Share This Page

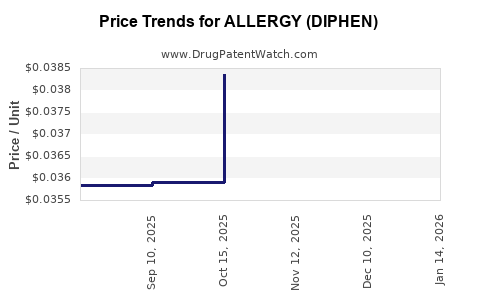

Drug Price Trends for ALLERGY (DIPHEN)

✉ Email this page to a colleague

Average Pharmacy Cost for ALLERGY (DIPHEN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALLERGY (DIPHEN) 25 MG MINITAB | 50844-0329-07 | 0.03654 | EACH | 2025-12-17 |

| ALLERGY (DIPHEN) 25 MG MINITAB | 50844-0329-07 | 0.03751 | EACH | 2025-11-19 |

| ALLERGY (DIPHEN) 25 MG MINITAB | 50844-0329-07 | 0.03836 | EACH | 2025-10-22 |

| ALLERGY (DIPHEN) 25 MG MINITAB | 50844-0329-07 | 0.03592 | EACH | 2025-09-17 |

| ALLERGY (DIPHEN) 25 MG MINITAB | 50844-0329-07 | 0.03583 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: ALLERGY (DIPHEN)

Introduction

ALLERGY (DIPHEN), a formulation of Diphenhydramine, is a widely used antihistamine primarily indicated for allergy relief, insomnia, and motion sickness. With a long-standing presence in the pharmaceutical market, understanding its current market dynamics, competitive landscape, and future pricing trajectories is essential for stakeholders. This analysis evaluates the market size, growth drivers, challenges, regulatory influences, and projected pricing trends of Diphenhydramine, especially focusing on the OTC segment where it predominantly resides.

Market Overview

Global Market Size and Segmentation

Diphenhydramine's market primarily operates within the antihistamine segment of the broader allergy medication market, which was valued at approximately $12.2 billion globally in 2022, with OTC drugs constituting over 70% of this market [1]. Diphenhydramine’s contribution is primarily driven through OTC formulations like ALLERGY (DIPHEN), Benadryl, and generics.

Geographical Distribution

The North American market remains dominant, securing over 50% of sales due to high OTC utilization and strong brand recognition. Europe follows, with expanding demand in emerging markets such as Asia-Pacific, where increasing awareness of allergy medications and rising disposable incomes are fostering market growth.

Competitive Landscape

Key Players

- Johnson & Johnson (Benadryl)

- Sandoz (generics)

- Mylan (generics)

- Teva Pharmaceuticals

- Local pharmaceutical firms in emerging markets

Market Share Dynamics

Brand dominance persists in mature markets, but the generic segment is rapidly growing, driven by price competition and regulatory approvals easing entry barriers. The proliferation of OTC options diminishes the market share of any single brand but sustains overall sales volumes.

Regulatory Environment

Diphenhydramine's OTC status in the U.S. and many countries simplifies distribution but subjects the product to guideline adherence for safety warnings. Stringent regulations in emerging markets pose challenges but also opportunities through localized approvals.

Market Drivers

- Increasing prevalence of allergic rhinitis and associated respiratory conditions.

- Rising consumer preference for OTC medications for self-care.

- Aging populations susceptible to allergies and sleep disorders.

- Continuous product innovation, including combination formulations.

Market Challenges

- Competition from newer antihistamines with improved safety profiles.

- Safety concerns over sedative effects, especially in vulnerable populations.

- Regulatory hurdles in some jurisdictions.

- The generic price erosion impacting margins.

Price Analysis

Historical Pricing Trends

Historically, Diphenhydramine OTC products like ALLERGY (DIPHEN) have retailed in the U.S. between $4 and $10 for a 25-60 count box, depending on brand and formulation. Generic versions tend to be priced approximately 20-30% lower than branded counterparts to capture price-sensitive consumers.

Pricing Factors

- Brand vs. Generic: Generics typically undercut brand names by a significant margin.

- Packaging and Formulation: Liquid, tablet, or gel formulations influence pricing.

- Distribution Channel: Pharmacy, online, or retail outlets impact markups.

