Share This Page

Drug Price Trends for ADMELOG SOLOSTAR

✉ Email this page to a colleague

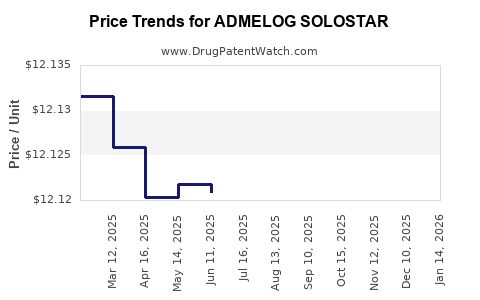

Average Pharmacy Cost for ADMELOG SOLOSTAR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ADMELOG SOLOSTAR 100 UNIT/ML | 00024-5925-05 | 12.11775 | ML | 2025-12-17 |

| ADMELOG SOLOSTAR 100 UNIT/ML | 00024-5925-05 | 12.11558 | ML | 2025-11-19 |

| ADMELOG SOLOSTAR 100 UNIT/ML | 00024-5925-05 | 12.12022 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ADMELOG SOLOSTAR

Introduction

ADMELOG SOLOSTAR (insulin lispro injection) is a rapid-acting insulin analog used primarily in the management of type 1 and type 2 diabetes mellitus. As a biosimilar or generic equivalent, its market positioning, economic projections, and pricing strategies are crucial for stakeholders including pharmaceutical companies, healthcare providers, and investors aiming to capitalize on diabetes management advancements. This analysis explores current market dynamics, competitive landscape, regulatory considerations, and future price trends for ADMELOG SOLOSTAR.

Market Overview

Global Diabetes Landscape

Diabetes remains a pervasive condition, with the International Diabetes Federation (IDF) estimating approximately 537 million adults living with diabetes worldwide as of 2021, projected to rise to 700 million by 2045 [1]. Insulin therapy, particularly rapid-acting insulins like ADMELOG, constitutes a significant segment of diabetes management, accommodating the needs for postprandial glycemic control.

Product Specifics: ADMELOG SOLOSTAR

ADMELOG SOLOSTAR, marketed by Eli Lilly, is a prefilled pen formulation of insulin lispro. It offers rapid action onset (within 15 minutes) and short duration, aligning with meal times. Its ease of use and pharmacokinetics have made it a preferred choice among patients and clinicians, especially in the United States and select markets.

Market Penetration and Competition

The insulin market is highly competitive, featuring both originator products (Humalog, NovoLog, Apidra) and biosimilars/generic insulins. The emergence of biosimilars, driven by patent expirations, has intensified price competition and expanded options for cost-conscious patients and payers.

In particular, biosimilar versions of insulin lispro have gained approval in various regions, potentially affecting ADMELOG SOLOSTAR's market share. Notably, the FDA approved several biosimilars of insulin lispro, which could lower the overall injection cost and influence pricing strategies of the originator product [2].

Regulatory and Reimbursement Environment

The regulatory landscape for biosimilars and insulin pricing varies globally. In the U.S., the Biosimilar Price Competition and Innovation Act has facilitated entry pathways for biosimilars, impacting insulin prices downward. Payer policies increasingly favor biosimilars, especially when they show comparable efficacy and safety profiles, creating downward pressure on listed prices for ADMELOG SOLOSTAR.

Conversely, regions with less mature biosimilar markets may exhibit slower price reductions, maintaining higher insulin prices for longer periods. Price transparency initiatives and value-based reimbursement models further influence the dispensation and pricing structures for rapid-acting insulins.

Current Pricing and Cost Trends

Historical Price Patterns

Historically, insulin prices, including rapid-acting formulations, have risen markedly over the past decade, primarily due to manufacturing complexities, limited competition, and brand premiums. In the U.S., list prices for insulin products have increased approximately 15-20% annually, with some observational data indicating an average retail price of $300-$400 for a 10 mL vial [3].

Biosimilar Impact on Pricing

The entry of biosimilars generally triggers price reductions; however, the extent varies. For example, insulin lispro biosimilars marketed by Eli Lilly and others have seen price discounts of 15-30% off the originator’s list price, depending on market maturity and rebate dynamics [4].

