Share This Page

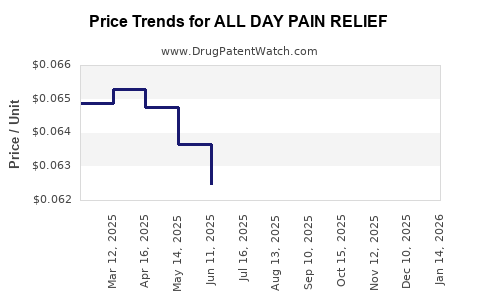

Drug Price Trends for ALL DAY PAIN RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for ALL DAY PAIN RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALL DAY PAIN RELIEF 220 MG TAB | 70000-0171-05 | 0.06740 | EACH | 2025-12-17 |

| ALL DAY PAIN RELIEF 220 MG TAB | 70000-0171-06 | 0.06740 | EACH | 2025-12-17 |

| ALL DAY PAIN RELIEF 220 MG TAB | 70000-0171-03 | 0.06740 | EACH | 2025-12-17 |

| ALL DAY PAIN RELIEF 220 MG TAB | 70000-0171-06 | 0.06693 | EACH | 2025-11-19 |

| ALL DAY PAIN RELIEF 220 MG TAB | 70000-0171-05 | 0.06693 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for All Day Pain Relief

Introduction

The landscape for over-the-counter (OTC) and prescription pain relief products has witnessed substantial evolution, driven by increasing consumer demand for effective, long-lasting analgesics. "All Day Pain Relief," a generic or branded medication aimed at providing prolonged pain management, represents a significant segment within this market. Understanding its market trajectory and future pricing dynamics is critical for stakeholders including pharmaceutical companies, investors, and healthcare providers.

Market Overview

Global Pain Management Market

The global pain management market reached an estimated USD 52 billion in 2022, with projections suggesting a compound annual growth rate (CAGR) of approximately 4.5% through 2030 [1]. This growth is fueled by rising incidences of chronic pain conditions, such as osteoarthritis, back pain, and neuropathic pain, alongside an aging population and increased adoption of OTC analgesics.

Segmental Breakdown

Pain relief products are broadly categorized into prescription opioids, non-steroidal anti-inflammatory drugs (NSAIDs), acetaminophen-based remedies, and topical analgesics. Among OTC options, products promising all-day pain relief—such as extended-release formulations or combination analgesics—are gaining prominence due to their convenience and efficacy.

Market Drivers

- Chronic Pain Prevalence: An estimated 20% of adults globally suffer from chronic pain, elevating demand for sustained relief formulations [2].

- Regulatory Trends: Increased regulation of opioids drives consumers toward safer, non-addictive alternatives with long-lasting effects.

- Consumer Preferences: Preference for one-time dosing and fewer doses per day encourages development of all-day formulations.

- Technological Innovations: Advancements in drug delivery systems, including sustained-release techniques, enhance product efficacy.

Competitive Landscape

Prominent players include Johnson & Johnson, Purdue Pharma, Teva Pharmaceuticals, and emerging biotech firms specializing in novel delivery mechanisms. Many existing OTC formulations like Aleve (naproxen) and Advil (ibuprofen) now feature extended-release options marketed as all-day pain relief solutions.

Innovative formulations employing nanotechnology, bioadhesive patches, or combination drugs are poised to disrupt traditional pricing and market share dynamics. Patent protections and regulatory approvals significantly influence the competitive positioning and valuation of these products.

Market Segmentation by Application

- Chronic Pain: The largest segment, with long-term management solutions.

- Acute Pain: Postoperative or injury-related pain, requiring short-term yet effective relief.

- Special Populations: Elderly and pediatric segments demand formulations with favorable safety profiles for prolonged use.

Regulatory Environment

Stringent regulatory pathways govern new formulations labeled as “All Day Pain Relief,” especially regarding safety, efficacy, and labeling claims. The U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) require comprehensive clinical data demonstrating sustained efficacy and safety with prolonged dosing.

