Share This Page

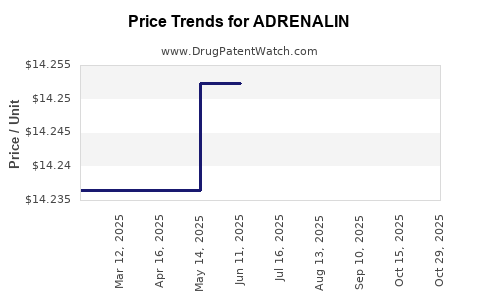

Drug Price Trends for ADRENALIN

✉ Email this page to a colleague

Average Pharmacy Cost for ADRENALIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ADRENALIN 1 MG/ML VIAL | 42023-0159-25 | 7.79554 | ML | 2025-10-28 |

| ADRENALIN 1 MG/ML VIAL | 42023-0159-25 | 14.22207 | ML | 2025-10-22 |

| ADRENALIN 1 MG/ML VIAL | 42023-0159-25 | 14.23640 | ML | 2025-09-17 |

| ADRENALIN 1 MG/ML VIAL | 42023-0159-25 | 14.29853 | ML | 2025-08-20 |

| ADRENALIN 1 MG/ML VIAL | 42023-0159-25 | 14.30807 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ADRENALIN (Epinephrine)

Introduction

ADRENALIN, widely known by its generic name epinephrine, is a cornerstone drug in emergency medicine, primarily used to treat severe allergic reactions (anaphylaxis), cardiac arrest, and other life-threatening conditions. As a critical component of emergency kits and hospitals worldwide, its market dynamics are shaped by regulatory, medical, and economic factors. This analysis evaluates current market trends, competitive landscape, regulatory influences, and projective pricing trajectories for ADRENALIN over the next five years.

Market Overview

Global Market Size and Growth

The global epinephrine market has exhibited steady growth, driven by increasing awareness of allergic conditions, expanding emergency medical protocols, and expanding healthcare infrastructure. As of 2022, the market was valued at approximately USD 2.5 billion, with a compound annual growth rate (CAGR) estimated at 6-8% through 2027 [1].

The North American market dominates due to high healthcare expenditure, widespread adoption in emergency protocols, and robust pharmaceutical infrastructure. Europe follows, with Asia-Pacific showing rapid growth prospects driven by rising allergy prevalence and expanding healthcare access.

Key Market Segments

- Formulation types: Auto-injectors (e.g., EpiPen), ampoules, vials.

- Distribution channels: Hospitals, clinics, outpatient pharmacies, emergency response services.

- End-user: Healthcare providers, emergency responders, direct consumers (patients with prescriptions).

The auto-injector segment accounts for over 70% of sales, primarily because of ease of administration and patient compliance.

Competitive Landscape

The marketplace is characterized by a mix of branded and generic players. Mylan (now part of Viatris) has historically dominated with the EpiPen brand, maintaining significant market share despite recent controversies and pricing debates [2]. Other competitors include ADrenaclick, Auvi-Q, and emerging generics manufacturers.

Patent expirations and regulatory approvals for biosimilar and generic forms have intensified competition. The entry of generics has exerted downward pricing pressure, particularly in mature markets, creating a dynamic environment for pricing and market share redistribution.

Regulatory and Reimbursement Factors

Regulatory approvals hinge on safety, efficacy, and manufacturing standards. The U.S. FDA's approval processes significantly influence market access, with pre-existing patent protections years ago providing brand monopoly control.

Reimbursement policies further impact sales, with insurance coverage and governmental programs like Medicaid influencing both end-user access and pricing stability. The ongoing debate over EpiPen pricing has spotlighted reimbursement mechanisms and access equity, prompting regulatory interventions.

Market Challenges

- Pricing controversy and public scrutiny over EpiPen’s pricing hikes have led to legislative efforts to promote generic alternatives.

- Supply chain disruptions caused by manufacturing issues or global crises (e.g., COVID-19) can impact availability.

- Regulatory hurdles in emerging markets slow expansion and access.

Price Trends and Projections

Historical Pricing Trends

Epinephrine auto-injectors' prices have historically increased substantially from 2012 to 2016, peaking with EpiPen's price hikes, which drew consumer and legislative ire. Since then, prices have plateaued and declined in response to increased competition and regulatory pressures.

Projected Price Trajectory (2023-2027)

- Auto-injectors: Due to rising generics, prices are expected to decline modestly by approximately 3-5% annually, with potential stabilization as competition matures.

- Generic forms: Presumed to be priced 50-70% lower than branded equivalents, increasing their market penetration.

- Market-driven pricing: Insurance reimbursements, procurement contracts, and public health initiatives will strongly influence net prices.

Impact of Biosimilars and Generics

The anticipated entry of biosimilars and generics will apply downward pressure on prices. In the U.S., generic epinephrine auto-injectors could see a price reduction of 40-60% over the next five years, aligning with trends observed in other injectable pharmaceuticals [3].

Future Outlook and Key Drivers

- Growing allergy prevalence: Rising incidence of food allergies, insect sting allergies, and drug allergies globally is expected to sustain high demand.

- Innovation in delivery systems: Advances in auto-injector technology may justify premium pricing through improved usability and safety.

- Legislative reforms: Policies promoting affordability and the rollout of generic alternatives will impact pricing structures.

- Market expansion into emerging economies: Increasing healthcare infrastructure and allergy awareness will expand access, influencing volume and pricing.

Concluding Insights on Market and Pricing

While the overall demand for epinephrine will remain robust driven by emergency medical needs, pricing will be shaped predominantly by the regulatory environment and marketplace competition. The stabilization or slight decline in prices anticipates heightened competition, especially from generics, with premium brands potentially maintaining margins through innovation and branding.

Key Takeaways

- The global ADRENALIN market is expected to grow at a CAGR of 6-8%, fueled by rising allergy cases and expanding healthcare infrastructure.

- Branded auto-injectors have historically faced price hikes; however, recent increased market competition suggests prices will decline or stabilize over the next five years.

- Generics and biosimilars will drive down prices, with projections indicating reductions of 40-60% for auto-injectors, enhancing affordability.

- Reimbursement policies and legislative actions crucially influence net market prices and access.

- Innovations in delivery devices and emerging markets present opportunities for sustained growth and pricing strategies.

FAQs

1. What factors are most influential in shaping the future price of ADRENALIN?

Regulatory approvals, market competition, reimbursement policies, and technological innovations in delivery systems primarily influence future pricing.

2. How has competition affected the price of epinephrine auto-injectors?

Increased competition from generics and biosimilars has driven down prices, with some estimates citing reductions of up to 50% over recent years.

3. What impact do regulatory policies have on market prices?

Policies promoting generic approvals and pricing transparency tend to lower consumer prices, while restrictions can sustain higher brand premiums.

4. How might emerging markets influence ADRENALIN pricing trends?

Growing healthcare access and allergy prevalence in emerging markets will expand demand, potentially creating price premiums due to logistical and regulatory costs.

5. Will innovation in delivery methods affect the market and pricing?

Yes; improved auto-injector designs can command higher prices due to enhanced safety and usability, though market competition may limit premium pricing.

References

[1] Markets and Markets. "Epinephrine Market - Global Forecast to 2027," 2022.

[2] Reuters. "Mylan facing criticism over EpiPen pricing," 2016.

[3] IQVIA Institute. "The Impact of Biosimilars and Generics on Pharmaceutical Markets," 2021.

More… ↓