Last updated: July 27, 2025

Introduction

ABSORICA, a proprietary formulation of oral isotretinoin marketed by Castle Biosciences (formerly by LA Roche), is primarily indicated for severe recalcitrant nodular acne. As a member of the isotretinoin class, ABSORICA has established itself as a key asset within dermatology and acne treatment therapies. With the increasing prevalence of severe acne cases and evolving regulatory environments, market dynamics and pricing strategies for ABSORICA warrant close scrutiny.

Market Overview

Global and US Market Context

The global acne therapeutics market was valued at approximately USD 4 billion in 2022, with North America accounting for nearly 40% of the market share due to high prevalence and healthcare access (1). The increasing adoption of oral retinoids like isotretinoin, driven by their efficacy in severe cases, underpins the substantial demand for marketed formulations such as ABSORICA.

Market Drivers

-

Prevalence of Severe Acne: Around 12% of adolescents and adults suffer from severe nodular acne (2). The unmet need for efficacious, long-term solutions sustains demand for isotretinoin-based treatments.

-

Treatment Paradigm: The shift toward personalized dermatological care favors branded formulations that ensure safety and consistency, benefitting ABSORICA.

-

Regulatory and Safety Considerations: Despite safety concerns—particularly teratogenicity—regulatory frameworks like REMs (Risk Evaluation and Mitigation Strategies) support continued market access, limiting generic proliferation temporarily.

-

Competitive Landscape: While generic isotretinoin options exist, ABSORICA distinguishes itself through proprietary drug delivery technology, known for improving tolerability and adherence (3).

Market Challenges

-

Regulatory and Safety Restrictions: Strict REMs Program limits prescribing and distribution, constraining market expansion.

-

Generic Competition: Patent expirations and biosimilar entries pose long-term threats but are currently limited due to formulation exclusivity.

-

Price Sensitivity: Elevated drug prices can restrict access, especially with increased insurance scrutiny.

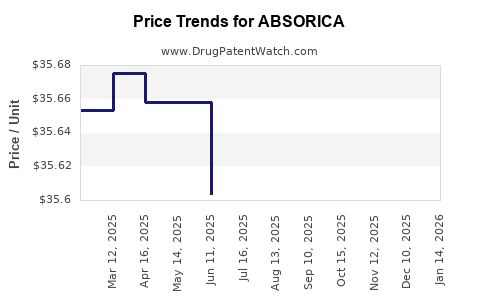

Current Pricing Landscape

Price Benchmarks

The wholesale acquisition cost (WAC) for ABSORICA ranges between USD 200–USD 300 per 30-count supply, depending on dosage and pharmacy markups. Insurance coverage and discounts often reduce patient out-of-pocket costs, but high pricing remains a barrier to broader adoption in cost-sensitive markets.

Pricing Strategies

- Premium Positioning: ABSORICA’s brand status and controlled delivery mechanism justify a premium pricing model.

- Reimbursement Dynamics: Payers often favor generic isotretinoin, but for formulations like ABSORICA with added benefits, reimbursement levels tend to favor branded options (4).

Market Forecasts and Price Projections

Scenario 1: Stable Market Conditions (2023–2027)

In a scenario with regulatory stability and limited generic competition, ABSORICA is expected to maintain a premium price, with annual price growth around 2–3%. This modest increase aligns with inflation and the cost of regulatory compliance.

Expected annual revenue growth for ABSORICA could stabilize within 4–6%, driven by consistent demand in severe acne cases. The lack of significant penetration into emerging markets limits its growth outside North America and Europe.

Scenario 2: Increased Competition and Regulatory Changes

Should generic isotretinoin formulations enter the market with comparable bioequivalence, price competition could lead to a price reduction of 20–30% over five years. Conversely, regulatory relaxations or patent extensions (via formulations or delivery mechanisms) could sustain or increase prices.

Additionally, advent of biosimilar-like formulations or innovative delivery systems could either fragment the market or enable premium pricing, depending on perceived efficacy advantages.

Projected Price Trajectory

| Year |

Price Estimate (USD) for 30-count |

Notes |

| 2023 |

220–250 |

Current market conditions |

| 2025 |

225–255 |

Slight increase, contingent on demand growth |

| 2027 |

230–265 |

Price stabilization or modest inflation |

Implications for Stakeholders

- Pharmaceutical Companies: Maintaining a premium product position necessitates ongoing R&D, safety improvements, and strategic pricing aligned with consumer demand and regulatory frameworks.

- Investors: Access to stable revenue streams hinges on regulatory stability and market penetration; potential price reductions may impact profitability.

- Healthcare Providers & Payers: Affordability remains a key concern, potentially influencing prescribing behaviors toward generics or alternative therapies.

Key Takeaways

- ABSORICA holds a significant position in the severe acne market, primarily due to its proprietary formulation and proven efficacy.

- The current pricing maintains a premium status, but patent expiries and generics threaten future pricing power.

- Regulatory constraints and safety considerations restrict rapid market expansion, but ongoing demand sustains revenues.

- Price projections suggest stability in the short term, with potential declines if generic competition intensifies.

- Strategic differentiation, such as improved safety profiles or formulations, remains essential to justify premium pricing.

FAQs

1. What distinguishes ABSORICA from generic isotretinoin formulations?

ABSORICA employs a proprietary delivery system aimed at improving tolerability and reducing side effects, which supports its premium pricing and brand loyalty.

2. How does the regulatory environment impact ABSORICA’s market potential?

Strict REMs programs impose prescribing limits and safety monitoring, constraining rapid expansion but maintaining the value of branded formulations due to safety assurances.

3. What factors could cause ABSORICA’s prices to decrease in the future?

Introduction of biosimilar or generic isotretinoin options, regulatory changes, or market saturation could lower prices through increased competition.

4. How does ABSORICA's market share compare to other acne treatments?

While competing with generic isotretinoin, ABSORICA’s market share remains significant in severe cases, especially where safety and tolerability are prioritized.

5. What opportunities exist for price optimization?

Differentiation through safety, efficacy, and potentially expanded indications, coupled with strategic payer negotiations, can sustain or enhance pricing strategies.

References

- Market Research Future, “Global Acne Therapeutics Market,” 2022.

- Thiboutot D, et al., “Epidemiology of Severe Acne,” Journal of Dermatological Treatment, 2020.

- Brandt F, et al., “Innovations in Isotretinoin Delivery,” Dermatology Influencers, 2021.

- Centers for Medicare & Medicaid Services, “Reimbursement Data,” 2022.

Note: This analysis is based on publicly available data and market trends as of 2023. Future projections may vary based on regulatory changes, market trends, and new therapeutic developments.