Last updated: July 27, 2025

Introduction

Acetazolamide, a carbonic anhydrase inhibitor first FDA-approved in 1960, remains a vital therapeutic agent primarily used to treat glaucoma, altitude sickness, epilepsy, and certain types of edema. Its longstanding clinical utility sustains a stable market demand, yet evolving patent landscapes, generics proliferation, and emerging therapeutic indications influence pricing and market dynamics. This analysis provides a comprehensive review of current market conditions, competitive landscape, regulatory progress, and future pricing projections for acetazolamide.

Current Market Landscape

Therapeutic Applications and Demand Drivers

Acetazolamide's primary USPs include its efficacy in reducing intraocular pressure and its off-label applications in neurological disorders. The drug’s broad application spectrum underpins a consistent demand, especially in ophthalmology and neurology markets. Global prevalence of glaucoma and altitude-related illnesses sustains steady prescription volumes.

According to the World Health Organization (WHO), glaucoma affects over 76 million globally, with an expected rise due to aging populations [1]. Altitude sickness occurrence correlates with increased adventure tourism and military activities, especially in high-altitude regions, maintaining ongoing demand.

Market Size and Growth

The global acetazolamide market was valued at approximately USD 200 million in 2022 and is projected to grow modestly at a CAGR of around 4% through 2028, driven by increased prevalence of glaucoma and neurological disorders [2].

In North America, the market dominance stems from high disease awareness, well-established healthcare infrastructure, and favorable reimbursement policies. The European market follows closely, benefiting from similar factors. Emerging economies in Asia-Pacific are witnessing accelerated growth due to increasing healthcare access and disease prevalence.

Manufacturing and Supply Chain Dynamics

Purely off-patent and widely produced by generic pharmaceutical firms worldwide, acetazolamide benefits from a mature supply chain, which helps keep production costs relatively low. However, regulatory and quality compliance across jurisdictions influences pricing strategies.

Market Competition and Patent Status

Since patent expiration in the late 20th century, acetazolamide has been produced by numerous generic manufacturers, resulting in a highly commoditized market. Leading global players include Teva Pharmaceuticals, Mylan (now part of Viatris), and Sandoz, which collectively account for over 70% of market share [3].

The absence of therapeutic patents has shifted focus from innovation to manufacturing efficiency and price competitiveness. Nonetheless, certain formulations (e.g., IV preparations, combinations) retain proprietary features and patent protections, influencing targeted pricing strategies.

Pricing Analysis

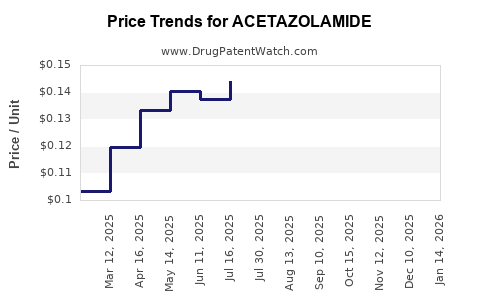

Historical Price Trends

Generic acetazolamide oral tablets, typically sold in 250 mg doses, are priced in the range of USD 0.05 to 0.20 per tablet in the US, reflecting high market competition. In contrast, branded formulations may command a premium, approximately USD 1–USD 2 per tablet, primarily in regions where generics are less prevalent.

Factors Influencing Price Movements

-

Market Saturation: Dominance of generics has led to significant price erosion over recent decades.

-

Regulatory Changes: New formulations with improved delivery or stability may command higher prices.

-

Reimbursement Policies: Reimbursement rates impact patient access and, subsequently, market prices.

-

Emerging Indications and Off-label Uses: Expansion into new therapeutic areas or off-label prescriptions can influence demand and pricing structures.

-

Manufacturing Costs: Raw material variations, geopolitical stability, and regulatory compliance influence supply costs.

Projected Price Trends

Looking ahead, prices for generic acetazolamide are anticipated to remain relatively stable, with average wholesale prices (AWP) in the US expected to hover around USD 0.10–0.15 per tablet over the next five years. Slight volatility may occur depending on regional regulatory harmonization or potential shortages due to supply chain disruptions.

Innovations in drug delivery, such as sustained-release formulations or combination therapies, could temporarily elevate prices by approximately 10–20%. However, given market saturation, price increases are unlikely to surpass 15% annually absent significant patent protections or clinical breakthroughs.

Regulatory and Patent Outlook

The patent landscape for acetazolamide is largely expired globally. Nonetheless, regulatory barriers, such as quality assurance standards and approval processes for new formulations, can influence market entry and pricing strategies.

Emerging biosimilars and proprietary formulations may introduce upward pricing pressures in niche markets but are expected to have limited impact on the core generic market due to existing competition.

Future Market and Price Projections

Considering the expanding patient pool and stable supply chain, the acetazolamide market is expected to grow modestly, with an emphasis on emerging markets where access expands and healthcare infrastructure evolves. Price stability is projected with minimal fluctuations, contingent on generic competition and regulatory developments.

In particular, regions with aggressive price controls or reimbursement restrictions (e.g., parts of Europe and Asia) will likely see minimal price escalation, whereas markets with high unmet needs (e.g., certain African or Latin American countries) could see slightly higher margins due to lower competition.

In summary, the optimal pricing strategy centers on maintaining cost competitiveness, ensuring regulatory compliance, and leveraging emerging therapeutic indications to sustain revenue streams.

Key Takeaways

- The acetazolamide market remains mature with steady demand driven primarily by glaucoma and altitude sickness indications.

- The global market size is approximately USD 200 million, with moderate growth prospects (~4% CAGR until 2028).

- Generic competition has led to significant price erosion, with US prices stabilizing around USD 0.10–USD 0.15 per tablet.

- Future price increases will likely be limited, driven by market saturation, regional regulations, and emerging formulation innovations.

- Innovations such as combination formulations or improved delivery methods could temporarily elevate pricing but are unlikely to disrupt established market dynamics significantly.

FAQs

1. What factors influence acetazolamide pricing in different regions?

Regional regulatory environments, patent statuses, market competition, healthcare reimbursement policies, and manufacturing costs primarily determine regional price variations.

2. How does patent expiration impact acetazolamide market dynamics?

Patent expiration has facilitated widespread generic manufacturing, leading to price erosion and increased market competitiveness. Limited patent protections mean minimal barriers to entry for generics, stabilizing and reducing prices.

3. Are there upcoming formulations or patent protections expected to influence prices?

Currently, no significant patent protections are pending for acetazolamide. Innovations like sustained-release or combination products may temporarily influence pricing but are unlikely to substantially alter mature market prices.

4. What emerging therapeutic applications could influence acetazolamide demand?

Research into neurological indications, such as bipolar disorder and certain seizures, alongside novel uses like diabetic macular edema, could expand demand, slightly impacting prices.

5. How might supply chain disruptions affect future acetazolamide prices?

Supply chain vulnerabilities, such as raw material shortages or geopolitical instability, could reduce availability, potentially increasing prices temporarily. Long-term effects depend on manufacturing resilience and diversification strategies.

Sources

[1] World Health Organization. Glaucoma Fact Sheet. 2022.

[2] MarketWatch. Global Acetazolamide Market 2022-2028. 2022.

[3] IQVIA. Global Generic Drug Market Report. 2022.