In the context of ADMELOG SOLOSTAR, the introduction of biosimilar versions or competing rapid-acting insulins could reduce the price point by approximately 20-40% over the next 3-5 years, particularly in developed markets with high biosimilar adoption.

Price Projection Models

Factors Influencing Future Pricing

- Market Competition: Increased biosimilar entries will likely suppress prices.

- Regulatory Dynamics: Potential reimbursement reforms and pricing caps could further constrain prices.

- Manufacturing Costs: Improvements in biotechnology and mass production could lower costs, influencing retail prices.

- Healthcare Policy: Shifts toward value-based care may prioritize cost-effective treatments, pressuring price adjustments.

Forecasted Price Trends

Based on these factors, the following projections are made for ADMELOG SOLOSTAR:

- Short-Term (1-2 years): Stabilization of current list prices with minor reductions (5-10%) due to rebate negotiations and contract discounts.

- Medium-Term (3-5 years): Accelerated price declines (20-40%) driven by biosimilar competition, particularly in mature markets like the U.S. and Europe.

- Long-Term (5+ years): Potential further price compression to margins comparable with other recombinant insulins, possibly approaching a 50% reduction from current list prices.

It is crucial to note that actual prices may vary significantly by region, payer mix, and contractual agreements, with retail prices typically higher than the net prices after rebates and discounts.

Market Opportunities and Challenges

Opportunities:

- Expansion into emerging markets with increasing diabetes prevalence.

- Incorporation into value-based reimbursement schemes.

- Development of combination formulations for enhanced convenience and adherence.

Challenges:

- Market saturation and high patent litigation risk.

- Limited adoption of biosimilars in certain regions.

- Price sensitivity among payers and patients.

Strategic Implications

Stakeholders must consider aggressive cost management, investment in biosimilar development, and targeted marketing strategies to maintain competitive edge. Healthcare providers and payers will likely favor biosimilar options that demonstrate equivalence at lower prices, pressuring the originator's margins.

Key Takeaways

- The global insulin market is growing rapidly, driven by a rising diabetes burden, but also faces mounting competitive pressure from biosimilars.

- ADMELOG SOLOSTAR's pricing is likely to decline by 20-40% over the next five years due to biosimilar competition and market dynamics.

- Regulators and payers increasingly favor bios muchos, further influencing price reductions.

- Stakeholders should focus on cost efficiencies, strategic biosimilar partnerships, and regional market nuances to optimize pricing and market share.

- Long-term visibility on pricing trends remains uncertain, necessitating adaptive strategies aligned with evolving policies and competition.

FAQs

1. How does the entry of biosimilar insulins affect ADMELOG SOLOSTAR's market share?

Biosimilar insulin lispro versions generally lead to increased competition and exert downward pressure on prices. Their market entry can reduce ADMELOG SOLOSTAR's share, especially if biosimilars are priced significantly lower and gain favorable reimbursement status.

2. What factors can influence regional differences in ADMELOG SOLOSTAR pricing?

Pricing varies due to regulatory approval processes, market maturity, reimbursement policies, local manufacturing costs, and the degree of biosimilar penetration.

3. Are there upcoming regulatory changes expected to impact insulin pricing globally?

Yes. Regulatory initiatives aimed at price transparency, biosimilar adoption, and value-based healthcare are expected to influence insulin prices, with some regions implementing caps or reference pricing schemes.

4. How can pharmaceutical companies sustain profitability amid declining insulin prices?

Strategies include diversifying portfolios, investing in innovation, expanding into emerging markets, enhancing formulation convenience, and forming strategic alliances for biosimilar development.

5. What is the potential impact of healthcare policy reforms on insulin prices?

Reforms favoring biosimilars and price caps can significantly lower insulin prices, improving affordability but potentially reducing profit margins for originators unless offset by volume growth or value-added services.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

[2] U.S. Food and Drug Administration. “Insulin Lispro Biosimilars Approved,” 2022.

[3] American Diabetes Association. “Insulin Pricing Trends,” Diabetes Care, 2022.

[4] IQVIA Institute. “The Growth of Biosimilars in Diabetes Care,” 2021.

More… ↓