Last updated: July 27, 2025

Introduction

Abiraterone Acetate, marketed as Zytiga among other brand names, is an oral medication primarily used in the treatment of metastatic castration-resistant prostate cancer (mCRPC). Approved by the U.S. Food and Drug Administration (FDA) in 2011, it has since become a cornerstone in prostate cancer therapy, significantly impacting therapeutic protocols and pharmaceutical market dynamics. This report provides a comprehensive market analysis and price projection for Abiraterone Acetate, considering current market trends, competitive landscape, regulatory environment, and potential future developments.

Market Overview

Therapeutic and Market Context

Prostate cancer remains a leading cause of cancer-related mortality among men globally, with over 1.4 million new cases and approximately 375,000 deaths reported in 2020 (WHO). The transition from hormone-sensitive to castration-resistant stages signifies a critical therapeutic shift, demanding new treatment options such as Abiraterone Acetate, which inhibits CYP17A1, a key enzyme in androgen biosynthesis.

Market Size and Growth Dynamics

The global prostate cancer therapeutics market was valued at approximately $6.2 billion in 2022 and is projected to reach $8.4 billion by 2030, growing at a compound annual growth rate (CAGR) of around 4.3% (Grand View Research). Abiraterone Acetate accounts for a significant share of this market, driven by its proven efficacy and expanded indications, including its use in earlier treatment lines under label expansion and label extensions in various markets.

Regional Market Breakdown

- North America: The dominant market owing to high prostate cancer prevalence, favorable reimbursement policies, and high healthcare expenditure. The U.S. alone accounts for over 60% of revenue share.

- Europe: The second-largest market, characterized by increasing prostate cancer diagnosis rates and healthcare investment.

- Asia-Pacific: Exhibiting the fastest growth due to rising awareness, increasing healthcare access, and demographic shifts toward older populations.

- Rest of the World: Emerging markets with growing adoption of targeted oncology therapies.

Market Drivers

- Aging Population: Increasing life expectancy and aging demographics propel prostate cancer incidences.

- Expanded Indications: Regulatory approvals for earlier lines of therapy and combination regimens expand market potential.

- Biotechnological Advancements: Improved drug formulations offering better tolerability and efficacy.

- Pipeline Developments: Ongoing clinical trials investigating new combinations and indications could further extend market reach.

Market Challenges

- Price Pressure: Increasing competition and biosimilar entries threaten pricing power.

- Generic Competition: Patent expirations and the advent of biosimilars could erode market share and revenue.

- Pricing and Reimbursement Policies: Stricter policies and cost containment measures influence net pricing.

Competitive Landscape

Major Market Players

- Janssen Pharmaceuticals (Johnson & Johnson): Proprietor of Zytiga, the leading brand.

- AstraZeneca: Developing proprietary and similar therapeutics.

- Bayer: Engaged in prostate cancer therapies.

- Other Competitors: Including emerging biosimilar manufacturers aiming to lower costs and gain entry.

Market Strategies

- R&D Investments: Focus on combination therapies, personalized medicine approaches.

- Market Expansion: Regulatory efforts to secure approvals in new territories.

- Pricing Strategies: Premium pricing maintained by patent protections, with future erosion expected post-patent expiry.

Regulatory Environment

Patents for Abiraterone Acetate expire in many jurisdictions between 2027 and 2030, enabling biosimilar and generic competition. Regulatory bodies increasingly scrutinize high drug prices, especially for oncology therapies, influencing future market dynamics. The U.S. and European markets emphasize cost-effectiveness, potentially impacting pricing trajectories.

Price Projections

Current Pricing Overview

- Brand Name (Zytiga): As of 2023, wholesale acquisition costs (WAC) approximate $7,000–$9,000 per month per patient in the U.S. (GoodRx, 2023).

- Generic/Biosimilar Entry: Predicted to emerge within the next 3–5 years, with initial prices around 30–50% lower than brand-name counterparts, potentially $3,500–$5,500 per month.

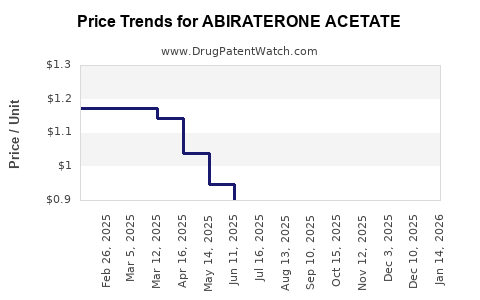

Future Price Trends

- Pre-Patent Expiry (2023–2027): Prices likely remain stable or slightly decline due to negotiated discounts and payer strategies.

