Share This Page

Drug Price Trends for ADZENYS XR-ODT

✉ Email this page to a colleague

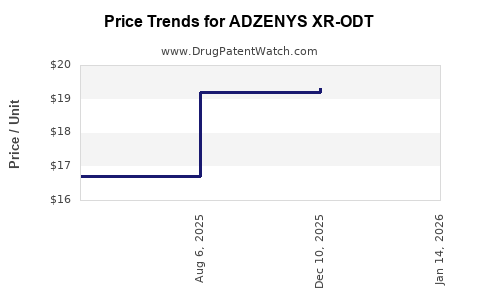

Average Pharmacy Cost for ADZENYS XR-ODT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ADZENYS XR-ODT 15.7 MG TABLET | 70165-0025-30 | 19.37429 | EACH | 2025-12-17 |

| ADZENYS XR-ODT 3.1 MG TABLET | 70165-0005-30 | 19.32850 | EACH | 2025-12-17 |

| ADZENYS XR-ODT 12.5 MG TABLET | 70165-0020-30 | 19.35208 | EACH | 2025-12-17 |

| ADZENYS XR-ODT 18.8 MG TABLET | 70165-0030-30 | 19.31341 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ADZENYS XR-ODT

Introduction

ADZENYS XR-ODT (extended-release orally disintegrating tablet) is a prescription medication developed by Supernus Pharmaceuticals for the management of Attention Deficit Hyperactivity Disorder (ADHD). As a novel oral soluble formulation of amphetamine, it positions itself within a competitive landscape of stimulant therapies. Understanding its current market dynamics and future price trajectories is essential for stakeholders ranging from healthcare providers to investors.

Therapeutic Landscape and Market Position

ADHD affects approximately 6-9% of children and 2-5% of adults globally (1). The stimulant class remains the cornerstone of ADHD management, with methylphenidate and amphetamine-based formulations constituting the majority of prescriptions. The introduction of ADZENYS XR-ODT in 2020 as a once-daily, easy-to-administer form with rapid disintegration contributed to its initial market entry.

Supernus positioned ADZENYS XR-ODT as a differentiated product due to its formulation benefits, including ease of administration for children and improved compliance. Its label indicates a dosing regimen aligned with existing extended-release stimulants, targeting market segments seeking convenient, non-intrusive treatment options.

Current Market Dynamics

1. Market Penetration and Adoption

Since launch, ADZENYS XR-ODT has gained moderate market share, primarily in pediatric clinics and ADHD specialty practices. Its uptake has been moderated by entrenched competitors like Vyvanse, Concerta, and Ritalin. According to IQVIA (2022), Supernus's share of the stimulant market remains below 10%, with ADZENYS XR-ODT representing a subset of this.

2. Competitive Landscape

The stimulant ADHD treatment market is highly competitive:

- Vyvanse (lisdexamfetamine) dominates with approximately 35-40% market share in the stimulant segment.

- Concerta (methylphenidate ER) and Adderall XR (amphetamine salts) collectively hold 35-40%.

- Generic versions have significantly eroded brand dominance, pressuring pricing and market share (2).

ADZENYS XR-ODT competes primarily based on formulation convenience and patent protection until late 2020s, but generic competition approval could infringe upon its exclusivity, affecting pricing and margins.

3. Pricing Strategies and Reimbursement

The average wholesale price (AWP) for branded stimulants like ADZENYS XR-ODT harmonizes with comparable products at approximately $250-300 per month (3). Insurers and pharmacy benefit managers (PBMs) often negotiate substantial discounts, leading to net prices closer to $150-200.

Insurance coverage policies favor generic formulations; thus, brand-name drug pricing is often less impactful due to high copayments or prior authorization hurdles. Notably, ADZENYS XR-ODT's pricing reflects its patent exclusivity, with no generic equivalents available until 2027 (4).

Market Opportunities and Challenges

Opportunities

- Growing ADHD prevalence: Rising diagnosis rates, especially in older adolescents and adults, expand potential patient base.

- Formulation preference: The ODT form appeals to children and patients with swallowing difficulties.

- Potential extensions: Supernus could expand indications or develop combination formulations for broader applications.

Challenges

- Generic competition: The imminent patent cliff for ADZENYS XR-ODT after 2027 risks significant price erosion.

- Pricing pressure: The increasing push for biosimilars and generics could substantially reduce premiums.

- Regulatory hurdles: Potential for future formulations or modifications to affect patent protections or market exclusivity.

