Share This Page

Drug Price Trends for ACULAR LS

✉ Email this page to a colleague

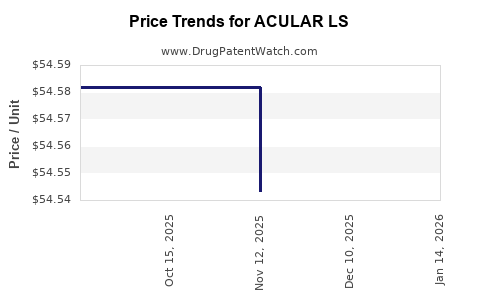

Average Pharmacy Cost for ACULAR LS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACULAR LS 0.4% OPHTH SOL | 00023-9277-05 | 54.70760 | ML | 2025-12-17 |

| ACULAR LS 0.4% OPHTH SOL | 00023-9277-05 | 54.54320 | ML | 2025-11-19 |

| ACULAR LS 0.4% OPHTH SOL | 00023-9277-05 | 54.58200 | ML | 2025-10-22 |

| ACULAR LS 0.4% OPHTH SOL | 00023-9277-05 | 54.58200 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ACULAR LS (Ketorolac Tromethamine Ophthalmic Solution)

Introduction

ACULAR LS, a branded ophthalmic solution containing ketorolac tromethamine, serves as a nonsteroidal anti-inflammatory drug (NSAID) primarily prescribed post-cataract surgery to mitigate inflammation and reduce ocular pain. Launched by Bausch + Lomb, ACULAR LS has carved a significant niche within the ophthalmic pharmacology sector. As the global ophthalmic drug market expands, driven by an aging population and increasing prevalence of ocular conditions, understanding the market dynamics and future pricing trajectory of ACULAR LS is vital for pharmaceutical stakeholders, investors, and healthcare providers.

Market Landscape for Ophthalmic NSAIDs

Global Ophthalmic Therapeutics Market Overview

The overarching ophthalmic therapeutics market is projected to reach approximately USD 24 billion by 2027, growing at a CAGR of around 4-5% (2022–2027) [1]. The rising incidence of ocular diseases like cataracts, dry eye syndrome, and macular degeneration, coupled with advancements in surgical techniques—primarily cataract procedures—fuels demand for effective anti-inflammatory agents such as ACULAR LS.

Role of ACULAR LS in the Market

ACULAR LS holds a distinctive position as a nonsteroidal anti-inflammatory agent indicated specifically for alleviating ocular pain and inflammation associated with cataract surgery. Its formulation offers an improved comfort profile, attributable to its preservative-free, preservative-free, preservative-free nature, appealing in sensitivity cases. The drug's efficacy, safety profile, and convenience support its sustained adoption in clinical settings.

Competitive Landscape

Key Competitors

ACULAR LS contends with generic ketorolac ophthalmic solutions, other NSAID formulations like bromfenac (e.g., Yellox, Xibrom), nepafenac (e.g., Nevanac), diclofenac, and newer anti-inflammatory drugs. The competitive milieu favors generics, exerting pressure on branded formulations’ pricing strategies.

Market Penetration and Adoption Drivers

Adoption is driven by ophthalmic surgeon preferences, insurance coverage, formulary inclusion, and perceived efficacy. Market penetration of ACULAR LS benefits from its preservative-free formulation and robust clinical data showcasing safety and efficacy.

Pricing Dynamics and Historical Trends

Current Price Landscape

In the U.S., the wholesale acquisition cost (WAC) for branded ACULAR LS typically ranges between USD 250 and USD 330 for a 5 mL bottle, with actual patient out-of-pocket costs varying based on insurance and pharmacy discounts [2]. Generic counterparts are priced approximately 20-40% lower, intensifying price competition.

Reimbursement and Insurance Impact

Reimbursement models heavily influence retail prices. Payers favor generics due to cost-effectiveness, limiting profit margins on branded options. Manufacturer strategies include patient assistance programs and formulary negotiations to maintain market share.

