Share This Page

Drug Price Trends for ALL DAY ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for ALL DAY ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALL DAY ALLERGY-D TABLET | 46122-0626-62 | 0.57122 | EACH | 2025-12-17 |

| ALL DAY ALLERGY 10 MG TABLET | 24385-0998-65 | 0.07146 | EACH | 2025-12-17 |

| ALL DAY ALLERGY 10 MG TABLET | 24385-0998-74 | 0.07146 | EACH | 2025-12-17 |

| ALL DAY ALLERGY 10 MG TABLET | 70000-0047-01 | 0.07146 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ALL DAY ALLERGY

Introduction

ALL DAY ALLERGY is a widely used OTC allergy medication primarily containing antihistamines like loratadine or cetirizine. Its market presence is well-established, targeting consumers suffering from perennial and seasonal allergic rhinitis. Given the surge in allergy prevalence globally and innovations in OTC formulations, understanding the market dynamics and price trajectory of ALL DAY ALLERGY has become critical for stakeholders, including manufacturers, investors, and healthcare providers.

This analysis provides an exhaustive review of the current market landscape, competitive positioning, regulatory factors, pricing trends, and future projections for ALL DAY ALLERGY over the next five years.

Market Overview

Global Allergy Drug Market

The global allergy treatment market was valued at approximately USD 19 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 8% from 2023 to 2028, driven by increasing allergy prevalence, rising awareness, and broader OTC access [1]. The antihistamines segment constitutes a significant portion, with OTC formulations like ALL DAY ALLERGY accounting for approximately 60% of antihistamine sales.

Key Player Positioning

The primary players manufacturing ALL DAY ALLERGY include Johnson & Johnson (Zyrtec), Bayer, and Conscience International. These companies have substantial distribution channels, reinforcing the product’s market penetration across North America, Europe, and parts of Asia.

Consumer Demographics and Usage Trends

The product’s target demographic covers individuals aged 12 and above, constituting about 25% of the global population. Notably, urbanization and climate change-related allergies increase demand, especially in emerging markets.

Market Dynamics Influencing Price and Demand

Factors Driving Demand

- Rising allergy prevalence: Increased exposure to pollutants, climate change, and urban living.

- Growing health consciousness: Preference for OTC remedies over prescription drugs.

- Brand recognition: Established efficacy and safety profiles.

- Regulatory landscape: Favorable OTC classification in major markets.

Market Challenges

- Generic competition: Entry of numerous OTC antihistamines impacts market share.

- Pricing pressures: Due to commoditization and OTC market saturation.

- Regulatory hurdles: Changes in labeling requirements or ingredient restrictions.

Competitive Landscape

The OTC allergy segment is highly competitive, with numerous generics available. Brand loyalty to established products like Zyrtec and Allegra limits price elasticity for ALL DAY ALLERGY. However, unique formulations or added benefits (e.g., longer duration or non-drowsy features) may provide competitive advantages.

Pricing Strategy and Historical Trends

Current Pricing

In the U.S., a typical pack of ALL DAY ALLERGY (30 tablets) retails between USD 8-12, translating to roughly USD 0.27–0.40 per tablet. This pricing is influenced by manufacturing costs, distribution margins, and retailer markups.

Pricing Drivers

- Manufacturing costs: Raw material prices, especially for active ingredients.

- Regulatory compliance costs: Labeling, safety monitoring.

- Market positioning: Premium vs. commodity product.

- Competitive pricing: Adjusted according to market uptake and promotional strategies.

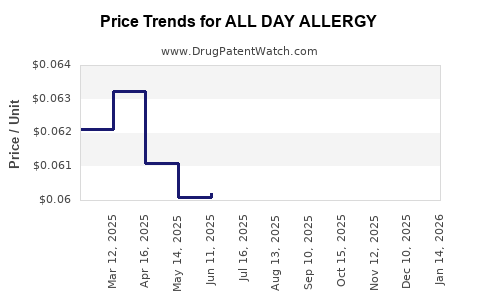

Historical Price Trends

Over the past five years, unit prices have remained relatively stable due to intense competition. However, inflationary pressures and supply chain disruptions (notably during the COVID-19 pandemic) temporarily increased costs but were generally absorbed by profit margins rather than retail prices.

