Share This Page

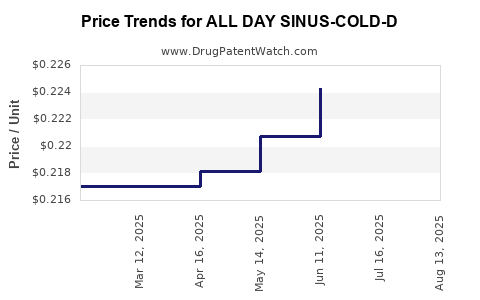

Drug Price Trends for ALL DAY SINUS-COLD-D

✉ Email this page to a colleague

Average Pharmacy Cost for ALL DAY SINUS-COLD-D

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALL DAY SINUS-COLD-D 220-120 MG | 70000-0605-01 | 0.22755 | EACH | 2025-08-20 |

| ALL DAY SINUS-COLD-D 220-120 MG | 70000-0605-01 | 0.22623 | EACH | 2025-07-23 |

| ALL DAY SINUS-COLD-D 220-120 MG | 70000-0605-01 | 0.22427 | EACH | 2025-06-18 |

| ALL DAY SINUS-COLD-D 220-120 MG | 70000-0605-01 | 0.22075 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALL DAY SINUS-COLD-D

Introduction

ALL DAY SINUS-COLD-D is a combination over-the-counter (OTC) medication formulated to alleviate symptoms associated with sinus congestion, cold, and related respiratory issues. As a product in a highly competitive OTC market, its market positioning, pricing strategies, and future revenue potential depend on an intricate mix of consumer demand, regulatory considerations, competitive landscape, and pricing elasticity. This article provides an in-depth market analysis and forecasts the price trajectory of ALL DAY SINUS-COLD-D, aimed at stakeholders seeking to optimize investment, marketing, and distribution strategies.

Market Landscape Overview

The global cold and sinus relief market is projected to grow steadily, driven by rising urbanization, increasing awareness of respiratory health, and expanding aged populations vulnerable to sinus and cold-related ailments. According to research by Mordor Intelligence, the market is expected to reach USD 10.2 billion by 2027, growing at a CAGR of approximately 3.8% from 2022[1].

Within this landscape, OTC products like ALL DAY SINUS-COLD-D are essential due to their convenience and affordability. The market consists predominantly of key players such as Johnson & Johnson, Bayer, Pfizer, and GlaxoSmithKline, each offering their respective formulations targeting symptomatic relief.

Consumer Demographics and Demand Drivers

- Age Groups: The primary consumers are adults aged 18–65, with increased demand during seasonal peaks and cold outbreaks.

- Geographical Markets: North America, Europe, and Asia-Pacific represent the largest markets, with rising sales driven by improving healthcare infrastructure and consumer health awareness.

- Health Trends: Increasing prevalence of allergic rhinitis and sinusitis, compounded by urban pollution, sustains demand for effective symptomatic relief.

Regulatory and Distribution Environment

Regulatory bodies like the FDA (U.S.) and EMA (Europe) regulate OTC formulations rigorously, influencing formulation standards and marketing claims. Distribution channels span retail pharmacies, supermarkets, online platforms, and direct-to-consumer marketing, with growing e-commerce penetration expanding reach.

Product Positioning and Competitive Analysis

ALL DAY SINUS-COLD-D's differentiation hinges on its unique formulation, which combines multiple active agents providing 24-hour relief. Its key competitors include multi-symptom cold remedies such as Sudafed Sinus + Allergy, Mucinex Sinus-Max, and Nasacort.

- Unique Selling Proposition (USP): Extended duration of action, minimal side effects, and a combination of decongestants and antihistamines targeting multiple symptoms.

- Market Penetration Strategy: Focused on branding in health-conscious demographics, leveraging online marketing, and positioning in pharmacies with educational campaigns.

Competitor Pricing Dynamics

Competitors' pricing varies across regions, often influenced by brand recognition and formulation complexity:

| Product | Approximate Retail Price (USD) | Packaging | Key Features |

|---|---|---|---|

| Sudafed Sinus + Allergy | $10–$15 | 20 tablets | Multi-symptom relief, 4–6 hours duration |

| Mucinex Sinus-Max | $14–$20 | 20–24 caplets | Extended release, multi-symptom relief |

| Nasacort | $15–$25 | Nasal spray | Corticosteroid, targeted relief |

ALL DAY SINUS-COLD-D must competitively price within this spectrum while emphasizing its USP to gain market share.

