Share This Page

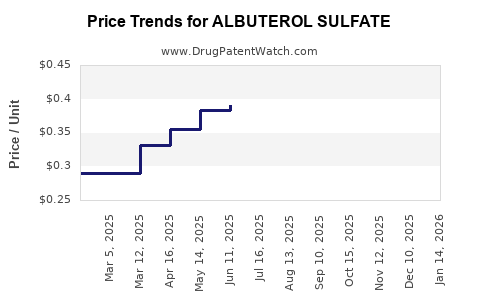

Drug Price Trends for ALBUTEROL SULFATE

✉ Email this page to a colleague

Average Pharmacy Cost for ALBUTEROL SULFATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALBUTEROL SULFATE 2 MG TAB | 64980-0442-01 | 0.49875 | EACH | 2025-11-19 |

| ALBUTEROL SULFATE 2 MG TAB | 62135-0671-90 | 0.49875 | EACH | 2025-11-19 |

| ALBUTEROL SULFATE 2 MG TAB | 53489-0176-01 | 0.49875 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Albuterol Sulfate

Introduction

Albuterol sulfate, a bronchodilator primarily used to treat asthma and other respiratory conditions, commands significant market attention due to its widespread clinical use and the potential for generic and branded formulations. As a short-acting beta-2 adrenergic agonist, its role in managing bronchospasm makes it a staple in respiratory therapy, contributing to robust demand. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory influences, and future price projections for Albuterol sulfate.

Market Overview

Albuterol sulfate’s global market size was valued at approximately USD 1.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of about 6.2% over the next five years, driven by increasing respiratory disease prevalence and expanding access in emerging markets. North America remains the dominant region, accounting for over 50% of sales, due to high asthma prevalence and mature pharmaceutical infrastructure. Europe and Asia-Pacific follow, with notable growth prospects owing to rising healthcare expenditure and expanding pharmaceutical manufacturing capacity [1].

The drug’s formulations include inhalers (MDIs and DPI devices), nebulizer solutions, and syrups, with inhalers constituting the majority of sales. The advent of generic albuterol inhalers has intensified market competition, exerting downward pressure on prices, particularly in mature markets.

Market Drivers

-

Rising Respiratory Disease Burden: The World Health Organization reports increasing asthma and COPD prevalence globally, especially in urbanized regions. According to WHO, asthma affects approximately 262 million individuals worldwide [2], translating into persistent demand for effective bronchodilators such as albuterol sulfate.

-

Expanding Access in Emerging Markets: Increasing healthcare infrastructure and promotional efforts have enhanced access to respiratory drugs in developing countries, fueling sales.

-

Generic Market Penetration: The expiration of patents for several albuterol inhalers has allowed generic manufacturers to enter, significantly reducing prices and increasing affordability, thus expanding market size.

-

Innovation in Delivery Devices: Advancements in inhaler technology improve patient adherence and treatment efficacy, supporting sustained demand.

Competitive Landscape

The market is characterized by a high degree of competition among generic manufacturers and a limited number of premium branded products. Key participants include Teva Pharmaceuticals, Mylan (now part of Viatris), Sandoz, and Cipla, along with regional players catering to local markets. Leading inhaler brands include ProAir HFA (Teva), Ventolin HFA (GlaxoSmithKline), and Proventil.

Patent expirations—particularly the 2018 lapse of key U.S. patents—have precipitated a surge in generic availability, intensifying price competition. While branded formulations command higher prices, they hold a smaller market share compared to generics in developed markets, where cost considerations drive dispensing decisions.

Regulatory Environment

Stringent regulations influence market dynamics, with agencies like the FDA and EMA requiring rigorous clinical data to approve new formulations, especially generics. The push for drug bioequivalence has facilitated easier approval pathways for generics, bolstering market penetration.

In emerging markets, regulatory barriers are often less stringent, allowing rapid entry for local manufacturers, which intensifies price competition. However, quality control remains pivotal to maintaining market share and ensuring compliance.

