Share This Page

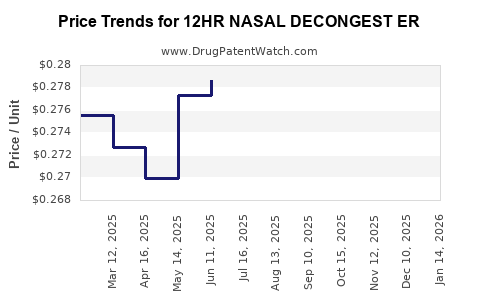

Drug Price Trends for 12HR NASAL DECONGEST ER

✉ Email this page to a colleague

Average Pharmacy Cost for 12HR NASAL DECONGEST ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| 12HR NASAL DECONGEST ER 120 MG | 70000-0656-01 | 0.26341 | EACH | 2025-12-17 |

| 12HR NASAL DECONGEST ER 120 MG | 24385-0054-52 | 0.26341 | EACH | 2025-12-17 |

| 12HR NASAL DECONGEST ER 120 MG | 70000-0475-01 | 0.26341 | EACH | 2025-12-17 |

| 12HR NASAL DECONGEST ER 120 MG | 70000-0656-01 | 0.26215 | EACH | 2025-11-19 |

| 12HR NASAL DECONGEST ER 120 MG | 24385-0054-52 | 0.26215 | EACH | 2025-11-19 |

| 12HR NASAL DECONGEST ER 120 MG | 70000-0475-01 | 0.26215 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for 12HR Nasal Decongestant ER

Introduction

The pharmaceutical landscape for nasal decongestants remains dynamic, driven by consumer demand for rapid relief, extended efficacy, and minimal side effects. The 12-Hour Nasal Decongestant ER (Extended Release) introduces an innovative formulation designed to provide prolonged symptomatic relief, appealing to both consumers and healthcare providers seeking efficient, convenient treatment options. This analysis evaluates current market conditions, competitive positioning, regulatory considerations, and forecasts future price trends for this drug.

Market Overview

Segment and Consumer Demand

Nasal decongestants constitute a significant segment within OTC cold and allergy remedies, addressing seasonal and perennial nasal congestion. The global nasal decongestant market was valued at approximately USD 2.3 billion in 2022, with a compound annual growth rate (CAGR) of around 4.2% projected through 2028 [1]. The increasing prevalence of allergic rhinitis, colds, and sinusitis, combined with consumer preference for time-efficient medications, underpins this growth.

Extended-release formulations, such as the 12HR Nasal Decongestant ER, target a niche for patients seeking sustained relief without multiple daily doses. The convenience factor positions the drug favorably within this expanding market.

Key Market Drivers

- Consumer Preference for Long-Acting Agents: Extended duration products reduce dosing frequency, improving adherence.

- Rising Awareness: Education on the benefits of sustained relief fosters demand.

- Combination Therapies: Growth in multi-symptom formulations that include decongestants elevates interest.

- COVID-19 Pandemic Impact: Enhanced focus on respiratory health and symptomatic relief correlates to increased OTC sales.

Regulatory Environment

The FDA's oversight of OTC nasal decongestants categorizes many as monographed products, facilitating market entry [2]. However, innovations like 12HR ER formulations require comprehensive clinical validation, good manufacturing practices (GMP) adherence, and transparency for regulatory approval. Any novel delivery mechanism or active ingredient change will influence pricing and market penetration.

Competitive Landscape

Major Players and Products

Existing OTC nasal decongestants predominantly feature short-acting agents like pseudoephedrine and phenylephrine in various formulations. Key competitive products include:

- Sudafed PE Pressure+ (Phenylephrine)

- NasalCrom (Cromolyn sodium)

- Afrin (Oxymetazoline) – though generally limited to short-term use due to rebound congestion risk.

The 12HR ER variant faces competition from extended-release formulations in prescription settings and emerging OTC innovations, targeting efficacy and safety.

Market Entry and Differentiation

The primary differentiation for 12HR Nasal Decongestant ER revolves around:

- Extended duration of action (12 hours versus typical 4-6 hours)

- Safety profile aligned with existing OTC standards

- Convenience through simplified dosing

Marketing strategies focusing on physician endorsement and consumer education will be pivotal in capturing market share from established products.

