Share This Page

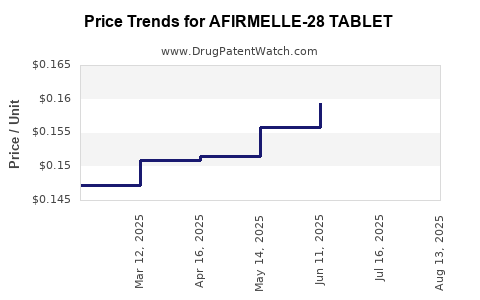

Drug Price Trends for AFIRMELLE-28 TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for AFIRMELLE-28 TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AFIRMELLE-28 TABLET | 65862-0849-28 | 0.15838 | EACH | 2025-08-20 |

| AFIRMELLE-28 TABLET | 65862-0849-88 | 0.15838 | EACH | 2025-08-20 |

| AFIRMELLE-28 TABLET | 65862-0849-28 | 0.16021 | EACH | 2025-07-23 |

| AFIRMELLE-28 TABLET | 65862-0849-88 | 0.16021 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for AFIRMELLE-28 TABLET

Introduction

AFIRMELLE-28 Tablet emerges in the pharmaceutical market as a combination oral contraceptive containing drospirenone and ethinylestradiol. As a post-market launch product, its strategic market positioning, competitive landscape, and pricing trajectory are crucial for stakeholders. This analysis provides an in-depth review of the current market context, demand drivers, competitive environment, and future price projections, enabling decision-makers to optimize commercialization strategies.

Market Overview

The global oral contraceptive market is projected to reach USD 9.4 billion by 2027, with a CAGR of approximately 4.2% from 2022 to 2027 [1]. The domain is characterized by a mature but evolving landscape driven by advancements in formulation, increased awareness of family planning, and expanding access in emerging markets. Drospirenone-based formulations, such as AFIRMELLE-28, are increasingly preferred owing to their favorable safety profile and added benefits like reduced water retention.

Target Markets and Demand Drivers

-

Geographical Focus:

The primary markets include North America, Europe, Asia-Pacific, and Latin America. North America currently dominates due to high contraceptive use and robust healthcare infrastructure. Emerging economies in Asia-Pacific, notably India and China, display rapid growth owing to expanding family planning programs and increasing awareness. -

Demographic Trends:

Women aged 15-49 constitute the main consumer base. Rising educational attainment and empowerment initiatives correlate with increased adoption of contraceptive methods. -

Regulatory and Policy Environment:

Regulatory approvals, patent status, and healthcare policies significantly influence market penetration. In many jurisdictions, contraceptives are exempt from age restrictions and require minimal prescription barriers, facilitating broader access. -

Market Demand Factors:

Since AFIRMELLE-28 offers a low side-effect profile and cycle stability, its formulary position enhances market appeal. The ongoing shift towards oral contraceptives with fewer hormones and simplified dosing further promotes uptake.

Competitive Landscape

The contraceptive market is fragmented with key branded products and generics. Major competitors include:

- Yasmin (Bayer)

- YAZ (Bayer)

- vaginal contraceptive devices (e.g., diaphragm, IUDs)

- Generic formulations of ethinylestradiol + drospirenone

AFIRMELLE-28 differentiates itself via:

- Proven efficacy and safety profile

- Competitive pricing strategies

- Potential for combination marketing with reproductive health services

Pricing Environment and Cost Structure

Pricing strategies are influenced by production costs, regulatory fees, market competition, and reimbursement policies. Manufacturing costs include active pharmaceutical ingredients (API), excipients, formulation, packaging, distribution, and marketing.

In North America and Europe, average retail prices for branded drospirenone/ethinylestradiol contraceptives range from USD 30 to USD 50 per pack per cycle [2]. Generic versions can be priced 20-40% lower, facilitating price competition. Given AFIRMELLE-28's positioning, initial wholesale pricing is anticipated around USD 25–35 per pack to establish market entry, with subsequent adjustments based on uptake and competitive dynamics.