Price Projection Analysis

Short-term (2023-2025)

In the near term, ADZENYS XR-ODT's pricing is expected to remain stable, maintained by patent protections and limited generic competition. The monthly wholesale price will likely hover around $250-300, consistent with branded stimulant therapy, with net prices reduced via negotiations.

Given current market penetration and insurance formulary preferences, the product's revenue margins are projected to fluctuate within a 10-15% range based on payer discounts and rebates.

Medium-term (2026-2028)

As patent protections expire in late 2027, generic equivalents of ADZENYS XR-ODT will enter the market. Generic amphetamine products are currently priced approximately $60-80 per month, but branded formulations tend to maintain higher prices due to brand loyalty.

Supernus and competitors could respond with reformulations or extended patents, which might temporarily sustain higher price points. However, a gradual decline of 25-40% in average net price is plausible by 2028, driven by increasing generic penetration.

Long-term (2029 and beyond)

Post-patent expiration, market share for ADZENYS XR-ODT will diminish, with prices likely settling at a uniform generic level. A stable post-generic price would approximate $50-80 per month, reflecting the typical generic stimulant costs.

Potential market expansion via new formulations, alternative dosing, or indications could influence this outlook, but these are speculative at this stage.

Regulatory and Market Dynamics Impacting Prices

FDA approval of generic versions and biosimilars will exert downward pressure on prices (5). Additionally, CMS and private insurers' policies favoring generics over branded drugs will exacerbate this trend.

Further, value-based pricing models and value-added services may influence the net prices achievable for ADZENYS XR-ODT before patent expiry. Supernus's strategic responses, such as developing extended patents or new formulations, may buffer some pricing erosion.

Summary of Price Trajectory

| Period | Estimated Price Range | Key Factors |

|---|---|---|

| 2023-2025 | $250 - $300/month | Patent protection, limited generic competition |

| 2026-2028 | $180 - $250/month | Patent expiry approaches, increasing generic entry |

| 2029+ | $50 - $80/month | Full generic market penetration, generic pricing norms |

Key Market Considerations

- Patent and Exclusivity: Patents lasting until 2027 will sustain premium pricing until then.

- Market Share Dynamics: Adoption rates depend on prescriber preference, formulary placement, and payer policies.

- Competitive Innovations: New formulations or delivery platforms could extend lifecycle or command premium prices.

- Price Sensitivity: Payers' growing emphasis on cost-effectiveness influences net reimbursement and access.

Key Takeaways

- Short-term prospects position ADZENYS XR-ODT as a premium-priced, brand-exclusive product with pricing around $250-300 per month.

- Patent expiration in 2027 will herald increased generic competition, precipitating substantial price reductions.

- Market share gains depend heavily on formulary inclusion, prescriber loyalty, and marketing efforts.

- Future pricing post-patent expiry will align closely with generic stimulant costs, approximately $50-80.

- Strategic innovation and lifecycle management could mitigate price erosion and sustain profitability.

FAQs

1. When does ADZENYS XR-ODT face patent expiration, and how does it impact pricing?

The patent protection for ADZENYS XR-ODT extends until late 2027. Post-expiry, generic versions are expected to enter the market, causing significant price reductions and volume shifts.

2. How does ADZENYS XR-ODT compare price-wise to other ADHD treatments?

Branded stimulants like Vyvanse and Concerta typically cost between $250-300 per month, similar to ADZENYS XR-ODT. Generic stimulants are considerably less expensive, often less than $80 monthly.

3. What factors influence the future pricing of ADZENYS XR-ODT?

Patent status, generic competition, formulary placement, payer negotiated discounts, and potential reformulations heavily influence future pricing.

4. Will the formulation of ADZENYS XR-ODT continue to provide a competitive advantage?

Yes, its convenience as an oral disintegrating tablet offers clinical differentiation. However, this advantage diminishes if generic alternatives adapt similar formulations.

5. How can stakeholders mitigate the impact of patent expiration on profitability?

Investing in formulation innovation, expanding indications, or developing combination therapies can extend lifecycle and sustain higher prices.

References

- American Psychiatric Association. Diagnostic and Statistical Manual of Mental Disorders (DSM-5). 2013.

- IQVIA. National Prescription Audit. 2022.

- GoodRx. Price comparison data for stimulant ADHD medications. 2022.

- FDA. Patent and exclusivity listings for ADZENYS XR-ODT. 2022.

- U.S. Food and Drug Administration. Generic Drug Approvals. 2022.

More… ↓