Share This Page

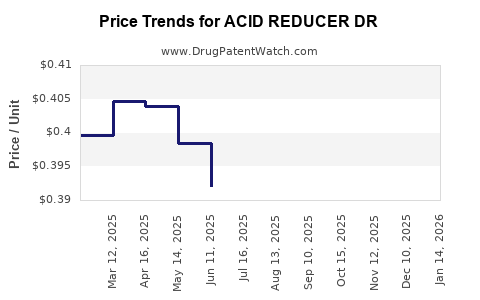

Drug Price Trends for ACID REDUCER DR

✉ Email this page to a colleague

Average Pharmacy Cost for ACID REDUCER DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ACID REDUCER DR 20 MG CAP | 70000-0232-03 | 0.39835 | EACH | 2025-12-17 |

| ACID REDUCER DR 20 MG CAP | 70000-0232-01 | 0.39835 | EACH | 2025-12-17 |

| ACID REDUCER DR 20 MG CAP | 70000-0232-02 | 0.39835 | EACH | 2025-12-17 |

| ACID REDUCER DR 20 MG CAP | 70000-0232-03 | 0.40334 | EACH | 2025-11-19 |

| ACID REDUCER DR 20 MG CAP | 70000-0232-01 | 0.40334 | EACH | 2025-11-19 |

| ACID REDUCER DR 20 MG CAP | 70000-0232-02 | 0.40334 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ACID REDUCER DR

Introduction

ACID REDUCER DR, a branded or generic pharmaceutical product targeting gastroesophageal reflux disease (GERD), peptic ulcers, and other acid-related disorders, occupies a significant segment within the gastrointestinal therapeutics market. This report analyzes current market dynamics, competitive landscape, regulatory environment, and future pricing projections, providing business professionals with actionable insights grounded in current industry data.

Market Overview

The global acid reducers market is driven by increasing prevalence of acid-related disorders, aging populations, and rising awareness regarding gastrointestinal health. According to Fortune Business Insights, the global gastroesophageal reflux disease (GERD) drugs market was valued at USD 13.9 billion in 2021 and is projected to grow at a CAGR of 3.8% through 2028 [1]. Acid reducers, primarily proton pump inhibitors (PPIs) like omeprazole and esomeprazole, and H2 receptor antagonists such as ranitidine, constitute a pivotal part of this sector.

ACID REDUCER DR competes within this landscape, targeting both prescription and over-the-counter (OTC) segments. Its positioning depends on its formulation efficacy, safety profile, pricing strategies, and regulatory approvals across major markets.

Regulatory and Patent Landscape Impact

Patent expirations have substantially shaped the market. For instance, patents on key PPIs like omeprazole expired in the early 2010s, ushering in a wave of generic equivalents and intense price competition [2]. Depending on its patent status, ACID REDUCER DR's pricing power varies:

- If patent-protected, it may command premium pricing.

- If generic, market prices tend to decline due to increased competition.

Regulatory approvals, especially FDA and EMA clearances, influence market access, with recent emphasis on safety profiles and potential off-label uses impacting value and pricing.

Competitive Landscape

The market features several domestic and international players:

- Market Leaders: AstraZeneca (Nexium), Pfizer (Prevacid), and Takeda (Dexilant) have historically dominated the PPI space.

- Generics and Store Brands: Nearly 80% of OTC acid reducers are generic or store brands, exerting downward pressure on pricing.

- Emerging Biologic Alternatives: Newer classes, like potassium-competitive acid blockers, threaten traditional PPIs' market share, influencing revenue forecasts.

ACID REDUCER DR's market share depends on its differentiation, efficacy, safety, and pricing strategies among competitors.

Current Pricing Landscape

Prescription Segment:

- The average wholesale price (AWP) for prescription PPIs ranges from USD 0.50 to USD 2.00 per pill, varying by molecule and dosage [3].

OTC Segment:

- OTC acid reducers retail at approximately USD 8–15 per pack (14 to 30 tablets), with significant price variability based on brand and formulation.

Impact of Generics:

- Generic versions reduce price points by 50-70%, incentivizing healthcare providers and consumers to opt for lower-cost options.

Pricing Strategies for ACID REDUCER DR:

- For a patent-protected drug, pricing could be set at a premium—USD 2–3 per pill.

- Once generic competition emerges, prices are likely to decline to USD 0.30–0.80 per pill.