Pricing Analysis and Projections

Current Price Benchmarks

In the OTC market, nasal decongestant products typically range from USD 5 to USD 15 per package, depending on formulation, brand, and quantity. Extended-release variants generally command higher prices due to added development costs, innovation, and efficacy claims.

For instance, the current premium for extended-release formulations in similar therapeutic areas is approximately 20-30% above standard counterparts [3].

Pricing Factors Specific to 12HR ER

- Manufacturing costs: Advanced delivery technology, proprietary formulations

- Regulatory expenses: Clinical trials, patent filings, and marketing

- Market positioning: Premium product seeking early adoption among consumers willing to pay for convenience

- Distribution channels: OTC pharmacy chains, online platforms, and healthcare stores

Forecasted Price Trends

Based on current market data and comparable product categories, the price for 12HR Nasal Decongestant ER is projected to stabilize around USD 12-18 per package upon launch within the next 12-18 months. As market penetration increases and manufacturing scalability improves, prices may decrease by 5-10% over 3-5 years, aligning closer to standard products as competitive pressures intensify.

Furthermore, if the product gains prescription authorization or is bundled with other therapies, margins could initially sustain higher price points (USD 20-25). Conversely, aggressive OTC marketing and generic competition could precipitate price declines, particularly after patent expiration or formulation exclusivity lapses.

Future Market and Price Projections

- Short-term (1-2 years): USD 12-18 per package, premium positioning with potential promotional discounts.

- Medium-term (3-5 years): USD 10-16, driven by competitive pricing, increased manufacturing efficiencies, and expanded distribution.

- Long-term (5+ years): USD 8-12, as generics and multiple brands enter, fostering price erosion and increased consumer choice.

Regional Variations

Prices will vary significantly across different markets. Developed regions (North America, Europe, Australasia) will see higher initial prices, reflecting regulatory standards and purchasing power. Emerging markets may adopt lower price points, especially as local manufacturers develop similar extended-release formulations.

Regulatory and Market Expansion Implications

Regulatory approval in key markets, such as the U.S. and EU, will influence the drug’s pricing strategies. A positive regulatory outcome stabilizes pricing, supports marketing messages, and can enable premium positioning. Conversely, delays or additional compliance costs can impact initial pricing and market rollout.

Expansion into prescription territory could increase pricing due to reimbursement pathways and insurance coverage but may also encounter more rigorous pricing pressures from payers.

Key Takeaways

- The 12HR Nasal Decongestant ER is positioned within a growing OTC segment emphasizing convenience and extended relief.

- Competitive pricing is anticipated to range from USD 12-18 per package at launch, with downward trends projected over multiple years.

- Market penetration strategies should focus on differentiation through efficacy, safety, and patient adherence benefits.

- Regulatory approvals and clinical validation are pivotal; their timing and outcomes will significantly influence pricing and market share.

- Price sensitivity varies regionally, with premium pricing favored in developed markets and aggressive pricing necessary for emerging markets.

FAQs

1. How does the 12HR Nasal Decongestant ER differ from existing OTC decongestants?

It offers a sustained 12-hour relief compared to standard formulations that typically last 4-6 hours, reducing dosing frequency and improving compliance.

2. What factors influence the initial pricing of the 12HR ER formulation?

Development costs, manufacturing complexity, regulatory approval status, market positioning, and competitive landscape primarily determine initial pricing.

3. Will the price of 12HR Nasal Decongestant ER decrease over time?

Yes. As production scales, competitors enter the market, and patent protections end, prices are likely to decline, making the product more accessible.

4. How does regulatory approval impact market price and adoption?

Positive approval enables marketing claims, consumer trust, and potential reimbursement arrangements, supporting premium pricing. Conversely, delays or restrictions can constrain profitability and competitive advantage.

5. What is the potential for international markets?

High-income countries will favor premium pricing strategies initially, while emerging economies may adopt lower prices to penetrate local markets effectively.

References

[1] Market Research Future. “Nasal Decongestants Market Analysis.” 2022.

[2] U.S. Food and Drug Administration. “OTC Monographs for Nasal Decongestants.” 2021.

[3] IBISWorld. “Over-the-Counter Cold & Allergy Medications Industry Report.” 2022.

More… ↓