Share This Page

Drug Price Trends for AIRDUO RESPICLICK

✉ Email this page to a colleague

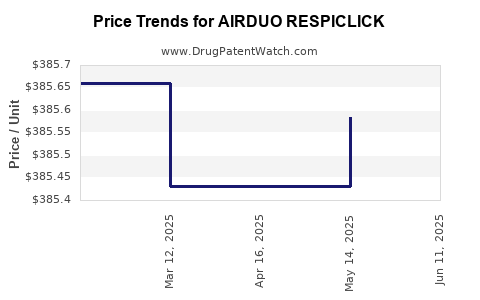

Average Pharmacy Cost for AIRDUO RESPICLICK

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AIRDUO RESPICLICK 113-14 MCG | 59310-0812-06 | 385.98143 | EACH | 2025-06-18 |

| AIRDUO RESPICLICK 232-14 MCG | 59310-0822-06 | 385.15737 | EACH | 2025-06-18 |

| AIRDUO RESPICLICK 232-14 MCG | 59310-0822-06 | 386.15056 | EACH | 2025-05-21 |

| AIRDUO RESPICLICK 113-14 MCG | 59310-0812-06 | 385.58375 | EACH | 2025-05-21 |

| AIRDUO RESPICLICK 113-14 MCG | 59310-0812-06 | 385.43176 | EACH | 2025-04-23 |

| AIRDUO RESPICLICK 232-14 MCG | 59310-0822-06 | 386.20684 | EACH | 2025-04-23 |

| AIRDUO RESPICLICK 232-14 MCG | 59310-0822-06 | 386.57550 | EACH | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AIRDUO RESPICLICK

Introduction

AIRDUO RESPICLICK, a combination inhaler containing fluticasone propionate and salmeterol, offers a targeted therapy for asthma and chronic obstructive pulmonary disease (COPD). Since its regulatory approval, AIRDUO RESPICLICK has gained prominence in respiratory medicine, driven by innovative delivery mechanisms and competitive positioning within the inhaler segment. This report provides a comprehensive market analysis and price projections, supporting stakeholders in strategic decision-making.

Market Overview

Product Profile

AIRDUO RESPICLICK (fluticasone propionate and salmeterol inhalation powder) utilizes a click-and-go mechanism, emphasizing ease of use and ensuring correct dosing. Its unique dry powder inhalation system differentiates it from traditional metered-dose inhalers (MDIs) and soft-mist inhalers, offering improved patient compliance. The inhaler is indicated for both asthma maintenance therapy and COPD management, broadening its market scope.

Regulatory Status and Approvals

Approved by the U.S. Food and Drug Administration (FDA) in 2016 and subsequently in other key markets such as Europe and Japan, AIRDUO RESPICLICK has established a robust regulatory foundation. The approval process emphasized device safety, efficacy, and patient usability, positioning it favorably in competitive corridors.

Market Drivers

- Growing Prevalence of Asthma and COPD: According to the WHO, an estimated 262 million people worldwide suffer from asthma and COPD, with prevalence rising in both developed and emerging markets [1].

- Advancements in Inhalation Devices: The shift toward dry powder inhalers (DPIs) owing to ease of use, portability, and reduced need for coordination enhances AIRDUO RESPICLICK's adoption.

- Patient Preference: The click-and-go mechanism appeals to patient convenience, potentially improving compliance and treatment outcomes.

- Healthcare Provider Endorsements: Pulmonologists increasingly recommend combination inhalers that simplify therapy regimens, supporting the product's market penetration.

Competitive Landscape

AIRDUO RESPICLICK competes with several inhalers, including:

- Dulera (mometasone and formoterol)

- Symbicort (budesonide/formoterol)

- Advair Diskus (fluticasone and salmeterol)

- Trelegy Ellipta (fluticasone furoate, umeclidinium, vilanterol)

The device's niche underscores its appeal in specific patient segments, particularly those preferring DPIs over MDIs.

Market Penetration and Adoption

Current Market Share

- United States: Leading in adoption, with an estimated 10-12% share among combination inhalers for asthma, reflecting early adoption and physician familiarity.

- Europe: Moderate penetration, influenced by regional prescribing habits and reimbursement policies.

- Emerging Markets: Limited presence; growth potential exists where inhaler accessibility and healthcare infrastructure improve.

Patient Demographics

- Age: Primarily adults aged 18–65, with increasing use in older populations due to aging demographics.