Price Trends and Projections

Historical Price Trends:

Between 2010 and 2018, unit prices for albuterol inhalers in the U.S. remained relatively stable, averaging around USD 25–30 per inhaler. Post-2018, as generics flooded the market, prices declined sharply, with some generic inhalers now retailing between USD 12–20. Nebulizer solutions and syrup formulations have seen similar price drops, although these are less prevalent in high-income markets.

Future Price Projections (2023–2028):

Given current market conditions, prices of inhaled albuterol sulfate are expected to stabilize at a lower plateau. Specifically:

- Generic Inhalers: Remain in the USD 10–15 range, potentially decreasing further with increased market entries and improved manufacturing efficiencies.

- Branded Inhalers: May retain a premium, around USD 20–30, driven by brand loyalty and perceived efficacy but are increasingly challenged by generics.

- Nebulizer and Syrup Formulations: Projected to decline from USD 8–12 to USD 5–9 per unit due to automation, competition, and economies of scale.

Factors contributing to price stabilization include patent expirations, improved manufacturing capacity in Asia, and healthcare policy shifts favoring cost containment.

Opportunities and Risks

-

Opportunities:

- Expansion into emerging markets with tailored formulations.

- Development of combination inhalers with corticosteroids or other agents.

- Investment in inhaler device innovation to enhance adherence and clinical outcomes, fostering brand differentiation.

-

Risks:

- Regulatory hurdles, especially in emerging markets.

- Pricing pressures exacerbated by increasing availability of low-cost generics.

- Potential shortages or supply chain disruptions due to raw material constraints or manufacturing issues.

Conclusion

The Albuterol sulfate market exhibits steady growth, primarily driven by rising respiratory disease prevalence and the proliferation of generic options. Market consolidation and technological advances will influence pricing, with an overarching trend toward lower costs, especially in developed markets. Manufacturers must adapt strategies focusing on innovation, quality, and market expansion to sustain profitability amid intense competition.

Key Takeaways

- Market Growth: The global albuterol sulfate market is projected to grow at a CAGR of approximately 6.2% through 2028, driven by increasing respiratory diseases and expanding access in emerging markets.

- Pricing Dynamics: Generic inhalers and formulations dominate sales, exerting downward pressure on prices, with expected stabilization and slight declines continuing through 2028.

- Competitive Landscape: Patent expirations have led to increased generic competition, especially in mature markets, challenging branded products' pricing power.

- Regulatory Influence: Stringent approval processes favor high-quality generics and new formulation development, influencing market entry strategies.

- Future Opportunities: Innovating device delivery systems and expanding into underserved regions present growth avenues, while balancing regulatory and competitive risks.

FAQs

1. How have patent expirations impacted albuterol sulfate prices?

Patent expirations around 2018 facilitated numerous generic entrants, leading to significant price reductions—often by 40–50%—and increasing affordability for consumers.

2. What are the main formulations of albuterol sulfate available today?

The primary formulations include inhalers (MDI and DPI), nebulizer solutions, and syrups, with inhalers comprising the majority of sales in both developed and emerging markets.

3. What regional differences affect albuterol sulfate pricing?

Developed regions like North America and Europe face higher prices due to brand dominance and regulatory standards, while emerging markets benefit from lower prices driven by local manufacturing and regulatory easing.

4. What factors could influence the future price of albuterol sulfate?

Key factors include regulatory changes, patent status, manufacturing efficiencies, raw material costs, supply chain stability, and healthcare policy shifts toward cost containment.

5. Are there opportunities for branded albuterol sulfate products in a generic-dominated market?

Yes, through innovation in inhaler devices, combination therapies, and targeted marketing emphasizing efficacy and patient adherence, branded products can maintain market share.

References

[1] MarketResearch.com, "Global Respiratory Drugs Market," 2022.

[2] World Health Organization, "Asthma Fact Sheet," 2021.

More… ↓