Share This Page

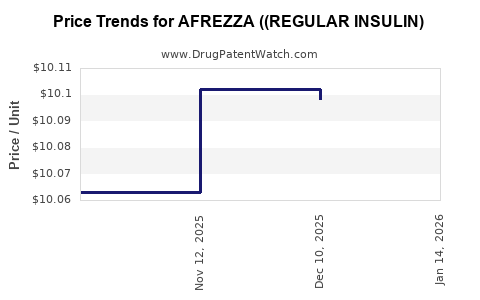

Drug Price Trends for AFREZZA ((REGULAR INSULIN)

✉ Email this page to a colleague

Average Pharmacy Cost for AFREZZA ((REGULAR INSULIN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AFREZZA ((REGULAR INSULIN) 8 UNIT CARTRIDGE | 47918-0878-90 | 10.10198 | EACH | 2025-11-19 |

| AFREZZA ((REGULAR INSULIN) 8 UNIT CARTRIDGE | 47918-0878-90 | 10.06305 | EACH | 2025-10-22 |

| AFREZZA ((REGULAR INSULIN) 8 UNIT CARTRIDGE | 47918-0878-90 | 10.10571 | EACH | 2024-12-16 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AFREZZA (Regular Insulin)

Introduction

AFREZZA (inhaled insulin) by Novo Nordisk represents a distinctive approach within the diabetes management landscape, offering rapid-acting insulin delivered via inhalation. Since its approval in 2014 by the U.S. Food and Drug Administration (FDA), AFREZZA has targeted a niche between traditional injectable insulins and emerging insulin delivery technologies. This analysis evaluates its market position, competitive environment, regulatory landscape, and price trajectories to inform strategic decisions for stakeholders.

Market Overview

Diabetes Global Burden

Type 1 and Type 2 diabetes collectively affect over 537 million adults worldwide, with projections reaching 643 million by 2030 [1]. The increasing prevalence underscores the demand for effective insulin therapies.insulin market growth, driven by rising diabetes incidence, expanded diagnosis, and advances in delivery methods, is expected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years [2].

AFREZZA’s Position in the Insulin Market

AFREZZA targets a specific patient subset: those seeking rapid-acting insulin suitable for mealtime glucose control without injections. Its unique inhaled delivery creates potential advantages concerning patient compliance and quality of life. However, its market share remains modest, constrained by factors including:

- Limited long-term pulmonary safety data.

- Competition from injectable rapid-acting insulins (e.g., Novo Nordisk’s NovoLog and Humalog, Eli Lilly’s Humalog).

- Concerns around inhaler device usability and patient acceptance.

In 2022, AFREZZA's estimated global sales hovered around $50 million, representing a small fraction of the total insulin market valued at approximately $29 billion in 2021 [3], indicating its niche status.

Target Demographics and Geographic Penetration

AFREZZA primarily competes within the U.S. and select European markets, where inhaled insulin's convenience appeals to active and needle-averse patients. Broader uptake outside the U.S. remains limited, largely due to regulatory complexities and market acceptance issues.

Regulatory and Clinical Developments

Regulatory Status

While FDA approved AFREZZA in 2014, subsequent years saw cautious post-market surveillance results, leading to a boxed warning and REMS (Risk Evaluation and Mitigation Strategy) program to mitigate pulmonary risks [4]. Approval retention in the U.S. remains, but its use is increasingly confined due to safety concerns.

In Europe, regulatory decisions varied; the European Medicines Agency (EMA) initially approved AFREZZA but later revoked its marketing authorization, citing insufficient benefit-risk balance [5].

Clinical Trials and Data

Long-term studies remain limited, with ongoing research into pulmonary safety and efficacy compared to injectable counterparts. The relatively limited data hampers broad adoption, especially for chronic use.

Competitive Landscape

Major Competitors

- Injectable Rapid-Acting Insulins: NovoLog (insulin aspart), Humalog (insulin lispro), and newer formulations like Fiasp.

- Technological Advancements: Automated insulin delivery systems and digital health integrations are gaining ground, potentially overshadowing inhaled options.

- Emerging Therapies: Injectable GLP-1 receptor agonists and oral insulin formulations are evolving, posing future competition.

Differentiators & Challenges

AFREZZA’s inhaled delivery offers convenience but faces adoption hurdles:

- Concerns about lung safety.

