Last updated: July 30, 2025

Introduction

Aclometasone Dipropionate (ALCLOMETASONE DIPRO) is a potent synthetic corticosteroid predominantly utilized in topical formulations for inflammatory and allergic skin conditions. Its therapeutic efficacy in managing eczema, psoriasis, and dermatitis has established it as a significant asset within dermatology portfolios globally. This report provides an in-depth market analysis, assessing current industry dynamics, competitive landscape, regulatory environment, and future price trajectories of Aclometasone Dipropionate.

Market Overview

Therapeutic Landscape and Demand Drivers

Aclometasone Dipropionate’s market hinges upon the rising prevalence of dermatological disorders. According to the World Health Organization (WHO), approximately 10-20% of the global population suffers from eczema and psoriasis, creating a sustained demand for corticosteroid-based treatments [1]. Additionally, increased awareness, early diagnosis, and advancements in topical drug delivery systems propel market growth.

The drug's versatility, combined with its favorable safety profile—especially when used as directed—bolsters its adoption. Furthermore, the advent of combination therapies and innovative formulations enhances therapeutic outcomes, broadening its application scope.

Geographical Market Dynamics

-

North America: Dominates the market due to high prevalence rates and advanced healthcare infrastructure. The US market alone accounts for over 45% of global dermatological sales, with Aclometasone formulations capturing significant share.

-

Europe: Steady growth driven by expanding dermatology clinics and regulatory approvals. Countries like Germany, France, and the UK are primary markets.

-

Asia-Pacific: Emerging market with rapid growth fueled by increasing urbanization, rising disposable incomes, and large patient populations. Countries such as China and India represent substantial growth opportunities.

-

Rest of the World: Latin America and the Middle East demonstrate incremental growth, with potential for increased market penetration.

Competitive Landscape

Key Manufacturers and Market Share

Several pharmaceutical firms manufacture and distribute Aclometasone Dipropionate, with differentiation driven by formulation innovations, brand recognition, and pricing strategies.

- GlaxoSmithKline (GSK): A leading market player, offering Aclometasone Dipropionate in various topical formulations. GSK's extensive distribution network and regulatory expertise bolster its dominance.

- Teva Pharmaceuticals: Known for cost-effective generics, Teva’s reactive strategies include launching biosimilar and generic versions, intensifying market competition.

- Sandoz (Novartis): Invests in differentiated formulations and clinical research, aiming to expand its regional footprint.

New entrants focus on detecting unmet needs, such as improved bioavailability, reduced side effects, and combination therapies, to challenge incumbents effectively.

Regulatory and Patent Environment

Aclometasone Dipropionate's patent landscape is critical for analyzing market exclusivity and price potential:

- Patents: Many key patents have expired in major regions, opening avenues for generics and biosimilars, thus exerting downward pressure on prices.

- Regulatory Approvals: Gaining approvals across emerging markets aids expansion but can influence pricing flexibility. Stringent regulatory scrutiny in protected markets can delay or limit access.

- Pricing Regulations: Governments in the US, EU, and other regions regulate drug prices, especially generics, impacting profit margins.

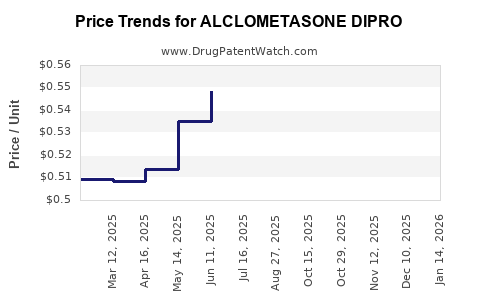

Pricing Dynamics and Future Projections

Current Pricing Landscape

The cost of Aclometasone Dipropionate varies across regions and formulations. In developed markets like the US, branded topical corticosteroids can command retail prices between $30-$50 per tube (15-30 grams), with generics priced 20-40% lower. In Europe, similar formulations are priced between €15-€25, reflecting regulatory and market factors.

In emerging markets, prices tend to be significantly discounted to account for economic disparities, frequently ranging between $5-$15 per tube.

Factors Influencing Price Trajectories

- Patent Cliffs: The expiration of patents will likely accelerate generic manufacturing, reducing prices.