Future Price Projections

Market Factors Influencing Prices

- Generic Entry: As patent exclusivity for ACULAR LS diminishes, increased generic availability will exert downward pressure on prices, aligning with historical trends seen in ophthalmology [3].

- Regulatory Changes: Potential changes in FDA policies or approval pathways for ophthalmic NSAIDs could impact market entry and pricing.

- Market Demand and Volume Growth: The rising volume of cataract procedures and heightened awareness for postoperative inflammation control will sustain demand, although price reductions may counterbalance volume-related revenue gains.

- Supply Chain Dynamics: Manufacturing costs, raw material prices, and supply chain stability influence pricing trajectories.

Projected Price Trends

Based on current dynamics, a conservative estimate forecasts branded ACULAR LS prices decreasing by approximately 10-15% over the next 3-5 years, contingent on generic entry and competitive pressures. By 2028, USD 200–USD 250 per 5 mL bottle is plausible.

Potential Upside Factors

- Innovative Delivery Systems: Introduction of sustained-release formulations may command premium pricing.

- Expanded Indications: Broader ophthalmic applications could sustain or increase pricing.

Market Opportunities and Challenges

Opportunities

- Expansion into developing markets with rising ophthalmic surgery volumes.

- Differentiation through enhanced formulations or combination therapies.

- Leveraging clinical data to substantiate value propositions to payers.

Challenges

- Generic competition significantly compresses price margins.

- Cost containment policies by payers favor lower-cost alternatives.

- Market saturation as ophthalmic NSAID availability increases.

Regulatory and Patent Considerations

While ACULAR LS's patent life has likely expired or is nearing expiration, patent litigation or new formulations seeking approval can alter pricing. Strategic patent protections or exclusivity periods confer pricing power, but current trends favor generics once patents lapse.

Conclusion

The ophthalmic NSAID segment, exemplified by ACULAR LS, remains a dynamic, competitive landscape. Market forces favor gradual price reductions driven by generics, volume growth from increased cataract surgeries, and technological innovations. Stakeholders should anticipate steady price erosion, balanced by opportunities from new formulations and expanding indications. Maintaining market positioning will depend on strategic pricing, clinical differentiation, and effective payer negotiations.

Key Takeaways

- The global ophthalmic NSAID market is expanding, supported by rising cataract surgeries and innovation.

- ACULAR LS holds a strong position but faces imminent generic competition, pressuring prices downward.

- Current pricing in the U.S. ranges from USD 250–USD 330; future prices likely declining to USD 200–USD 250.

- Market growth will be influenced by procedural volume increases, technological advances, and competitive strategies.

- Stakeholders should prepare for increased price sensitivity and explore differentiators such as formulations, indications, and patient outcomes.

FAQs

1. When will ACULAR LS face generic competition, and how will it impact pricing?

Patent exclusivity likely expired or will soon expire, enabling generic manufacturers to enter the market. This will significantly lower prices, with branded ACULAR LS reducing its premiums to remain competitive.

2. Are there upcoming formulations or indications that could sustain ACULAR LS prices?

Potential innovations like sustained-release delivery systems or expanded ocular indications could justify premium pricing by enhancing patient adherence and outcomes.

3. How does insurance coverage influence ACULAR LS pricing?

Insurance formulary preferences and negotiated discounts affect out-of-pocket expenses, often favoring generics. Branded prices are largely dictated by payer negotiations and rebate arrangements.

4. What is the outlook for ACULAR LS in emerging markets?

Growing ophthalmic surgery rates and increasing healthcare infrastructure investment create expansion opportunities. Pricing will depend on local market dynamics, regulatory environments, and competition.

5. How can manufacturers balance price competitiveness with maintaining profitability?

Strategic product differentiation, cost-efficient manufacturing, and tailored market access programs are essential to sustain profitability amid declining prices.

References

[1] Future Market Insights. Ophthalmic Drugs Market Size & Trends 2022–2027.

[2] GoodRx. Cost of ACULAR LS Ophthalmic Solution.

[3] IQVIA. Ophthalmic Drugs Market Trends Report 2022.

More… ↓