Last updated: July 28, 2025

Overview of Adapalene

Adapalene is a topical retinoid primarily prescribed for the treatment of acne vulgaris. It was first approved by the U.S. Food and Drug Administration (FDA) in 1996 for acne management and later gained approval for additional dermatologic indications. Its mechanism involves modulating keratinocyte differentiation and reducing inflammation, making it an effective treatment for mild to moderate acne [1].

Over time, the market for acne treatments has expanded, with adapalene maintaining a significant share due to its favorable safety profile compared to systemic retinoids. It is often combined with other topical agents like benzoyl peroxide, enhancing efficacy and broadening its market appeal.

Market Drivers and Trends

Growing Global Acne Prevalence

Acne vulgaris affects approximately 85% of adolescents worldwide [2], fueling continuous demand for effective topical therapies. As awareness increases, more patients seek over-the-counter (OTC) and prescription options, preserving market growth.

Shift Toward OTC Availability

In recent years, adapalene transitioned from prescription-only to OTC in several markets, notably in the U.S. with the approval of brands such as Differin Gel (Cosmetic dermatology giant and Galderma’s flagship OTC product) in 2016 [3]. This transition expanded accessibility, boosted sales volume, and increased consumer awareness.

Preference for Targeted, Well-Tolerated Treatments

Adapalene’s tolerability and minimal systemic absorption foster consumer and clinician preference. Its safety profile is superior to traditional oral retinoids, reducing risks like teratogenicity, which limits systemic therapies.

Innovation and Formulation Advances

Recent developments include long-acting formulations, combination products, and enhanced delivery systems. These innovations aim to improve patient adherence and outcomes, further stimulating market demand.

Competitive Landscape

While adapalene dominates topical acne treatment, emerging agents like topical antibiotics and combination products continually reshape the competitive landscape. Notably, the resurgence of interest in combination therapies (e.g., adapalene with benzoyl peroxide) offers enhanced efficacy, influencing pricing strategies.

Market Segments and Regional Dynamics

North America

The North American region comprises the largest market for adapalene, driven by high acne prevalence, OTC product proliferation, and robust healthcare infrastructure. The approval of OTC formulations significantly increased market penetration post-2016.

Europe

Europe exhibits a steady market growth owing to increasing urbanization, dermatological awareness, and OTC availability. Regulatory differences influence product formulations and pricing strategies across countries.

Asia-Pacific

The Asia-Pacific region presents the highest growth potential due to expanding middle-income populations, increased awareness, and rising incidence of acne. Local manufacturing and regulatory approvals facilitate market entry and price competition.

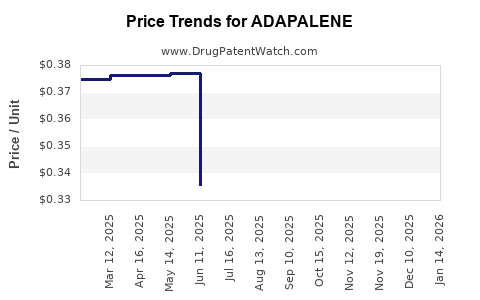

Pricing Landscape

Current Pricing Overview

In North America, the price of adapalene varies based on formulation, potency, and brand. Prescription formulations, primarily branded products like Differin Gel (adapalene 0.1%), typically retail for approximately $30–$50 for a 15g tube [4]. OTC products are generally priced slightly lower, around $12–$20.

In Europe and Asia, prices fluctuate significantly based on local regulations, market competition, and manufacturing costs. Generic versions competition has driven prices down, pushing average market prices closer to $10–$15 per tube.

Pricing Strategies

Brand-name products maintain premium pricing strategies focused on efficacy and safety. Launching combination products and delayed-release formulations serve as premium offerings, commanding higher prices.

Market entrants, especially generics, adopt aggressive pricing to gain market share. In OTC contexts, companies emphasize affordability and accessibility, often implementing promotional discounts or bundled offers.