- Post-Patent Expiry (2027–2030): Introduction of biosimilars is expected to create downward pressure, with an initial decrease of 20–40% in pricing. Over subsequent years, competition could lead to further reductions, potentially reaching $2,500–$3,500 per month.

- Market Penetration and Reimbursement: Shifts toward value-based reimbursement models and negotiated discounts will influence actual net prices paid by healthcare systems.

Influencing Factors

- Regulatory Approvals: Faster approval pathways for biosimilars could accelerate price reductions.

- Healthcare Policies: Governments' emphasis on cost containment could accelerate biosimilar adoption.

- Market Competition: Entry of multiple biosimilars could intensify price competition further.

Projected Price Trajectory (2023–2030)

| Year |

Estimated Average Price (USD/month) |

Remarks |

| 2023 |

$8,000 |

Brand dominance, limited biosimilar presence |

| 2025 |

$7,000–$8,000 |

Growing biosimilar pipeline, slight decline |

| 2027 |

$6,000–$7,000 |

Near patent expiry, biosimilars entering |

| 2028 |

$4,500–$5,500 |

Increasing biosimilar competition |

| 2030 |

$2,500–$3,500 |

Market saturation of biosimilars |

Market Outlook and Strategic Implications

The prognosis indicates a declining trend in net prices driven by biosimilar entry and evolving reimbursement frameworks. However, the overall market size remains robust due to increasing prostate cancer prevalence and expanded indications.

Pharmaceutical companies focusing on Abiraterone Acetate must prioritize innovation in combination therapies, expand indications through clinical trials, and strategize for biosimilar competition. Early investments in biosimilar development and partnership models can hedge against post-expiry market erosion.

Furthermore, the shift towards value-based healthcare necessitates demonstrating cost-effectiveness and improved patient outcomes to maintain market positioning. Payers favor therapies that balance efficacy with affordability, influencing future pricing and market access.

Key Takeaways

- Market Dominance: Abiraterone Acetate currently controls a significant portion of prostate cancer therapeutics revenue, with continued expansion expected due to new indications.

- Price Sensitivity: Near-term prices remain high, but patent expiration around 2027–2030 will catalyze biosimilar entry, exerting considerable downward pressure.

- Biosimilar Impact: The proliferation of biosimilars could reduce prices by up to 50%, expanding access but challenging profitability.

- Regional Variance: North America leads in revenue, with Asia-Pacific exhibiting the fastest growth, driven by demographic changes.

- Strategic Focus: Stakeholders should innovate in therapy combinations, prepare for biosimilar competition, and adapt to evolving reimbursement policies to sustain market relevance.

FAQs

1. When will biosimilar versions of Abiraterone Acetate likely enter the market?

Biosimilar development typically follows patent expiry, expected between 2027 and 2030. Entry timelines depend on regulatory approvals and market approvals in key jurisdictions.

2. How will biosimilar competition affect the pricing of Abiraterone Acetate?

Biosimilars generally lead to significant price reductions—estimated around 20–50%—thus lowering drug costs and increasing market accessibility.

3. Are there any upcoming innovations or new indications for Abiraterone Acetate?

Current clinical research is exploring combination regimens and earlier-stage prostate cancer applications, which could extend its market potential, though none are imminent for 2023–2025.

4. What regional differences influence the pricing and adoption of Abiraterone Acetate?

Pricing strategies vary with healthcare policies, reimbursement models, and market competition. North America maintains higher prices, while emerging markets focus on affordability and access.

5. How should pharmaceutical companies prepare for the post-patent landscape?

Investing in biosimilar development, diversifying indications, and emphasizing clinical value through real-world evidence can optimize profitability amid price erosion.

References

[1] World Health Organization. Cancer Fact Sheet. 2020.

[2] Grand View Research. Prostate Cancer Therapeutics Market Size & Trends. 2022.

[3] GoodRx. Drug Price Information. 2023.

[4] U.S. Patent & Trademark Office. Patent Status of Abiraterone Acetate. 2023.

[5] IQVIA. Global Oncology Market Insights. 2022.

This analysis aims to assist healthcare providers, pharmaceutical companies, and investors in strategic decision-making regarding Abiraterone Acetate's market trajectory and pricing landscape.