- Limited duration of market exposure, affecting brand penetration.

- High treatment costs compared to traditional insulins.

Pricing and Revenue Projections

Current Price Landscape

In the U.S., AFREZZA’s wholesale acquisition costs (WAC) approximate $2,300–$2,500 per 30-day supply [6]. Insurance coverage varies, with copays often impacting patient access.

Price Trends and Market Penetration

Factors influencing price projections include:

- Market acceptance: Limited uptake constrains volume growth; small patient base limits pricing power.

- Safety concerns: Regulatory caution may impact pricing strategies.

- Manufacturing costs: Inhalation device development and regulatory compliance increase costs; however, scale effects over time could reduce unit costs.

Future Price Projections (2023–2028)

Given the current market dynamics:

- Stable Pricing Scenario: Prices are likely to remain near current levels due to limited competition and small market share.

- Moderate Decline: If broader safety concerns or patent expirations emerge, aggressive discounting might occur, reducing prices by approximately 10-15% over five years.

- Premium Positioning Scenario: With increased safety data and expanded approval, AFREZZA could command prices 5-10% higher, especially if marketed as a premium convenience product.

Overall, a conservative projection indicates a marginal price decline or stabilization, with total revenues remaining under $100 million annually in mature markets.

Market Drivers and Barriers

Key Drivers

- Rising prevalence of insulin-dependent diabetes.

- Patient preference for needle-free therapy.

- Innovations in inhalation device technology, improving safety and efficacy.

- Physician interest in alternative delivery systems.

Barriers

- Safety concerns regarding pulmonary effects.

- Limited long-term data.

- Regulatory restrictions and caution.

- Competition from refined injectable insulins and digital health solutions.

- Reimbursement challenges in some markets.

Strategic Implications

Stakeholders should consider:

- Accelerating post-market safety studies to bolster confidence.

- Addressing reimbursement and insurance coverage issues.

- Differentiating AFREZZA through patient-centric marketing emphasizing convenience.

- Exploring combination therapies integrating AFREZZA with other diabetes medications.

- Leveraging technological advances in inhaler design for improved safety and efficacy.

Key Takeaways

- AFREZZA remains a niche product with modest current sales, constrained by safety concerns and regulatory limitations.

- Its unique inhaled delivery continues to appeal to specific patient segments, especially needle-averse individuals.

- Price projections suggest relative stability, with potential for slight declines owing to safety and market penetration challenges.

- Broader adoption hinges on accumulating long-term safety data, expanding clinician acceptance, and navigating reimbursement landscapes.

- The evolving diabetes market, characterized by technological innovations and new therapeutic modalities, necessitates strategic agility for stakeholders involved with AFREZZA.

FAQs

1. What is AFREZZA’s current market position within insulin therapies?

AFREZZA occupies a niche segment suitable for insulin-naive or needle-averse patients but accounts for less than 0.2% of the global insulin market owing to safety and regulatory challenges.

2. How does AFREZZA’s pricing compare to injectable insulins?

AFREZZA’s monthly cost (~$2,300–$2,500) exceeds most injectable rapid-acting insulins, which typically cost $300–$500, though insurance coverage can significantly offset these costs.

3. What factors could impact AFREZZA’s future price trajectory?

Regulatory safety findings, expanding clinical data, reimbursement policies, and competitive innovations will influence pricing stability and potential adjustments.

4. Are there ongoing efforts to improve the safety profile of inhaled insulin?

Yes, Novo Nordisk and other entities are investing in research to enhance pulmonary safety, optimize inhaler device design, and gather long-term safety data to mitigate concerns.

5. Will AFREZZA see broader adoption with technological advancements?

Potentially, if future research confirms long-term safety and efficacy, integrating with digital health tools, AFREZZA could expand its patient base, influencing both market size and price strategies.

Sources:

[1] International Diabetes Federation. “IDF Diabetes Atlas, 9th Edition,” 2019.

[2] MarketsandMarkets. “Insulin Market by Type, Application, and Region,” 2022.

[3] IQVIA. “Global Use of Medicines in 2021.”

[4] FDA. “AFREZZA (insulin human [inhalation] Syringe) REMS Information,” 2014.

[5] European Medicines Agency. “MA Revocation for AFREZZA,” 2018.

[6] GoodRx. “AFREZZA Pricing and Cost Guide,” 2023.

More… ↓