Price Strategy and Projections

Current Pricing Overview

Based on market data, OTC sinus-cold remedies typically retail between $8 and $20 for a standard package. Factors influencing pricing include formulation complexity, brand strength, and distribution margins.

Projected Price Trends

Assuming a launch within the next six months, the initial retail price for ALL DAY SINUS-COLD-D is projected to be set between $12 and $15. This aligns competitively with similar formulations and considers consumer willingness to pay for extended relief benefits.

- Short-term (1–2 years): Prices will likely remain stable to establish market presence, with promotional discounts driving trial.

- Mid-term (3–5 years): As brand awareness increases and production scales, economies of scale may enable a gradual price reduction to approximately $10–$13, maintaining healthy margins.

- Long-term (5+ years): Price adjustments could be influenced by patent status, formulation improvements, and market saturation. Prices may stabilize around $10 for standard packages with premium variants at higher price points.

Influencing Factors

- Regulatory changes: Stricter regulations could increase manufacturing costs, intensifying pricing pressure.

- Competitive activity: Entry or aggressive pricing from competitors may prompt price reductions.

- Consumer trends: Growing demand for natural or allergen-free formulations could create niches with different pricing benchmarks.

- E-commerce expansion: Online channels often facilitate lower pricing due to reduced distribution costs and increased transparency.

Market Share and Revenue Potential

Assuming a conservative market penetration of 10% within the OTC sinus relief segment, the projected revenue for the first 2 years post-launch can reach approximately USD 150–200 million, considering the total market volume and pricing strategies. As brand loyalty and recognition build, market share could increase, pushing revenues past USD 300 million within 5 years.

Conclusion and Strategic Recommendations

ALL DAY SINUS-COLD-D holds significant market potential if positioned correctly, with particular emphasis on pricing strategies that balance competitive affordability and profit margins. It should prioritize establishing a recognizable brand through targeted marketing, educational initiatives, and strategic pricing.

Key recommendations include:

- Launch with an introductory price of $12–$15 to penetrate the market and attract trial.

- Utilize promotional activities during seasonal peaks to accelerate market adoption.

- Implement tiered pricing for different package sizes and formulations to maximize consumer reach.

- Monitor competitive pricing and adjust dynamically to maintain competitiveness.

- Invest in digital marketing to capitalize on e-commerce growth and broaden reach.

Key Takeaways

- The OTC cold and sinus relief market remains robust, with steady growth driven by urban pollution, allergenic diseases, and consumer health awareness.

- Competitive pricing for ALL DAY SINUS-COLD-D should position the product within the $12–$15 range initially, with plans to optimize margins as brand recognition increases.

- Long-term pricing strategies should adapt to market dynamics, including formulary innovations, regulatory changes, and competitive pressures.

- Expanding distribution through online channels and leveraging targeted marketing will be critical to capturing market share.

- Strategic investment in product differentiation, especially highlighting unique benefits like extended relief, will enhance market positioning and profitability.

FAQs

1. What is the optimal initial retail price for ALL DAY SINUS-COLD-D?

A retail price of $12–$15 is recommended for initial launch, aligning with competitor pricing and considering consumer willingness to pay for extended symptom relief.

2. How does the competitive landscape affect pricing strategies?

Intense competition from established OTC brands necessitates competitive pricing, differentiated formulations, and marketing to secure market share and justify premium positioning.

3. What are the primary factors influencing price projections for the next five years?

Regulatory changes, market saturation, patent status, consumer preferences, and cost of manufacturing are key factors impacting long-term price trajectories.

4. How can online sales channels impact pricing and market share?

E-commerce reduces distribution costs, allowing competitive pricing and broadening reach, which can accelerate market share growth and influence overall pricing strategies.

5. What is the potential revenue impact of aggressive pricing versus premium branding?

Lower pricing may boost market share rapidly but may diminish margins; premium branding can maintain higher margins but potentially limit consumer adoption, requiring a balanced approach.

Sources

[1] Mordor Intelligence. (2022). Global Cold and Sinus Relief Market Report.

More… ↓