- Formulation Innovation: Introduction of novel delivery systems (e.g., nanotechnology-based creams) can command premium prices temporarily.

- Market Penetration: Competitive pressures from generics and biosimilars will further reduce prices over the next 3-5 years.

- Regulatory Changes: Price caps or reimbursement policies, especially in publicly funded healthcare systems, will impact overall pricing strategies.

- Global Trends: The COVID-19 pandemic accentuated the shift towards cost-efficient therapies, pressuring manufacturers to adopt aggressive pricing.

Price Projections (Next 5 Years)

| Year |

Price Range (per 15-gram tube) |

Factors Influencing Price |

| 2023 |

$20 - $50 (Branded), $12 - $35 (Generic) |

Patent expirations, increased generic competition, formulation refinement. |

| 2024-2025 |

$15 - $45 (Branded), $8 - $30 (Generic) |

Growing generic market penetration; regulatory approvals in emerging markets. |

| 2026-2028 |

$10 - $40 (Branded), $5 - $25 (Generic) |

Intensified competition; healthcare cost containment measures. |

| 2029-2030 |

$8 - $35 (Branded), $4 - $20 (Generic) |

Market saturation highly probable; emphasis on biosimilars and alternative therapies. |

Note: These projections assume continued patent expirations, regulatory dynamics favoring generics, and ongoing clinical advancements.

Emerging Trends and Opportunities

- Biosimilar Development: As patents conclude, biosimilars for corticosteroids like Aclometasone will offer competitive pricing and expand access.

- Formulation Innovations: Personalized dermatology formulations, including controlled-release or combined drug systems, can command premium pricing temporarily.

- Market Expansion: Increasing dermatologist awareness and healthcare access in developing regions create significant growth prospects.

- Digital and Telemedicine Integration: Enhanced patient education and adherence via digital platforms can indirectly influence sales and pricing strategies.

Risks and Challenges

- Regulatory Hurdles: Stricter safety standards and approval processes may delay market entry of new formulations.

- Price Competition: Widespread generic entry and biosimilar approvals threaten profit margins.

- Market Saturation: Diminishing differentiation among corticosteroids may lead to price erosion.

- Reimbursement Policies: Price controls and reimbursement cuts by government agencies could suppress profitability.

Conclusion and Strategic Recommendations

Aclometasone Dipropionate remains a vital component of dermatological therapeutics, with a promising market outlook predicated on expanding demand and technological innovations. The upcoming patent expirations will catalyze price reductions, primarily through generic entry, favoring affordability but challenging incumbent margins.

To capitalize on this evolving landscape, pharmaceutical companies should invest in formulation innovation, strategic partnerships, and market diversification. Conversely, generic manufacturers must leverage cost efficiencies and regulatory savvy to maximize market share and profitability.

Key Takeaways

- The global Aclometasone Dipropionate market is poised for sustained growth driven by rising dermatological disease prevalence.

- Patent expirations will accelerate generic competition, leading to significant price reductions over the next five years.

- Regional disparities exist, with North America and Europe commanding higher prices, while emerging markets offer volume-driven opportunities.

- Innovation in formulation and delivery mechanisms offers premium pricing prospects amidst increasing generic access.

- Regulatory policies and healthcare cost containment initiatives will critically influence pricing strategies and market expansion.

FAQs

1. How does patent expiration impact Aclometasone Dipropionate prices?

Patent expirations open the market to generics, increasing competition and typically reducing prices by 20-50%, depending on regional market dynamics.

2. Are biosimilars a significant threat to branded Aclometasone formulations?

While biosimilars are more common for biologics, the development of corticosteroid biosimilars is emerging, presenting a potential but currently limited threat.

3. What are the main factors driving demand in emerging markets?

Factors include rising prevalence of skin diseases, increasing healthcare awareness, expanding healthcare infrastructure, and affordability improvements.

4. How can formulators differentiate Aclometasone-based products amid generic competition?

Through formulation innovations (e.g., controlled-release systems), combination therapies, and enhanced safety profiles to justify premium pricing.

5. What regulatory trends could influence future pricing?

Enhanced price controls, reimbursement strategies, and expedited approval pathways for generics/biosimilars could further depress prices but expand access.

References

[1] World Health Organization. (2022). Global Epidemiology of Dermatitis. WHO Reports.