Market Trends Influencing Price Projections

-

Patent Expiration and Generic Entry:

The expiration timeline critically influences future price trajectories. A patent expiry within the next 2-3 years could result in a steep price decline, aligning with generic market trends.

-

Regulatory Developments:

The FDA’s recent focus on drug safety, especially concerning PPI-related adverse events, may affect pricing if contraindications or warnings are added, impacting market acceptance and cost.

-

Market Penetration in Emerging Economies:

Growing healthcare expenditure and increasing prevalence of acid disorders in countries like China and India will expand market size, potentially supporting higher prices in these regions.

-

Shift Toward OTC Availability:

Incremental moves toward OTC status can propel volume sales but typically suppress unit prices in the retail channel.

-

Therapeutic Innovation:

The advent of novel acid suppression therapies (e.g., vonoprazan) may exert downward pressure on traditional PPI pricing, emphasizing the importance of early market positioning.

Price Projections (2023–2028)

| Year | Prescription Segment ($/pill) | OTC Segment ($/pack) | Comments |

|---|---|---|---|

| 2023 | 1.50 – 2.50 | 10 – 15 | Steady with patent protections; premium pricing during exclusivity period. |

| 2024–2025 | 0.80 – 1.20* | 8 – 12* | Post-patent expiry; entry of generics drives prices downward. |

| 2026–2028 | 0.30 – 0.80* | 6 – 10 | Market stabilization with dominant generics; potential for niche premium for formulations with improved safety. |

*Note: These projections assume standard patent expiry timelines and generic market responses consistent with historical trends.

Strategic Considerations for Stakeholders

- Brand Differentiation: Investing in formulation improvements and safety profiles can justify premium pricing even amidst generic competition.

- Pricing Flexibility: Emphasizing volume growth through OTC and international markets can offset reduced per-unit margins.

- Regulatory Monitoring: Staying ahead of regulatory changes ensures competitive pricing strategies, especially if safety warnings impact consumer acceptance.

- Market Expansion: Targeting emerging economies with tailored pricing models can sustain growth amid competitive pressures.

Key Takeaways

- Patent Status Is Crucial: Protected status allows premium pricing; imminent patent expirations will likely lead to substantial price declines.

- Market Competition Is Intense: The proliferation of generics significantly reduces per-unit price, especially in mature markets.

- Emerging Markets Offer Growth Opportunities: Tailored strategies in developing regions can support revenue streams despite global price pressures.

- Regulatory Developments Influence Pricing: Changes in safety testing and approval standards can either bolster or diminish market value.

- Innovation Maintains Premium Positioning: Formulation improvements or novel delivery mechanisms can sustain higher prices even in competitive environments.

FAQs

1. When is ACID REDUCER DR likely to face patent expiration, and how will that impact pricing?

Patent expiration typically occurs within 2–4 years post-launch. Upon expiry, generic manufacturers enter the market, often reducing prices by 50–70%. This transition can diminish ACID REDUCER DR's profitability unless it maintains differentiation through formulation, safety, or brand strength.

2. How does the rise of OTC acid reducers influence market dynamics?

OTC availability increases accessibility and volume sales but exerts downward pressure on unit prices. It shifts revenue emphasis from high-margin prescriptions to volume-driven OTC sales, affecting overall pricing strategies.

3. What are the risks of regulatory changes affecting ACID REDUCER DR’s price?

Safety warnings, new contraindications, or label restrictions can reduce a drug’s appeal, leading to price reductions or formulary exclusions. Keeping abreast of regulatory trends is critical for maintaining market share at optimal pricing.

4. In which emerging markets can ACID REDUCER DR realize higher price premiums?

Countries with rising GERD prevalence, such as China, India, and Southeast Asian nations, offer growth opportunities. Pricing strategies tailored to local economic contexts, along with partnerships, can maximize revenues.

5. How will innovations like potassium-competitive acid blockers impact the PPI market?

These novel therapies could replace traditional PPIs, encouraging a price war and pressuring existing acid reducer prices. Strategic innovation and early adoption are key to sustaining premium pricing in evolving markets.

References

[1] Fortune Business Insights, "Gastroesophageal Reflux Disease (GERD) Drugs Market Size, Share & Industry Analysis," 2022.

[2] U.S. Food and Drug Administration, "Drug Patent Expirations," 2021.

[3] RedBook Online, "Average Wholesale Prices for Gastrointestinal Drugs," 2022.

More… ↓