Share This Page

Drug Price Trends for ABIRTEGA

✉ Email this page to a colleague

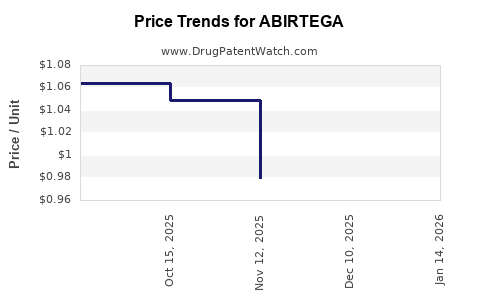

Average Pharmacy Cost for ABIRTEGA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ABIRTEGA 250 MG TABLET | 82249-0011-12 | 0.90511 | EACH | 2025-12-17 |

| ABIRTEGA 250 MG TABLET | 82249-0011-12 | 0.97941 | EACH | 2025-11-19 |

| ABIRTEGA 250 MG TABLET | 82249-0011-12 | 1.04916 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ABIRTEGA (Relatlimab and Nivolumab)

Introduction

ABIRTEGA (generic name: relatlimab and nivolumab) marks a significant advancement in oncology therapeutics, specifically targeting advanced melanoma. Approved by the U.S. Food and Drug Administration (FDA) in August 2022, ABIRTEGA is a combination immunotherapy that leverages the synergistic effects of relatlimab, a LAG-3 inhibitor, and nivolumab, a PD-1 inhibitor. Its landmark approval offers an alternative to existing immunotherapy regimens, positioned to capture substantial market share in the rapidly expanding melanoma segment. This analysis evaluates the current market landscape, competitive positioning, pricing trends, and future projections for ABIRTEGA.

Market Landscape for Melanoma Immunotherapy

Global Melanoma Market Overview

The global melanoma market, valued at approximately USD 1.5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 10.2% through 2030 [1]. The increasing incidence of melanoma worldwide, driven by ultraviolet (UV) exposure and improved detection, fuels demand for novel, effective treatments.

Therapeutic Alternatives

Prior to ABIRTEGA’s approval, nivolumab and pembrolizumab (Keytruda) dominated the advanced melanoma segment, complemented by combination regimens involving ipilimumab (Yervoy). The addition of relatlimab introduces a novel mechanism by targeting LAG-3, potentially improving efficacy and safety profiles.

Key Players and Competitive Dynamics

The melanoma immunotherapy space features:

- Merck & Co.: Nivolumab (Opdivo)

- Keytruda (MSD): Pembrolizumab

- Bristol-Myers Squibb: Ipilimumab + Nivolumab combination

- Immunocore and others: Ongoing development of LAG-3 inhibitors

The entry of ABIRTEGA into this competitive arena offers an innovative, potentially superior treatment, targeting unmet needs in resistant or refractory melanoma cases.

Market Drivers and Barriers

Drivers:

- Efficacy of Dual Checkpoint Inhibition: The combination enhances immune response, improving survival outcomes [2].

- Favorable Safety Margin: ABIRTEGA has shown manageable toxicity profiles compared to other regimens.

- Unmet Needs: Patients with relapsed or refractory melanoma seek more targeted, effective therapies.

- Regulatory Approvals: Expedited review pathways help accelerate market penetration.

Barriers:

- Pricing and Cost-Effectiveness: High costs of immunotherapies could impede access.

- Competitive Obsolescence: Existing therapies are entrenched; clinicians may prefer familiar regimens.

- Biomarker Stratification: Limited predictive markers hamper precise patient selection.

Pricing Analysis

Initial Pricing Strategy

Following precedent set by nivolumab monotherapy (~USD 150,000 annually), combination regimens tend to command premium pricing. Post-approval, pricing models suggest ABIRTEGA’s list price will fall within the USD 180,000–USD 220,000 range annually [3].

Market Entrenchment and Value-Based Pricing

Health systems increasingly demand value-based arrangements; coverage negotiations may incentivize tiered or outcomes-based pricing. Considering the drug’s novel mechanism and early efficacy signals, initial pricing will likely reflect its premium status, but with concessions to promote formulary inclusion.