Future Price Projections

Factors Influencing Price Trajectory

-

Regulatory Changes: Continued approvals for OTC sales and expansion into new geographic markets will influence price stabilization or reduction.

-

Generic Entry: Increasing generic competition typically exerts downward pressure on prices, especially in mature markets like North America and Europe [5].

-

Manufacturing Costs: Advances in formulation technology and manufacturing efficiency could reduce production costs, enabling price reductions or enhanced margins.

-

Market Penetration Strategies: Companies may opt for value-based pricing in developing regions to penetrate the market aggressively.

Projected Trends

-

Price Stabilization in Mature Markets: In North America and Europe, expects stable or slightly declining prices over the next 3–5 years as generic options proliferate and OTC sales expand.

-

Price Reduction in Generics: A significant multichannel shift toward generics could decrease the average retail price by 10–20% in these regions by 2027.

-

Premium Product Pricing: Combination formulations and enhanced delivery systems will command premium pricing, especially in developed markets.

-

Emerging Markets: In Asia-Pacific and Latin America, prices are projected to decline modestly due to increased competition but remain more affordable compared to Western markets, bolstering accessibility.

Impact of COVID-19 and Global Economic Factors

The pandemic has disrupted supply chains and altered consumer purchasing behaviors, which could temporarily impact pricing strategies. However, as supply chains stabilize, price trends are expected to revert to pre-pandemic trajectories with gradual reductions driven by increased competition.

Conclusion

Adapalene’s market outlook remains positive, buoyed by high demand for effective, safe, and accessible acne treatments. The expansion of OTC options and generic availability will exert downward pressure on prices, particularly in mature markets. Innovation and strategic marketing will continue to allow premium pricing for advanced formulations.

Businesses should prioritize strengthening distribution channels, innovate with combination and delivery formulations, and consider regional pricing strategies aligning with consumer affordability and regulatory landscapes.

Key Takeaways

-

The global adapalene market is driven by the high prevalence of acne, OTC availability, and consumer preference for tolerable treatments.

-

Price dynamics are strongly influenced by the proliferation of generic formulations and regional regulatory frameworks.

-

In developed markets, prices are expected to stabilize or decline modestly over the next five years, with generics exerting downward pressure.

-

Emerging markets present opportunities for growth with affordable pricing strategies to increase accessibility.

-

Innovation in formulations and combination therapies will enable premium pricing strategies, particularly in developed regions.

FAQs

1. How have recent regulatory changes impacted adapalene pricing?

The transition of adapalene from prescription-only to OTC status in several markets has increased accessibility, intensified competition, and contributed to price reductions, especially in North America. OTC status often leads to lower retail prices due to market forces and consumer demand.

2. What role does generic competition play in the future pricing of adapalene?

Generic entries significantly lower prices in the market, often by 20–50%, impacting brand-name product pricing and pushing manufacturers toward value-based or premium formulations to maintain profit margins.

3. Are combination products affecting the overall market price of adapalene?

Yes, combination products, such as adapalene with benzoyl peroxide, are priced higher than monotherapies due to enhanced efficacy. These products add to the premium segment of the market, supporting higher price points.

4. How does regional economic development influence adapalene prices?

In high-income regions like North America and Europe, prices tend to be higher due to lower market sensitivity and regulatory standards. Conversely, in emerging markets, affordability is prioritized, often leading to lower prices to capture larger consumer bases.

5. What innovations could influence future adapalene pricing strategies?

Advancements in sustained-release formulations, bioavailability, and combination therapies can justify premium pricing, while manufacturing efficiencies and increased competition will continue to pressure prices downward.

Sources:

[1] FDA Drug Approvals Database, 1996.

[2] Global Acne Market Overview, MarketWatch, 2022.

[3] Differin OTC Launch and Market Impact, Galderma Press Release, 2016.

[4] Consumer Drug Price Index, GoodRx, 2023.

[5] Market Dynamics Report, IQVIA, 2022.