Last updated: July 27, 2025

Introduction

AIMOVIG (Erenumab) is a groundbreaking calcitonin gene-related peptide (CGRP) receptor antagonist developed by Novartis and Amgen. Approved by the U.S. Food and Drug Administration (FDA) in 2018, AIMOVIG is touted as a pioneering therapy for preventing migraines in adult patients. Its advent revolutionized the migraine-preventive landscape, historically characterized by limited efficacy and adverse effects. As a biologic with substantial market potential, understanding AIMOVIG's market dynamics and pricing trajectory is imperative for stakeholders, including investors, healthcare providers, and policy makers.

Market Landscape for Migraine Therapies

Pre-AIMOVIG Market Dynamics

Prior to AIMOVIG, migraine prophylaxis primarily relied on off-label use of medications such as beta-blockers, antiepileptics, and antidepressants, which offered modest efficacy and posed tolerability concerns. The therapeutic gap underscored the need for targeted therapies, creating potential for biologic agents—particularly CGRP inhibitors.

Emergence of CGRP Inhibitors

AIMOVIG introduced the first monoclonal antibody specifically approved for migraine prevention, leading to the emergence of a new therapeutic class. Its approval spurred subsequent entrants, including Emgality (galcanezumab) and Ajovy (fremanezumab), with the latter approved shortly after AIMOVIG, broadening the treatment options.

Market Size and Patient Potential

Worldwide, roughly 1 billion people suffer from migraines, with over 39 million in the United States alone. Chronic migraines (≥15 days/month) affect approximately 4% of the population, representing a concentrated segment for AIMOVIG’s target demographic. The U.S. migraine market is projected to reach $4–5 billion by 2025, fueled by demand for effective, targeted therapies.

Market Penetration and Adoption Trends

Since launch, AIMOVIG has garnered approval from multiple regulators globally, including the European Medicines Agency (EMA). Adoption has been swift among neurologists and headache specialists owing to its favorable safety profile and efficacy. As of 2022, estimates suggest AIMOVIG holds approximately 25-30% of the migraine preventive biologic market share (approximate, based on industry reports).

Pricing Strategy and Revenue Generation

Initial Pricing and Reimbursements

At launch, AIMOVIG's list price was approximately $575 to $635 per month in the U.S., translating to $6,900 to $7,620 annually. The pricing was aligned with other biologics and justified by its innovative mechanism, clinical efficacy, and improved patient outcomes. From a payer perspective, high per-unit prices are often offset by reduced healthcare costs associated with migraine-related disability, emergency visits, and productivity loss.

Value-Based Pricing and Reimbursement Challenges

Reimbursement negotiations with insurers, including Medicare and Medicaid, critically influence actual therapeutic access and revenue. Initial coverage hurdles shifted as clinical data established AIMOVIG's cost-effectiveness, particularly when factoring in improved quality of life and reduced disability.

Market Competition and Price Compression

In subsequent years, competitive pressures from similar CGRP drugs (e.g., Galcanezumab and Fremanezumab) and biosimilars may lead to price adjustments. Their entry has generally prompted slight price reductions or tighter formulary restrictions for AIMOVIG to maintain market share.

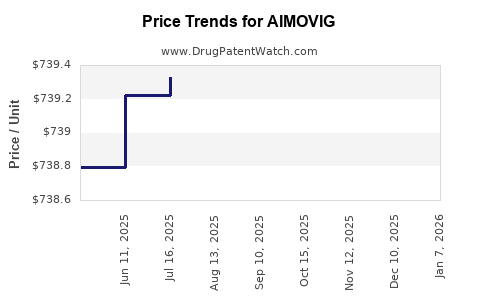

Pricing Trends and Future Projections

Industry analysts expect AIMOVIG’s average wholesale price (AWP) to stabilize or slightly decline by 2024–2025, owing to increased use of biosimilars and market competition. However, premium positioning based on durable efficacy and brand recognition may sustain relatively high prices relative to traditional preventive drugs.

Market Forecasts (2023-2030)

Sales Volume and Revenue Growth

Projections indicate that AIMOVIG’s revenue will grow steadily, driven by expanding indications (e.g., cluster headache, off-label uses), increased diagnosis, and higher penetration among both neurologists and general practitioners. By 2025, global sales could surpass $2.5 billion, with untapped markets in Europe, Asia-Pacific, and Latin America.

Price Trajectory

Given current dynamics, a compound annual growth rate (CAGR) in price of approximately 2-3% is anticipated, consistent with biologic inflation rates and reimbursement trends. Price stabilization is expected as biosimilars become more prevalent.

Impact of Biosimilar Outsourcing

The introduction of biosimilars—such as SembraBio’s ERN-001 or other competitors—may exert downward pressure. Nonetheless, AIMOVIG’s established market presence, clinician familiarity, and clinical outcomes could mitigate full commoditization, allowing for premium pricing to persist in niche segments.

Regulatory and Market Access Factors

Regulatory initiatives such as price negotiations in countries like the UK (via NHS) and potential legislation impacting drug pricing in the U.S. could significantly influence AIMOVIG’s pricing trajectory. Also, value-based arrangements, wherein reimbursement levels depend on real-world effectiveness, are likely to modify net prices.

Conclusion

AIMOVIG maintains a strong foothold in the migraine prophylactic market, with a strategic pricing approach reflective of its biologic nature and clinical efficacy. While immediate price reductions are unlikely, the evolving competitive landscape and biosimilar entry could moderate price growth and introduce downward pressure in the long term. Stakeholders should monitor regulatory developments, market penetration rates, and biosimilar pipeline progress to gauge future price movements."

Key Takeaways

- AIMOVIG's initial pricing at ~$6,900–$7,620 annually positioned it as a premium biologic addressing an unmet medical need.

- The drug commands significant market share due to its targeted mechanism and favorable safety profile.

- Competitive pressures and biosimilar development are expected to gently reduce prices over the next 3-5 years.

- Market expansion into new geographies and indications offers revenue growth opportunities.

- Regulatory and payer landscape evolutions will be critical in shaping AIMOVIG’s ultimate pricing and market penetration strategies.

FAQs

1. How does AIMOVIG’s price compare to other migraine preventives?

AIMOVIG’s annual cost (~$7,000+) exceeds traditional oral preventives like propranolol or topiramate, which typically cost a few hundred dollars per year. However, AIMOVIG’s cost is justified by its higher efficacy and better tolerability profile in suitable patients.

2. Will biosimilars significantly impact AIMOVIG’s market share?

Potential biosimilars could induce price competition, but AIMOVIG’s established brand reputation and clinician familiarity may preserve a competitive edge, leading to a more gradual market share decline.

3. Are there patient access programs to mitigate high costs?

Yes, Novartis offers patient assistance and copay programs to improve access, but overall, insurer reimbursement policies heavily influence real-world affordability.

4. How might future regulations affect AIMOVIG’s pricing?

Legislative measures aimed at drug price transparency, negotiation, and value-based pricing could pressure AIMOVIG’s net prices, especially in government-funded healthcare systems.

5. What strategic pricing considerations should Novartis contemplate?

Balancing premium pricing against competitive threats, expanding indications, and demonstrating cost-effectiveness will be key to maximizing revenue and market penetration.

Sources:

[1] Novartis press releases, FDA approval documents (2018).

[2] Industry reports: IQVIA, Evaluate Pharma.

[3] Market analytics: Health Economics and Outcomes Research (HEOR) studies.

[4] Public payer and insurer coverage policies.