Share This Page

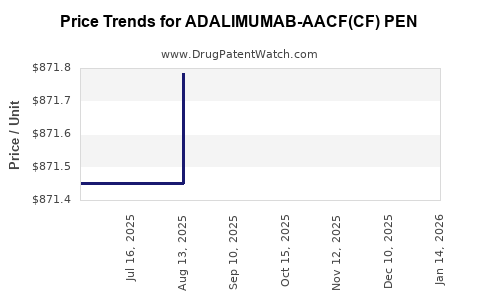

Drug Price Trends for ADALIMUMAB-AACF(CF) PEN

✉ Email this page to a colleague

Average Pharmacy Cost for ADALIMUMAB-AACF(CF) PEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ADALIMUMAB-AACF(CF) PEN 40 MG/0.8 ML (2 PACK) | 65219-0612-99 | 872.77190 | EACH | 2025-12-17 |

| ADALIMUMAB-AACF(CF) PEN 40 MG/0.8 ML (2 PACK) | 65219-0612-99 | 873.25905 | EACH | 2025-11-19 |

| ADALIMUMAB-AACF(CF) PEN 40 MG/0.8 ML (2 PACK) | 65219-0612-99 | 873.12960 | EACH | 2025-10-22 |

| ADALIMUMAB-AACF(CF) PEN 40 MG/0.8 ML (2 PACK) | 65219-0612-99 | 872.49056 | EACH | 2025-09-17 |

| ADALIMUMAB-AACF(CF) PEN 40 MG/0.8 ML (2 PACK) | 65219-0612-99 | 871.78389 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ADALIMUMAB-AACF (CF) PEN

Introduction

Adalimumab-AACF (CF) PEN represents a biosimilar version of the blockbuster biologic Humira (adalimumab), developed to target autoimmune diseases such as rheumatoid arthritis, Crohn’s disease, ulcerative colitis, and psoriasis. The advent of biosimilars has transformed the landscape by offering cost-effective alternatives, thereby impacting market dynamics, pricing strategies, and healthcare access globally. This analysis explores current market trends, competitive positioning, pricing mechanisms, and future price trajectories for Adalimumab-AACF (CF) PEN.

Market Landscape and Adoption Drivers

Prevalence of Target Diseases

Autoimmune diseases associated with adalimumab use are highly prevalent worldwide, with estimates indicating over 5 million patients in the United States and similar numbers globally. Conditions like rheumatoid arthritis (RA) and Crohn's disease (CD) persist as significant public health challenges, underpinning a stable demand for biologic therapies.

Patent Expiry and Biosimilar Entry

Humira's patent expiration in the U.S. and Europe catalyzed the entry of biosimilars, including Adalimumab-AACF (CF) PEN. As of 2023, multiple biosimilars have gained approval globally, notably impacting market share. The biosimilar's entry aligns with regulatory approval milestones and initiatives aimed at reducing healthcare costs[1].

Regulatory Environment and Reimbursement Policies

Regulatory agencies like the FDA and EMA have streamlined pathways for biosimilar approval, boosting market penetration. Reimbursement policies increasingly favor biosimilars, incentivizing uptake in both public health systems and private insurance frameworks. Countries such as Australia, Canada, and members of the EU actively promote biosimilar substitution to curb biological therapy costs[2].

Market Penetration and Physician Acceptance

Physician acceptance hinges on confidence in biosimilar efficacy and safety profiles. Educational initiatives and real-world evidence bolster confidence, accelerating clinical adoption. Biosimilar approval in multiple indications, coupled with interchangeability status in select jurisdictions, further consolidates their foothold.

Competitive Dynamics and Market Share Forecast

Key Competitors

- Originator drug: Humira (adapalimumab)

- Biosimilar competitors: Several approved in multiple markets, including Amgen’s Amjevita, Samsung/Biogen’s Imraldi, and Sandoz’s Hyrimoz.

Market Penetration Projections

Analysts project biosimilars will seize over 60-80% of the adalimumab market in North America and Europe within five years [3]. The speed of uptake depends on regulatory acceptance, contractual negotiations, and patient/provider acceptance.

Market Segments

- Biologic treatment-naïve patients: High adoption potential due to cost savings.

