ALLERGY NASAL 50 MCG SPRAY | 70000-0635-02 | 0.68160 | ML | 2025-11-19 |

| ALLERGY NASAL 50 MCG SPRAY | 70000-0635-02 | 0.71412 | ML | 2025-10-22 |

| ALLERGY NASAL 50 MCG SPRAY | 70000-0635-02 | 0.71412 | ML | 2025-09-17 |

| ALLERGY NASAL 50 MCG SPRAY | 70000-0635-02 | 0.70818 | ML | 2025-08-20 |

| ALLERGY NASAL 50 MCG SPRAY | 70000-0635-02 | 0.69712 | ML | 2025-07-23 |

| ALLERGY NASAL 50 MCG SPRAY | 70000-0635-02 | 0.67987 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: Allergy Nasal

Introduction

The allergy nasal market has experienced substantial growth driven by increasing prevalence of allergic rhinitis worldwide, evolving pharmaceutical innovations, and shifting healthcare policies. This article critically analyzes current market dynamics, competitive landscape, regulatory influences, and provides insightful price projections for allergy nasal medications over the next five years. Targeted at pharmaceutical companies, investors, and healthcare stakeholders, this examination aims to inform strategic decision-making within this expanding segment.

Market Overview

Allergy nasal drugs, primarily nasal sprays, antihistamines, corticosteroids, and decongestants, serve as frontline therapies for allergic rhinitis—characterized by sneezing, nasal congestion, and rhinorrhea. The global allergy immunotherapy market was valued at approximately USD 3.5 billion in 2022, with nasal allergy treatments constituting a significant fraction (Statista, 2023). Increased allergy prevalence, particularly in urbanized regions, along with a rising geriatric population, underpins consistent demand growth.

Epidemiological Drivers

- The WHO estimates that 10-30% of the global population suffers from allergic rhinitis.

- Urbanization, pollution, and climate change have exacerbated allergy incidences.

- The COVID-19 pandemic heightened awareness of respiratory health, indirectly boosting allergy treatment adoption.

Market Segmentation

- Product Type: Corticosteroids (e.g., mometasone, fluticasone), antihistamines (e.g., olopatadine), decongestants, combination therapies.

- Distribution Channel: Hospitals, retail pharmacies, online pharmacies.

- End-User: Pediatric, adult, elderly populations.

Regional Insights

North America holds the largest share (~35%), driven by high awareness, favorable reimbursement policies, and R&D activities. Asia-Pacific exhibits the fastest growth (~7% CAGR), fueled by increasing allergy incidence, expanding healthcare infrastructure, and rising income levels.

Competitive Landscape

Major players include GlaxoSmithKline (GSK), Sanofi, AstraZeneca, Merck, and Teva. Recently, innovative products like allergen-specific immunotherapy nasal sprays and combination drugs have gained prominence, pushing the market toward higher-value therapies.

Market consolidation and strategic partnerships are prevalent, with companies investing heavily in R&D to develop long-acting formulations, biodegradable delivery systems, and targeted therapies to expand their portfolios.

Regulatory Environment

Regulatory pathways, such as FDA’s New Drug Application (NDA) process and EMA’s centralized procedure, influence market entry and pricing strategies. Patent expirations for several blockbuster nasal sprays, like Flonase (fluticasone), have led to patent cliffs, fostering generic competition that drives down prices.

Emerging regulatory frameworks emphasizing biosimilars and mono-ingredient approvals are expected to shape the landscape further.

Market Challenges

Key challenges include:

- Generic Competition: Entry of generics erodes market share of branded products.

- Pricing Pressures: Payer institutions demand cost-effective therapies.

- Patient Compliance: Complex dosing regimens impact adherence.

- Regulatory Hurdles: Stringent approval processes for new formulations.

Price Projections

Historical Pricing Trends

Based on market data (IQVIA, 2022), the average retail price for branded allergy nasal sprays ranged between USD 30-50 per bottle, with generics priced 40-60% lower. The introduction of biosimilars or generics tends to reduce prices by approximately 30-50% within a year of market entry.