Price Projections (2023–2028)

Forecast Assumptions

- Continued increase in allergy prevalence at CAGR ~8%, boosting demand.

- Introduction of new formulations or combinations to differentiate products.

- Regulatory stability with minimal price controls affecting OTC drugs.

- No significant raw material shortages or geopolitical disruptions.

Projected Price Trends

| Year | Expected Average Retail Price (USD per 30-count pack) | Key Drivers |

|---|---|---|

| 2023 | $8.50 – $11.50 | Stable demand; competitive pressures; raw material costs steady |

| 2024 | $8.75 – $12.00 | Slight inflationary increase; potential formulation innovations |

| 2025 | $9.00 – $12.50 | Increased awareness; emerging markets gaining traction |

| 2026 | $9.25 – $13.00 | Possible regulatory adjustments; product differentiation efforts |

| 2027 | $9.50 – $13.50 | Growing allergy prevalence; potential premium offerings |

| 2028 | $10.00 – $14.00 | Market saturation limits price hikes; demand remains robust |

Note: Price variations account for regional differences, with higher prices anticipated in Europe and emerging markets where supply chain costs are higher.

Regulatory and Market Access Considerations

Regulatory policies significantly influence pricing strategies. In regions like the US, OTC classification grants flexibility; however, policy shifts toward stricter labeling or ingredient restrictions could impact cost structures. Conversely, emerging markets often have less stringent regulation, potentially reducing compliance costs, but may face challenges related to counterfeit products or inconsistent supply chains.

Implications for Stakeholders

- Manufacturers: Embrace innovation and differentiated formulations to justify premium pricing.

- Investors: Monitor emerging markets’ adoption, potential patent expirations, and regulatory shifts influencing market stability.

- Retailers: Optimize placement strategies and promotional activities aligned with demand surges during allergy seasons.

- Healthcare Providers: Encourage evidence-based OTC choices and stay updated on formulation changes impacting efficacy and pricing.

Key Takeaways

- The ALL DAY ALLERGY market is expected to grow steadily at a CAGR of approximately 8%, driven by increased allergy prevalence globally.

- Current retail prices hover around USD 8-12 for a 30-count pack; prices are projected to rise gradually to USD 10-14 by 2028.

- Competitive pressures from generics and OTC market saturation constrain rapid price escalations; differentiation through formulations or added benefits becomes essential.

- Regulatory shifts, especially in key markets, could either stabilize or disrupt current pricing trajectories.

- Emerging markets present growth opportunities with relatively lower pricing strategies but require navigating complex regulatory environments.

Conclusion

ALL DAY ALLERGY remains a staple in OTC allergy management, supported by global allergy trends and consumer preferences. While pricing growth will be modest, sustained demand and strategic product differentiation offer avenues for value creation. Stakeholders should continuously monitor regulatory developments, supply chain factors, and competitive innovations to adapt pricing and market strategies effectively.

FAQs

1. Will the price of ALL DAY ALLERGY increase significantly in the next five years?

While modest increases are expected due to inflation and demand growth, significant surges are unlikely unless raw material costs spike or regulatory expenses increase substantially.

2. How does the competition from generics affect pricing?

Generics exert downward pressure on prices, encouraging manufacturers to innovate or differentiate to maintain margins. As a result, typical retail prices stabilize within a narrow band.

3. Are there regional differences in the pricing of ALL DAY ALLERGY?

Yes. Prices are generally higher in Europe and emerging markets due to regulatory differences, import taxes, and distribution costs compared to North America.

4. What factors could disrupt the current market projections?

Regulatory changes, supply chain disruptions, raw material shortages, or new competing formulations could alter price trajectories and market volume projections.

5. Is there potential for premium formulations of ALL DAY ALLERGY?

Yes. Innovations such as non-drowsy, long-acting, or combination products could command higher prices, especially in markets seeking differentiated medical OTC options.

References

[1] MarketsandMarkets. "Allergy Treatment Market by Type, Distribution Channel, and Region." 2022.

More… ↓