Share This Page

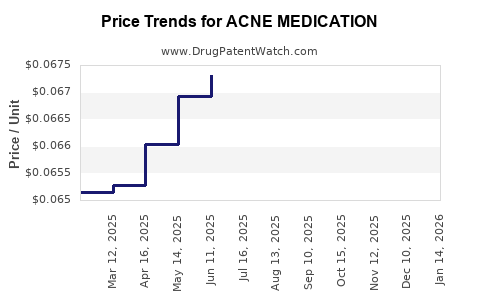

Drug Price Trends for ACNE MEDICATION

✉ Email this page to a colleague

Average Pharmacy Cost for ACNE MEDICATION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACNE MEDICATION 5% GEL | 00536-1055-25 | 0.22230 | GM | 2025-12-17 |

| ACNE MEDICATION 5% GEL | 00536-1055-56 | 0.07830 | GM | 2025-12-17 |

| ACNE MEDICATION 2.5% GEL | 00536-1129-25 | 0.20261 | GM | 2025-12-17 |

| ACNE MEDICATION 10% GEL | 00536-1056-25 | 0.23345 | GM | 2025-12-17 |

| ACNE MEDICATION 10% GEL | 00536-1056-56 | 0.08612 | GM | 2025-12-17 |

| ACNE MEDICATION 10% GEL | 00536-1056-56 | 0.08627 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Acne Medication

Introduction

Acne medication remains one of the most significant segments within dermatological pharmaceuticals, driven by increasing prevalence, evolving treatment paradigms, and consumer demand for effective skincare solutions. This analysis explores current market dynamics, competitive landscape, regulatory environment, and future price projections for acne medications, offering valuable insights for stakeholders and investors.

Market Overview

Global Market Size and Growth

The global acne medication market was valued at approximately USD 4.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 5.8% through 2028 [1]. Factors fueling this expansion include rising dermatological awareness, increasing incidence of adolescent and adult acne, and advancements in drug formulations.

Key Drivers

- Rising Prevalence of Acne: Acne affects nearly 85% of adolescents globally, with incidence persisting into adulthood—affecting up to 50% of women aged 20-29 [2].

- Innovative Therapeutics: Development of targeted therapies such as topical retinoids, antibiotics, and hormonal agents expand treatment options.

- Increased Access: Growing availability through teledermatology and OTC sales broadens reach, especially in emerging economies.

Market Segments

- Topical Agents: Retinoids, benzoyl peroxide, antibiotics.

- Systemic Treatments: Oral isotretinoin, antibiotics, hormonal therapy.

- Emerging Therapies: Laser and light therapies, biologics under research.

Competitive Landscape

Major Players

Leading pharmaceutical companies include Johnson & Johnson, Galderma, Pfizer, and Novartis. Noteworthy products encompass:

- Differin (adapalene) – Topical retinoid, FDA-approved for OTC sale in the US.

- Epiduo (adapalene and benzoyl peroxide) – Combination topical.

- Accutane (isotretinoin) – Oral retinoid, prescribed for severe cases.

Market Dynamics

The increase in OTC formulations and emphasis on personalized medicine are reshaping competition. Patent expirations of key drugs and the entry of biosimilars further influence pricing strategies.

Regulatory Environment

Regulatory agencies like the FDA, EMA, and various national bodies govern approval pathways, influencing market availability and pricing. The expedited approval of certain brands and increasing acceptance of generics pressure pricing dynamics.

Pricing Strategies and Trends

Current Pricing Landscape

- Brand-name drugs such as Accutane can cost USD 200–400 per course.

- Generic formulations are often available at USD 20–50, significantly more affordable.

- OTC products like Differin retail between USD 10–30.

Influencing Factors

- Patent Exclusivity: Extended patents keep prices high; amid patent expirations, generic competition reduces prices.

- Regulatory Approvals: Accelerated approvals and approval of biosimilars exert downward pressure.

- Market Penetration Strategies: Tiered pricing in emerging markets boosts access and volume.

Pricing Challenges

- Insurance and reimbursement policies vary significantly across regions.

- Patient Affordability: Cost-sensitive markets favor generics and OTC options, impacting revenue streams for branded drugs.

Future Price Projections (2023–2030)

Short-term (1–3 years)

- Stable or Slight Decline in Prices of Established Drugs due to patent expirations and increased generic availability.

- Incremental Price Hikes in Innovative Therapies: Companies may implement price hikes for newly launched proprietary formulations with superior efficacy or safety profiles, especially in developed markets.

Mid to Long-term (4–8 years)

- Moderate Price Reduction: Proliferation of biosimilars and generics is expected to drive prices downward.

- Premium Pricing for Advanced Therapies: Biologics or targeted biologic-like agents could command higher prices, though their affordability may be limited to select patient populations.

- Market Disparity: Developed markets likely to see more stable pricing due to reimbursement schemes; emerging markets may witness continued price erosion and shifting of formulary preferences.

Impact of Technological Innovation

Introduction of novel formulations, including sustained-release topical agents or combination therapies that demonstrate improved outcomes, could sustain higher price points for certain products.

Emerging Trends and Their Influence on Pricing

Personalized Medicine

The move towards tailored therapies may lead to premium pricing for diagnostics and bespoke medication formulations.

Regulatory Incentives

Accelerated approval pathways and orphan drug designations could enable premium pricing for niche or breakthrough therapies.

Market Entry of Biosimilars and Generics

Expected to erode prices of high-cost systemic treatments (e.g., isotretinoin), especially post-patent expiry.

Strategic Implications for Stakeholders

- Pharmaceutical companies should optimize patent protections, invest in innovative formulations, and explore partnerships to sustain premium pricing.

- Payers and providers need to balance access with cost management, especially amid rising drug prices.

- Investors should monitor patent timelines, approval pipelines, and regional market expansions to anticipate price shifts.

Key Takeaways

- The acne medication market is poised for steady growth, driven by rising prevalence and innovation.

- Patent expirations and generic entry will exert downward pressure on prices in developed markets.

- Premium pricing will likely persist for innovative therapies demonstrating substantial clinical benefits.

- Emerging markets may experience more aggressive price reductions and increased OTC sales.

- Stakeholders must adapt to evolving regulatory landscapes and technological advances to optimize pricing strategies.

FAQs

1. What factors influence the pricing of acne medications?

Pricing is primarily affected by patent status, manufacturing costs, regulatory approvals, market competition, and regional reimbursement policies.

2. How will patent expirations impact the acne drug market?

Patent expirations typically lead to increased generic competition, reducing prices and expanding access but potentially impacting revenues for original branded drugs.

3. Are biologics being developed for acne treatment?

Biologics are under investigation for severe, refractory acne cases, and their high development costs suggest they will command premium prices upon approval.

4. What role do OTC acne medications play in market pricing?

OTC products offer affordable options, capturing significant market share, which exerts downward pressure on prescription drug prices.

5. How is innovation expected to influence future drug prices?

Innovative formulations or targeted biologic therapies that demonstrate superior efficacy may sustain higher price points, especially if they address unmet needs.

Sources:

[1] MarketWatch, "Global Acne Treatment Market Size, Share & Trends Analysis," 2022.

[2] American Academy of Dermatology Association, "Acne: Epidemiology and Treatment Trends," 2021.

More… ↓