Price Projections and Market Penetration

-

Initial Phase (Year 1):

Launch occurs with a wholesale price point of approximately USD 27–30, targeting early adopters and key opinion leaders. Promotional efforts emphasize safety profile, efficacy, and convenience. -

Growth Phase (Years 2-3):

As brand recognition and market share grow, price stabilization at USD 25–28 per pack is expected. Volume-driven strategies and partnerships with healthcare providers will facilitate penetration in both developed and emerging markets. -

Mature Phase (Years 4-5):

Competitive pressures and patent expirations on branded rivals could lead to further price reductions, potentially down to USD 20–25 per pack in commoditized markets. Volume expansion and formulary inclusion will offset margins. -

Long-term Outlook (Beyond Year 5):

Price adjustments will depend on market saturation, regulatory changes, and adoption of biosimilar or generic versions. Expected average retail prices could decline to USD 15–20 per pack with increased commoditization.

Influencing Factors on Price Dynamics

-

Regulatory Approvals & Reimbursement Policies:

Favorable policies will support premium pricing strategies. Reimbursement coverage significantly impacts retail price sensitivity. -

Patent Life & Exclusivity:

Patent expiry timelines influence the timing of generics entering the market, pressuring prices downward. -

Market Competition & Provider Networks:

Exclusive distribution agreements or formulary placements can maintain higher pricing levels. -

Consumer Preferences & Demand Elasticity:

Preference shifts towards low-maintenance contraceptive options will support pricing stability if AFIRMELLE-28 demonstrates superior benefits.

Conclusion

AFIRMELLE-28 is positioned in a competitive but lucrative segment of the oral contraceptives market. Its pricing trajectory is expected to start at USD 27–30 per pack, with a gradual decline aligned with market saturation, generic competition, and regulatory factors. Strategic pricing, combined with targeted marketing and key partnerships, will be critical for maximizing market share and profitability.

Key Takeaways

- Market Potential: The contraceptive market remains robust, with growth driven by expanding demand in both developed and emerging regions.

- Pricing Strategy: Initial wholesale pricing around USD 27–30 is optimal for deployment, with potential reductions to USD 20–25 as competition intensifies.

- Competitive Differentiation: Emphasizing safety, efficacy, and formulary access will sustain premium pricing in early phases.

- Regulatory & Reimbursement Impact: Strong regulatory support and insurance coverage will facilitate market penetration and price stability.

- Long-Term Outlook: Expect gradual price reductions aligned with patent expirations, increased generics, and market maturity.

FAQs

1. What factors influence the pricing of AFIRMELLE-28?

Pricing depends on manufacturing costs, regulatory approvals, competitive landscape, reimbursement policies, and market demand. Early strategies focus on competitive positioning, with prices adjusting as market dynamics evolve.

2. How does AFIRMELLE-28 compare to existing contraceptives?

AFIRMELLE-28 offers a favorable safety and efficacy profile, with potential advantages like cycle stability and reduced side effects, aiding its differentiation and pricing leverage.

3. What is the most likely price trend for AFIRMELLE-28 over the next five years?

Starting at USD 27–30 per pack, prices are projected to decline gradually to USD 20–25 per pack, driven by increased competition and market saturation.

4. Which markets present the highest growth opportunities for AFIRMELLE-28?

Emerging markets in Asia-Pacific, Latin America, and regions with expanding reproductive health initiatives offer significant potential due to increasing contraceptive adoption.

5. How will patent and regulatory developments affect AFIRMELLE-28 pricing?

Patent protections prolong exclusivity and support premium pricing. Patent expirations or regulatory approvals of generics will exert downward pressure on prices.

Sources

[1] Fortune Business Insights, "Oral Contraceptive Market Size, Share & Industry Analysis," 2022.

[2] IQVIA, "Global Contraceptive Market Pricing Data," 2022.

More… ↓