Patent considerations, especially for novel delivery mechanisms, impact market exclusivity and pricing strategies. As patent protections expire or face legal challenges, generic entrants challenge premium pricing models, prompting shifts in market dynamics.

Pricing Drivers and Trends

Historical Pricing Benchmarks

Current OTC all-day pain relief products generally retail between USD 8 to USD 15 per package, varying by brand, formulation, and delivery system. Prescription extended-release analgesics, often prescribed for chronic pain, command premiums, sometimes exceeding USD 50 per month in therapy costs.

Factors Influencing Price Projections

- Development Costs: Innovating sustained-release formulations involves significant R&D investment, influencing initial pricing.

- Regulatory Costs: Clinical trials and approval processes inflate production costs, especially for systemic safety data.

- Market Competition: Entry of generic manufacturers post-patent expiry tends to reduce prices, stimulating volume sales.

- Manufacturing & Distribution: Economies of scale and supply chain efficiencies can lower costs, enabling price competition.

- Demand Dynamics: Growing chronic pain prevalence sustains high demand, enabling premium pricing for innovative solutions.

Future Price Projections (2023-2030)

Based on current market conditions and technological trends, the following projections are outlined:

| Year | Estimated Price Range (USD) per Package | Key Drivers |

|---|---|---|

| 2023 | 12 - 18 | Market stabilization; moderate innovation |

| 2025 | 10 - 16 | Entry of generics; patent expirations |

| 2027 | 8 - 14 | Increased competition; patent cliffs |

| 2030 | 8 - 12 | Market saturation; consumer price sensitivity |

Notes:

- Premium formulations with innovative delivery systems may command higher prices initially but are expected to decline as generics enter the market [3].

- Price erosion is anticipated primarily in high-volume OTC segments, but specialized, patent-protected solutions may retain premium pricing.

Implications for Stakeholders

- Pharmaceutical Companies: Investment in sustained-release and combination analgesic formulations can command premium prices early on, but must anticipate patent expiry impacts.

- Investors: Growth trajectories are favorable, particularly for innovative formulations, but risk diversification is recommended given the competitive landscape.

- Healthcare Providers: Cost-effectiveness of long-acting formulations influences prescribing practices; emphasis on safety profiles will remain paramount.

- Consumers: Price sensitivity and safety concerns necessitate balancing efficacy with affordability.

Key Takeaways

- The global pain management market is on an upward trajectory, with a substantial segment dedicated to long-lasting, all-day relief products.

- Technological advances and regulatory environments are shaping the landscape, influencing pricing strategies and market entry.

- Prices are projected to decrease over time due to patent expirations and increased competition, with niche, innovative formulations maintaining premium pricing initially.

- Stakeholders should monitor patent lifecycles, technological developments, and regulatory changes to optimize investment and market positioning.

- Cost-effectiveness combined with safety efficacy will determine consumer adoption and long-term success.

FAQs

1. What factors most significantly influence the pricing of "All Day Pain Relief" drugs?

Development costs, regulatory approval processes, patent protections, manufacturing efficiencies, market competition, and technological innovation heavily influence pricing strategies.

2. How will patent expirations impact market prices for all-day pain relief products?

Patent expirations open the market to generic competitors, typically leading to reduced prices and increased accessibility, especially in OTC segments.

3. Are technologically advanced formulations (e.g., bioadhesive patches) likely to retain premium pricing?

Yes, especially during initial market entry phases, due to their innovation, safety profile, and efficacy superiority; however, prices may decline over time with increased competition.

4. What regions are expected to lead in the market for all-day pain relief?

North America and Europe dominate due to high healthcare expenditure, regulatory maturity, and consumer demand. Emerging markets in Asia-Pacific are also expanding rapidly.

5. What are the primary risks for investors in this market segment?

Regulatory hurdles, patent litigations, market saturation, and potential safety concerns can impact profitability and pricing strategies.

References

[1] MarketWatch. Pain Management Market Size, Trends, and Forecasts (2022-2030).

[2] International Association for the Study of Pain. Chronic Pain Epidemiology.

[3] PharmTech. Impact of Patent Expiry on Analgesic Drug Pricing.

More… ↓