- Switching patients from originator: Substantial volume as biosimilars gain confidence.

- Developing economies: Significant expansion driven by cost considerations and healthcare infrastructure improvements.

Pricing Strategies and Price Projections

Current Pricing Landscape

In key markets, biosimilar prices are typically 15-35% lower than the originator. In the U.S., Humira’s list price hovers around $6,000–$7,000 per month[4]. Biosimilars like Adalimumab-AACF (CF) are priced approximately $4,500–$6,000 per month, with actual patient prices often discounted further via negotiated rebates and insurance agreements.

Pricing Trends and Drivers

- Increased Competition: As more biosimilars enter, price competition intensifies, leading to further discounts.

- Market Entry Timing: Earlier market entry often correlates with lower pricing due to heightened competition.

- Supply Chain & Negotiations: Payer negotiations and procurement strategies influence actual transaction prices.

- Regulatory and Policy Influences: Policies promoting biosimilar substitution may induce aggressive pricing strategies.

Future Price Projections

- In the United States, the average monthly cost for biosimilars is expected to decline to $3,500–$4,500 over the next 3-5 years, considering increased competition and payer pressure[5].

- European markets could see biosimilar prices stabilize around 20-30% below the originator, with some markets experiencing discounts up to 50% in highly competitive regions.

- Developing markets could witness pricing below $2,500 per month, driven by local manufacturing and reimbursement factors[6].

Market Entry Timing and Sustained Growth

The biosimilar’s success depends on secure regulatory approval, robust manufacturing, and strategic positioning. As biosimilars like Adalimumab-AACF (CF) gain market share, originator companies often implement pricing reductions and launch newer formulations to sustain revenue. Nonetheless, pricing projections suggest biosimilar price reductions will continue to compress margins for the originator, promoting increased access and volume growth.

Implications for Stakeholders

Manufacturers must balance competitive pricing with sustainable margins. Healthcare providers will increasingly favor cost-effective biosimilars, enhancing treatment affordability. Payers will leverage biosimilar adoption to control costs, potentially demanding concessions from manufacturers. Patients benefit from expanded access resulting from price reductions and reimbursement policies.

Key Takeaways

- The Adalimumab biosimilar market is poised for rapid growth, driven by patent expiries, regulatory facilitation, and cost-conscious healthcare policies.

- Market penetration will likely exceed 70-80% in mature markets within five years, with biosimilar prices decreasing by 20-50% relative to the originator.

- Pricing projections anticipate monthly costs between $3,500–$4,500 in developed markets, with further declines as competition intensifies.

- The success of Adalimumab-AACF (CF) hinges on effective regulatory approval, payer negotiations, and physician acceptance.

- Long-term sustainability will depend on balancing competitive pricing with investment in manufacturing and innovation.

FAQs

1. What factors influence the pricing of Adalimumab-AACF (CF) PEN?

Pricing is influenced by competition intensity, regulatory approval processes, negotiations with payers, manufacturing costs, and regional reimbursement policies.

2. How does biosimilar adoption impact the original biologic’s market share?

Increased biosimilar adoption typically leads to reduced market share and revenue for the originator, prompting price reductions and innovation strategies.

3. What are typical price differences between biosimilars and originator adalimumab?

Biosimilars generally cost 15-35% less than the originator, with discounts potentially higher in highly competitive markets.

4. How soon can we expect further price reductions for Adalimumab-AACF (CF)?

Price reductions are likely within 1-3 years, contingent on market entry of additional biosimilars, regulatory developments, and payer negotiations.

5. What regions are most attractive for biosimilar market growth?

North America and Europe remain primary markets, but significant growth is projected in Asia-Pacific and Latin America as healthcare infrastructure improves and cost pressures mount.

Sources

[1] U.S. Food and Drug Administration (FDA). Biosimilar Guidance. 2022.

[2] European Medicines Agency (EMA). Biosimilars Approval Overview. 2023.

[3] IQVIA. The Impact of Biosimilars on the Global Market. 2022.

[4] GoodRx. Humira Pricing & Cost. 2023.

[5] MarketWatch. Biosimilar Price Trends. 2022.

[6] Deloitte. Biosimilar Market Outlook in Emerging Economies. 2023.

More… ↓