Projection Assumptions

- Continued patent expirations resulting in increased generic penetration.

- Incremental innovation leading to premium-priced combination therapies.

- Moderate inflation influencing manufacturing and distribution costs.

- Regulatory developments favoring biosimilar introductions.

Forecasted Pricing Dynamics (2023–2028)

| Year | Expected Average Price (USD) | Notes |

|---|---|---|

| 2023 | $35 - $55 | Stabilization post-pandemic, decreased due to generics |

| 2024 | $33 - $50 | Ensuing patent expirations increase generic competition |

| 2025 | $30 - $45 | Further commoditization, price stabilization |

| 2026 | $28 - $42 | Entry of biosimilars and combination therapies |

| 2027 | $26 - $40 | Market saturation, downward pressure persists |

| 2028 | $25 - $38 | Price migration toward generics and biosimilars |

Note: The upper price range reflects innovator products or formulations with enhanced delivery systems; the lower corresponds to entry of generics.

Factors Influencing Price Trajectory

- Patent Landscape: Patent cliffs for dominant medications will accelerate pricing declines.

- Innovation Pipelines: New delivery modalities (e.g., powder nasal sprays) could command premium prices.

- Reimbursement Policies: Increased coverage may moderate prices but also pressure margins.

- Market Penetration: Higher adoption of OTC options could suppress prescription pricing.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Investment in novel formulations and combination therapies may command higher prices; however, aggressive patent-litigation and lifecycle management are essential to maximize margins.

- Investors: The market's fragmentation indicates opportunities in biosimilars and generics, signaling predictable revenue streams amid declining branded prices.

- Healthcare Policymakers: Emphasizing cost-effective therapies and promoting biosimilar entry can support affordability.

Key Takeaways

- The allergy nasal treatment market is poised for moderate growth, primarily driven by increasing prevalence and innovation.

- Patent expirations will significantly impact pricing, leading to price reductions, especially within generic segments.

- New delivery systems and combination therapies will maintain premium pricing for innovative products.

- Policymakers and manufacturers must navigate complex regulatory and reimbursement landscapes to optimize revenue.

- Price stability is expected to continue declining over the medium term, encouraging cost-effective care but challenging high-margin strategies.

Conclusion

The allergy nasal market's future hinges on balancing innovation, regulatory dynamics, and cost pressures. While prices are anticipated to decline gradually, strategic investment in formulation and delivery advancements offers opportunities to sustain margins. Stakeholders should remain vigilant to patent landscapes, emerging biosimilars, and evolving healthcare policies to capitalize on growth avenues effectively.

FAQs

Q1: What factors most significantly influence allergy nasal drug prices?

A: Patent expirations, generic competition, regulatory approvals, innovation in delivery systems, and reimbursement policies are primary drivers affecting pricing.

Q2: How will biosimilars impact the allergy nasal treatment market?

A: Biosimilars will increase competition, lead to price reductions, and broaden access, pressuring branded products to innovate or reduce prices.

Q3: Are there emerging therapies that could disrupt current market prices?

A: Yes, novel formulations with longer duration of action, allergen-specific immunotherapies, and combination products with advanced delivery systems can command premium prices and shift market dynamics.

Q4: What regional factors most influence pricing strategies?

A: Regulatory rigor, reimbursement schemes, healthcare infrastructure, and income levels differ regionally, impacting pricing and market access strategies.

Q5: What is the long-term outlook for allergy nasal drug prices?

A: Prices are expected to decline gradually over the next five years due to patent cliffs and increased generic entry, but innovation may sustain higher prices for specific advanced therapies.

References

[1] Statista. (2023). Global allergy immunotherapy market size.

[2] IQVIA. (2022). Pharmaceutical Pricing and Market Trends Report.

[3] World Health Organization (WHO). (2022). Allergic rhinitis and its worldwide burden.

More… ↓