Share This Page

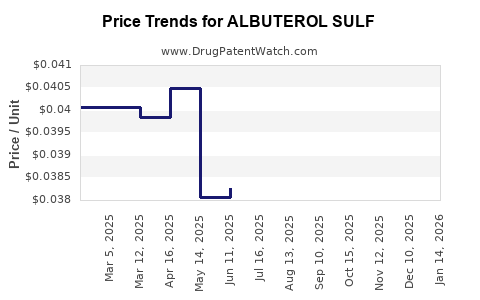

Drug Price Trends for ALBUTEROL SULF

✉ Email this page to a colleague

Average Pharmacy Cost for ALBUTEROL SULF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALBUTEROL SULFATE 2 MG TAB | 62135-0671-90 | 0.49857 | EACH | 2025-12-17 |

| ALBUTEROL SULF 2 MG/5 ML SYRUP | 62135-0189-47 | 0.03377 | ML | 2025-12-17 |

| ALBUTEROL SULFATE 2 MG TAB | 64980-0442-01 | 0.49857 | EACH | 2025-12-17 |

| ALBUTEROL SULF 2 MG/5 ML SYRUP | 70752-0102-12 | 0.03377 | ML | 2025-12-17 |

| ALBUTEROL SULFATE 2 MG TAB | 53489-0176-01 | 0.49857 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Albuterol Sulfate

Introduction

Albuterol sulfate, a bronchodilator primarily used to treat bronchospasm associated with asthma, chronic obstructive pulmonary disease (COPD), and other respiratory conditions, remains a critical asset in respiratory therapy. As a generic inhalation medication, its market dynamics are shaped by patent expirations, manufacturing trends, regulatory changes, and competitive landscape. This analysis provides an in-depth overview of the current market environment and offers targeted price projections, enabling pharmaceutical companies, investors, and healthcare stakeholders to make strategic decisions.

Market Overview

Global Market Size and Trends

The global respiratory drugs market, anchored prominently by asthma and COPD treatments, was valued at approximately USD 30 billion in 2022, with inhaled bronchodilators like albuterol sulfate accounting for a significant share [1]. The rising prevalence of respiratory illnesses, especially in developing economies due to pollution and tobacco use, drives consistent demand.

The inhaler segment dominates the albuterol sulfate market owing to patient preference for ease of use and rapid onset of action. Metered-dose inhalers (MDIs) constitute roughly 70% of the inhalation formulations, with dry powder inhalers (DPIs) and nebulized forms filling niche roles.

Patent Status and Generic Entry

Albuterol sulfate was originally protected by patents dating back to the 1980s, with key patents expiring around 2007-2012. The subsequent patent expirations opened the market for generic manufacturers, vastly increasing product availability and pressure on pricing [2].

The influx of generics typically results in significant price erosion; however, patent litigation, brand loyalty, and regulatory entry barriers sometimes temper the decline.

Manufacturers and Competitive Landscape

Major stakeholders include

- Brand Providers: Typically held by Eli Lilly (Ventolin), GlaxoSmithKline (Ventolin Diskus), and AstraZeneca.

- Generics Producers: Numerous generic companies, including Teva Pharmaceuticals, Sun Pharmaceuticals, and Mylan, manufacture albuterol sulfate inhalers.

Market competition persists not just due to the number of manufacturers but also because of innovations in device delivery systems and combination therapies.

Regulatory Environment

The U.S. FDA approves both brand and generic albuterol inhalers. Despite generic approval pathways, manufacturers face hurdles relating to device design and bioequivalence studies.

In 2020, the FDA proposed strategies to enhance device-based therapeutics' standards, impacting future cost structures [3]. Additionally, central regulatory policies in regions like the EU and Asia influence market access and pricing.

Pricing Dynamics

Historical Pricing Trends

Historically, albuterol sulfate inhaler prices in the U.S. experienced sharp declines post-generic entry:

- Brand inhalers (e.g., Ventolin): Approximately USD 30–50 per inhaler before patent expiry.

- Generic inhalers: Prices reduced to USD 15–25 shortly after market entry [4].

In emerging markets, prices tend to be lower but more variable, influenced by reimbursement policies and local manufacturing costs.