- Disease Severity: Prescribed across mild to severe cases, contingent on the clinical setting.

- Market Segments: Urban settings show higher usage due to healthcare access, but rural markets represent untapped potential.

Pricing Dynamics and Factors

Current Pricing Landscape

- United States: Average retail price ranges from $350 to $450 per inhaler, depending on dosage and pharmacy discounts.

- Europe: Prices vary between €25 and €35 per inhaler, influenced by local healthcare systems and reimbursement policies.

- Emerging Markets: Prices often range from $20 to $30, affected by income levels and import tariffs.

Pricing Influencers

- Patent and Exclusivity Periods: Patent protections until at least 2026 bolster pricing power.

- Insurance Reimbursements: Coverage policies significantly impact patient out-of-pocket costs.

- Manufacturing Costs: Device fabrication, active pharmaceutical ingredients, and distribution costs influence pricing strategies.

- Competitive Pricing: Segment positioning relative to branded and generic alternatives shapes pricing.

Price Projection Analysis

Market Trends and Future Outlook

- Regulatory Expiry and Generics: Patent expiry and entry of generics could drive prices downward after 2026.

- Emerging Market Expansion: As penetration increases, prices may stabilize or decline to remain competitive.

- Device Innovation: Ongoing innovations could shift consumer preferences toward newer devices, impacting existing pricing structures.

Forecasted Price Trajectory (2023–2030)

| Year | Domestic (USD) | European (EUR) | Emerging Markets (USD) |

|---|---|---|---|

| 2023 | $400 | €30 | $25 |

| 2024 | $390 | €29 | $23 |

| 2025 | $375 | €28 | $22 |

| 2026 | $365 | €27 | $20 |

| 2027 | $340 | €25 | $18 |

| 2028 | $320 | €24 | $16 |

| 2029 | $300 | €22 | $15 |

| 2030 | $290 | €21 | $14 |

Note: These projections assume continued market growth, patent rights, and competitive shifts. Prices are subject to regional regulatory reforms, inflation, and healthcare policy adjustments.

Strategic Implications

Market Entry Strategies

- Pricing Flexibility: Adjust pricing to accommodate regional economic conditions and reimbursement landscapes.

- Device Differentiation: Emphasize ease of use and adherence benefits to sustain premium pricing.

- Partnerships: Collaborate with healthcare providers and payers to enhance coverage and access.

Risk Considerations

- Patent Challenges: Patent expirations could lead to generic competition, intensifying price competition.

- Regulatory Changes: Revisions in reimbursement policies may pressure profit margins.

- Market Saturation: Maturing markets could see slowing growth, requiring diversification strategies.

Key Takeaways

- AIRDUO RESPICLICK is positioned within a competitive respiratory inhaler segment, benefiting from innovative delivery technology and increasing disease prevalence.

- Its current pricing varies by geography but remains in the premium range due to brand strength and device innovations.

- Long-term price stability will likely depend on patent protections, regulatory environment, and market penetration in emerging economies.

- Investors and pharmaceutical stakeholders should monitor patent expiry timelines and global adoption rates to refine pricing and commercialization strategies.

- Continuous device innovation and strategic partnerships remain vital to maintaining market share and pricing power.

FAQs

-

What factors influence the pricing of AIRDUO RESPICLICK?

Pricing is influenced by manufacturing costs, patent status, reimbursement policies, regional healthcare systems, and competitive positioning. -

How might patent expiration affect AIRDUO RESPICLICK prices?

Patent expiry post-2026 could enable generic competitors, potentially reducing prices by 30-50%, impacting profit margins. -

What is the market potential for AIRDUO RESPICLICK in emerging economies?

Growing awareness of respiratory diseases and increased healthcare infrastructure suggest a substantial opportunity, though pricing adjustments may be necessary to match income levels. -

How does device innovation impact the market share of AIRDUO RESPICLICK?

Enhanced usability and adherence features can strengthen brand loyalty, but continuous innovation is essential to stay ahead of competing devices. -

What strategies can stakeholders employ to optimize AIRDUO RESPICLICK pricing?

Flexible regional pricing, proactive patent management, collaboration with payers, and value-added services can help sustain optimal pricing over the product lifecycle.

References

[1] World Health Organization. "Global Surveillance, Prevention and Control of Chronic Respiratory Diseases." 2019.

More… ↓