- Regulatory Changes: Safety warnings or new approvals can cause temporary price fluctuations.

Current Market Pricing

As of 2023, the average retail price of ALLERGY (DIPHEN) OTC capsules stands at approximately $5.50 for a standard 50-count bottle in the U.S., with generics averaging around $4.50. Variability exists based on purchasing channels, with online sales often at discounted rates.

Future Price Projections

Short-Term Outlook (Next 2-3 Years)

Limited significant shifts in the core pricing structure are expected, given the mature status of Diphenhydramine’s OTC market. Slight downward pressure may arise from increased generic competition and online pharmacy offerings, potentially reducing prices by 5-10%.

Medium to Long-Term Outlook (3-10 Years)

Several factors could influence future pricing:

- Regulatory Impact: Stricter safety warnings or formulations that limit sedative effects could sow supply constraints, possibly raising prices.

- Market Penetration: Expansion into emerging markets with rising awareness could stabilize pricing due to increased volume.

- Innovation and Combination Therapies: Introduction of advanced formulations or combination drugs might command premium pricing, although this could reduce the share of traditional Diphenhydramine products.

- Competition and Patent Dynamics: Expiry of patents and increased generic availability will continue to exert downward pressure, maintaining a competitive price landscape.

Based on current trends and assuming a gradual increase in demand coupled with competitive pressures, a conservative projection suggests a 1-3% annual decrease in average retail prices over the next decade, barring regulatory shocks.

Impact of Patent and Regulatory Changes

Diphenhydramine formulations are largely off-patent, reinforcing intense price competition. However, any future regulatory requirements demanding reformulation for safety, such as reduced sedative effects, could lead to manufacturing costs increases and subsequent price inflation. Conversely, streamlined approval pathways in emerging markets could fuel volume-based price reductions.

Key Market Opportunities

- Developing combination OTC formulations targeting sleep and allergy relief.

- Expanding distribution channels, notably digital and telehealth platforms.

- Entering underpenetrated markets with model pricing strategies.

Potential Risks

- Emergence of newer, non-sedative antihistamines reducing Diphenhydramine's market share.

- Regulatory restrictions owing to safety concerns, impacting availability or formulation.

- Price sensitivity among consumers, especially amid economic downturns.

Conclusion

The market for ALLERGY (DIPHEN), anchored by Diphenhydramine's established presence, remains stable with predictable pricing patterns shaped by competition, regulation, and consumer preferences. While immediate price reductions are anticipated due to generic competition, long-term growth hinges on innovation, regulatory environment, and expansion into emerging markets. Price stabilization or modest declines are probable, maintaining Diphenhydramine’s position as a cost-effective OTC allergy and sleep remedy.

Key Takeaways

- The OTC allergy market, dominated by Diphenhydramine, is mature with high generic penetration and consistent pricing.

- Short-term price declines of 5-10% are expected due to competitive pressures; long-term modest decreases are projected.

- Regulatory considerations, notably safety warnings, could influence formulations and prices.

- Market expansion opportunities exist in emerging regions driven by increasing allergy awareness.

- Price strategies should emphasize access, innovation, and regional compliance to sustain profitability.

FAQs

1. How are Diphenhydramine prices expected to evolve in the next five years?

Prices are expected to decline modestly, around 1-3% annually, driven by increased generic competition and online retail influence, with potential stabilization due to market saturation.

2. What factors most significantly influence the retail price of ALLERGY (DIPHEN)?

Brand versus generic status, formulation, packaging, distribution channels, and regulatory changes are key determinants affecting retail pricing.

3. How does regulatory oversight impact Diphenhydramine's market prices?

Regulations requiring safety warnings or formulation modifications may increase manufacturing costs, potentially raising prices. Conversely, deregulation can enhance market competition and suppress prices.

4. Is there room for premium pricing in the Diphenhydramine market?

Yes. Innovation such as combination formulations or addiction to novel delivery methods could justify premium pricing, though Paced by regulatory approval and consumer acceptance.

5. Which regions present the most growth opportunity for Diphenhydramine?

Emerging markets in Asia-Pacific and Latin America offer expansion potential due to rising allergy prevalence, increasing disposable incomes, and evolving OTC access policies.

Sources:

[1] IQVIA, "Global Allergy Medication Market Report," 2022.

More… ↓