Current Price Landscape

As of 2023:

- U.S. retail prices for brand-name inhalers hover around USD 30–40.

- Generic alternatives are often priced between USD 10–20.

- Insurance coverage and PBMs significantly influence out-of-pocket expenses for patients.

Key Factors Affecting Prices

- Market Competition: Increased generic entries facilitate downward pressure.

- Supply Chain Dynamics: Manufacturing costs, raw material prices, and distribution influence retail pricing.

- Regulatory and Reimbursement Policies: Favorable reimbursement policies in developed markets support stable pricing; restrictive policies can depress prices further.

Price Projections (2023–2030)

Short-Term (2023–2025)

- Price stabilization is anticipated due to increased market saturation.

- In developed markets like the U.S., average inhaler prices are forecasted to decline by approximately 10–15%, driven by insurance negotiations and increased generic competition.

- Emerging markets may see marginal price decreases or stability, contingent on local regulatory changes and economic factors.

Medium-to-Long Term (2026–2030)

- Further price erosion of 15–20% is expected, especially with the proliferation of low-cost generics.

- Innovation in inhaler devices (e.g., smart inhalers) could introduce premium pricing segments, partially offsetting downward pressure.

- Market consolidation might reduce competition in certain regions, potentially stabilizing or even increasing prices temporarily.

Potential Price Drivers

- Regulatory incentives for biosimilar and generic approvals.

- Emerging biosimilar therapies for respiratory conditions influencing traditional inhaler pricing.

- Pricing regulations in key markets like Europe and Asia.

- Patent litigations delaying generic entry and maintaining higher prices temporarily.

Impacted Stakeholders

- Pharmaceutical Manufacturers: Must adapt to competitive pressures and innovate device technology.

- Healthcare Providers: Need to consider cost-effective inhalation options for patients.

- Patients and Payers: Benefit from reduced prices but face access disparities based on regional policies.

- Investors: Should monitor regulatory and patent landscapes to anticipate future pricing trends.

Conclusion

The albuterol sulfate market's trajectory is characterized by declining prices driven by generic competition, with some regional stabilization influenced by regulatory and economic dynamics. Manufacturers focused on device innovation and strategic positioning can harness opportunities in premium inhaler segments. Stakeholders should remain vigilant of patent expirations, regulatory reforms, and technological advancements, which will shape future pricing and market accessibility.

Key Takeaways

- The expiration of key patents catalyzed substantial generic competition, leading to significant price reductions.

- Current market prices for generic albuterol sulfate inhalers are approximately USD 10–20 in the U.S., with ongoing downward pressure expected over the next decade.

- Innovation in inhaler device technology can offset some pricing pressures, opening new premium markets.

- Regulatory environments and regional reimbursement policies will heavily influence pricing trends.

- Strategic positioning, including device differentiation and market expansion into emerging economies, will be critical for profitability.

FAQs

1. How has patent expiration affected albuterol sulfate pricing?

Patent expirations around 2012 facilitated the entry of numerous generics, driving prices down by approximately 50–60% in mature markets like the US.

2. What are the main factors influencing future price trends?

Market competition, technological innovation, regulatory policies, patent status, and regional economic factors will govern future pricing trajectories.

3. Are there any opportunities for premium pricing in the albuterol sulfate market?

Yes. Advanced inhaler devices with digital connectivity and personalized delivery features can command higher prices, especially in developed markets.

4. How does regional regulation impact albuterol sulfate prices?

Stringent regulatory requirements can delay generic entry, maintaining higher prices; conversely, supportive policies can accelerate generic availability and lower prices.

5. What is the outlook for developing countries?

Prices are generally lower but can be affected by import restrictions and reimbursement infrastructures. Expansion and local manufacturing may provide cost benefits.

Sources

[1] MarketWatch, "Respiratory Drugs Market Size, Share & Trends," 2022.

[2] FDA Patent Archives, "Albuterol Sulfate Patent Status," 2010–2015.

[3] U.S. FDA, "Device-based Therapeutic Standards," 2020.

[4] Pharmacy Times, "Albuterol Inhaler Price Trends," 2022.

More… ↓