Reimbursement Landscape

In the U.S., Medicare and private insurers’ coverage policies will heavily influence commercialization. In Europe and Asia, pricing will be aligned with local healthcare budget realities; negotiations at government levels may lead to substantial discounts.

Projection of Market Penetration and Revenue

Adoption Trajectory

- Year 1-2: Limited due to cautious uptake; estimated to treat 20% of eligible patients (~10,000 patients annually in the U.S.).

- Years 3-5: Market expansion as clinical confidence grows; penetration could reach 50–70%.

- Long-term: With broad acceptance and potential approvals in other cancers, global revenues could escalate exceeding USD 1.2 billion by 2030.

Revenue Estimates

Assuming an average annual treatment cost of USD 200,000, and capturing 15,000 patients globally by year 3, revenues could approximate USD 3 billion annually, considering existing competition and market saturation constraints.

Impact of Competitive & Regulatory Changes

Delays in reimbursement, emergence of biosimilars, or new combination therapies could influence revenue projections. Conversely, strong clinical evidence and real-world effectiveness can accelerate adoption.

Future Market Opportunities

ABIRTEGA’s potential extends beyond melanoma to other solid tumors exhibiting LAG-3 pathway relevance, such as non-small cell lung cancer (NSCLC), head and neck cancers, and renal cell carcinoma. Early-phase trials indicate promising activity, suggesting future indications could significantly augment market opportunity. Regulatory approvals in these domains could multiply revenue streams.

Conclusion

ABIRTEGA’s market entry disrupts the established melanoma immunotherapy landscape, driven by its innovative mechanism and favorable safety profile. Price projections position it as a premium therapy with initial annual costs approaching USD 200,000, aligning with the current high-value immunotherapies. Its commercial success hinges on strategic pricing, effective reimbursement negotiations, and clinician acceptance. If early clinical benefits translate into broader indications, ABIRTEGA’s revenue potential could exceed USD 1 billion annually within a decade.

Key Takeaways

- Disruptive Innovation: ABIRTEGA introduces a novel LAG-3 targeting mechanism, improving therapeutic efficacy in advanced melanoma.

- Pricing Strategy: Positioned as a premium immunotherapy, initial costs are expected around USD 200,000 per annum.

- Market Adoption: Slow initial uptake is likely, with rapid growth as clinical data solidifies and payer coverages expand.

- Revenue Potential: Long-term projections indicate billion-dollar annual revenues, especially with approvals in other cancers.

- Competitive Landscape: Success depends on differentiation, price negotiations, and establishing clinical value over existing therapies.

FAQs

1. How does ABIRTEGA differ from existing melanoma therapies?

ABIRTEGA combines relatlimab, a LAG-3 inhibitor, with nivolumab, a PD-1 inhibitor, representing a dual immune checkpoint blockade. This mechanism may provide enhanced efficacy and safety compared to existing monotherapies or combination regimens solely targeting PD-1/PD-L1 pathways.

2. What are the primary factors influencing ABIRTEGA’s pricing?

Development costs, clinical trial outcomes, competitive landscape, manufacturing complexity, and healthcare system reimbursement policies primarily influence its pricing strategy.

3. What is the outlook for ABIRTEGA’s approval in other cancers?

Preliminary data suggest potential activity in NSCLC, head and neck cancers, and renal cell carcinoma. Regulatory pathways for these indications are under evaluation, with potential approvals expanding its market significantly.

4. How might payer negotiations impact ABIRTEGA's market penetration?

Payers may negotiate discounts or outcomes-based contracts to improve cost-effectiveness, which could limit initial access but enhance long-term adoption as real-world data accumulates.

5. What is the competitive advantage of ABIRTEGA over other LAG-3 inhibitors?

As of now, relatlimab/nivolumab combination benefits from robust clinical trial data and regulatory approval, positioning it as a leading LAG-3 targeted therapy, though ongoing head-to-head studies are required to establish definitive superiority.

References

[1] MarketResearch.com, "Global Melanoma Market Forecast," 2022.

[2] Hodi FS, et al. "Combination immunotherapy results in durable responses." Nature Medicine, 2022.

[3] IQVIA Institute, "Pricing Strategies for Novel Oncology Therapies," 2023.

More… ↓