Share This Page

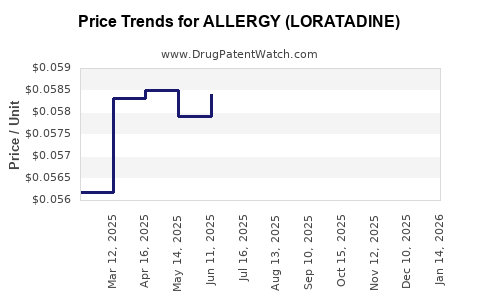

Drug Price Trends for ALLERGY (LORATADINE)

✉ Email this page to a colleague

Average Pharmacy Cost for ALLERGY (LORATADINE)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALLERGY (LORATADINE) 10 MG TAB | 69230-0328-03 | 0.05535 | EACH | 2025-12-17 |

| ALLERGY (LORATADINE) 10 MG TAB | 51660-0526-01 | 0.05535 | EACH | 2025-12-17 |

| ALLERGY (LORATADINE) 10 MG TAB | 51660-0526-05 | 0.05535 | EACH | 2025-12-17 |

| ALLERGY (LORATADINE) 10 MG TAB | 51660-0526-31 | 0.05535 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Loratadine (ALLERGY Medications)

Introduction

Loratadine, marketed under brand names such as Claritin, is a widely used second-generation antihistamine primarily indicated for allergy relief. Given the substantial global demand for allergy medications and the competitive landscape of antihistamines, understanding the market dynamics and future pricing trends for loratadine is critical for pharmaceutical stakeholders, investors, and healthcare policymakers.

This analysis delves into the current market landscape, regulatory environment, patent considerations, competitive factors, and projected pricing trajectories for loratadine over the upcoming years.

Market Landscape

Global Market Size

The global allergy medication market was valued at approximately USD 17.2 billion in 2021, with antihistamines representing a significant segment. Loratadine constitutes a sizeable portion, accounting for an estimated 25-30% of the non-prescription antihistamine segment, driven by high demand due to its favorable safety profile, minimal sedative effects, and over-the-counter availability in many regions.

Regional Dynamics

- North America: The largest market, driven by high prevalence of allergic rhinitis (~20-30% of adults) and strong OTC penetration. The US leads in sales, with Claritin remaining a leading brand.

- Europe: A mature market with increasing consumer awareness and regulatory acceptance of OTC allergy medications.

- Asia-Pacific: Fastest growth rate driven by rising allergy prevalence, urbanization, and expanding healthcare infrastructure. Key markets include China, India, and Japan.

- Latin America & Middle East: Emerging markets with expanding OTC channels and increasing healthcare access, contributing to global demand.

Market Drivers

- Rising incidence of allergic rhinitis and conjunctivitis.

- Increasing preference for OTC antihistamines due to convenience and safety.

- Aging populations with chronic allergy conditions.

- COVID-19 pandemic spurring heightened health consciousness and self-medication.

Competitive Landscape

Major players include Johnson & Johnson (Claritin), Takeda Pharmaceuticals, Teva Pharmaceuticals, and various generic manufacturers. The generic segment commands significant market share, with many local producers offering loratadine-based products at competitive prices.

Regulatory and Patent Environment

Patent Expiry and Generic Competition

Loratadine's primary patents expired in the early 2010s in major markets, leading to a proliferation of generic versions. This patent cliff significantly impacted brand-name sales but also expanded market accessibility.

Regulatory Frameworks

Most jurisdictions facilitate OTC availability for loratadine, subject to regulatory approval. The US FDA, EMA, and other agencies maintain rigorous standards, but once patent protections lapse, market entry pathways favor generics, intensifying competition and driving prices downward.

Price Trends and Projections

Historical Price Patterns

- Brand-name loratadine (Claritin): Historically commanded premium pricing (~USD 10-20 per pack).

- Generics: Entered the market valuations at significantly lower prices (~USD 3-8 per pack), resulting in substantial price erosion for branded products.

Current Price Dynamics

In 2023, average retail prices for loratadine packages are approximately:

- Brand-name: USD 12-15 per pack.

- Generics: USD 3-7 per pack, with some regional variations.

Prices are further influenced by insurance reimbursement policies, pharmacy markups, and discount programs.

Future Price Projections (2024–2028)

Factors Influencing Future Pricing

- Generic Competition: The continued influx of generics will suppress prices, with expected average decreases of 10-15% annually.

- Market Saturation: As most markets are saturated, price stabilization or slight declines are anticipated.

- Regulatory Changes: Potential OTC reclassification, with pricing possibly stabilizing or increasing marginally due to increased accessibility.

- Manufacturing Costs: Slight reductions expected from process optimizations, but external inflationary pressures may offset savings.

Predicted Price Trend

- Brand-name loratadine: Likely to decline gradually to USD 8-12 per pack by 2028, barring new formulations or patents.

- Generics: Expected to stabilize around USD 2-5 per pack, with some premium options approaching USD 6-7 in premium markets.

Market Entry and Pricing Strategies

New entrants can leverage low-cost manufacturing to capture market share, particularly in emerging markets. Price competition will remain fierce, with companies focusing on volume sales rather than premium pricing.

Challenges and Opportunities

Challenges

- Price erosion: Sustained generic competition limits profit margins.

- Regulatory hurdles: Variations in OTC classification may impact distribution and pricing.

- Market saturation: Reduced potential for growth in mature markets.

Opportunities

- Product Differentiation: Development of combination products or formulations with added benefits.

- Expanding Markets: Penetration into underdeveloped regions with increasing allergy prevalence.

- Digital and Direct-to-Consumer Sales: Enhancing accessibility and reducing distribution costs.

Key Takeaways

- The loratadine market is mature, with generics driving significant price declines.

- Prices are projected to decrease by approximately 10-15% annually in the coming years, stabilizing around USD 2-5 per pack for generics.

- Brand-name products will continue to command higher prices but will experience gradual erosion.

- Strategic focus should be on cost-efficient manufacturing, market expansion, and potential product innovations to sustain profitability.

- Policymakers and companies should monitor regulatory shifts that could impact OTC status and pricing dynamics.

FAQs

Q1: How has patent expiry affected loratadine pricing?

Patent expiry in the early 2010s led to an influx of generic manufacturers, resulting in significant price reductions and increased market accessibility.

Q2: Are there upcoming regulatory changes that could influence loratadine prices?

Potential reclassification of loratadine as OTC in some regions may improve access but could also lead to further pricing pressure due to increased competition.

Q3: What regions offer the highest growth potential for loratadine?

Asia-Pacific and Latin America present robust growth opportunities due to rising allergy prevalence and expanding healthcare infrastructure.

Q4: How do manufacturing costs impact pricing strategies?

Advancements in manufacturing and economies of scale reduce costs, enabling companies to sustain competitive pricing and capture market share.

Q5: What are the risks to price stability for loratadine?

Regulatory changes, market saturation, or a shift toward more effective or innovative allergy treatments could threaten future price stability.

References

- Grand View Research, "Antihistamines Market Analysis," 2022.

- IQVIA, "Global Prescription Drug Market Data," 2022.

- U.S. Food and Drug Administration (FDA), "OTC Drug Review," 2023.

- European Medicines Agency (EMA), "Regulatory Updates," 2022.

- MarketWatch, "Loratadine Price Trends," 2023.

More… ↓