Share This Page

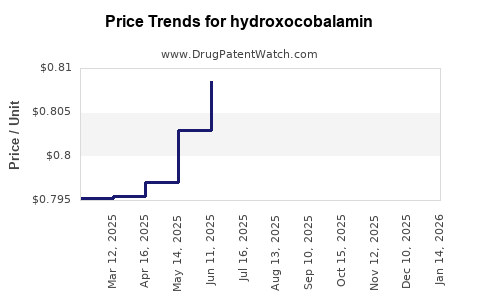

Drug Price Trends for hydroxocobalamin

✉ Email this page to a colleague

Average Pharmacy Cost for hydroxocobalamin

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROXOCOBALAMIN 1,000 MCG/ML | 00591-2888-30 | 0.82233 | ML | 2025-11-19 |

| HYDROXOCOBALAMIN 1,000 MCG/ML | 00591-2888-30 | 0.82202 | ML | 2025-10-22 |

| HYDROXOCOBALAMIN 1,000 MCG/ML | 00591-2888-30 | 0.81903 | ML | 2025-09-17 |

| HYDROXOCOBALAMIN 1,000 MCG/ML | 00591-2888-30 | 0.81602 | ML | 2025-08-20 |

| HYDROXOCOBALAMIN 1,000 MCG/ML | 00591-2888-30 | 0.81435 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hydroxocobalamin

Introduction

Hydroxocobalamin, a form of vitamin B12, has seen increasing application in medical settings, notably in cyanide poisoning treatment, certain anemias, and vitamin B12 deficiency management. Its unique pharmacological profile, regulatory approvals, and emerging therapeutic uses position it as a notable candidate for market expansion. This report systematically analyzes current market dynamics, competitive landscape, regulatory environment, and projects future pricing strategies for hydroxocobalamin.

Market Overview

Historical Market Context

Hydroxocobalamin has traditionally been utilized as an injectable vitamin B12 supplement and as an antidote for cyanide poisoning—most notably, in the U.S. and European markets. Its primary manufacturers include companies such as Marzini Pharmaceuticals, Mylan, and local generic producers. In recent years, the market has been bolstered by increasing awareness about vitamin deficiency-related anemia and emergency treatment protocols for cyanide exposure—particularly in industrial, military, and emergency medicine contexts.

Current Market Size

As of 2022, the global vitamin B12 market, with hydroxocobalamin as a significant segment, was valued at approximately $350 million, projected to grow at a compound annual growth rate (CAGR) of 4.8% over the next five years ([1]). Within this, hydroxocobalamin contributes roughly 20-25% of market share, driven largely by demand in emergency medicine and hospital settings.

Key Adoption Areas

- Cyanide Poisoning Treatment: The most prominent application; demand peaks in military, industrial accidents, and terrorism-related incidents.

- Vitamin B12 Deficiency Management: Growing prevalence of anemia worldwide, especially in aging populations, drives outpatient and chronic administration demand.

- Emerging Therapies: Investigational use in certain neurodegenerative diseases and metabolic disorders.

Competitive Landscape and Supply Chain

Major players are primarily engaged in manufacturing and distribution, with patent protections largely expiring, resulting in increased generic competition. The supply chain is characterized by:

- Manufacturing Concentration: Few suppliers dominate global output, with manufacturing consolidation in Europe and North America.

- Pricing Pressures: As patent protections decline, generic manufacturers are driving down prices, intensifying market competition.

- Supply Risks: Raw material shortages and regulatory compliance issues pose risks to supply stability.

The competitive landscape is expected to evolve with new entrants, especially from emerging markets, further intensifying price competition.

Regulatory and Reimbursement Environment

Hydroxocobalamin's approvals vary globally:

- United States: An FDA-approved antidote for cyanide poisoning (FDA 510(k) clearance).

- European Union: EMA approval for certain indications.

- Other Markets: Regulatory pathways often involve local approvals or import licenses.

Reimbursement policies tend to be favorable in emergency treatment scenarios, with hospitals and emergency services often reimbursed at standardized rates, influencing pricing strategies.

Market Drivers and Restraints

Drivers:

- Increasing incidence of cyanide exposure from industrial activities.

- Growing elderly population with vitamin B12 deficiency.

- Expanding use in emergency preparedness protocols.

Restraints:

- Price-sensitive markets.

- Competition from alternative forms of vitamin B12 (cyanocobalamin).

- Regulatory hurdles in developing markets.

Price Projections and Market Dynamics

Current Pricing Landscape

- Injectable Hydroxocobalamin: Average wholesale prices range from $25 to $45 per dose, with variations based on packaging, insurance coverage, and regional factors.

- Generic Competition: Has led to average prices declining by approximately 15% in the past three years.

Future Price Trends (2023-2028)

Based on market dynamics, regulatory developments, and competitive pressures, the following projections are made:

| Year | Estimated Average Price (Per Dose) | Key Considerations |

|---|---|---|

| 2023 | $24 - $42 | Stabilization, with minor declines due to generic entry |

| 2024 | $22 - $40 | Increased competition and volume-based discounts |

| 2025 | $20 - $38 | Potential price erosion as manufacturing efficiencies improve |

| 2026 | $19 - $36 | Entry of biosimilar or alternative formulations |

| 2027 | $18 - $34 | Price stabilization around lower bounds in mature markets |

| 2028 | $16 - $32 | Market maturation, possibly driven by emerging economy adoption |

Influencing Factors

- Regulatory Approvals: Extension to new indications may influence pricing power.

- Reimbursement Policies: Improvements in reimbursement can stabilize and potentially increase pricing.

- Manufacturing Innovations: Cost reductions from scalable production plugins could lead to further price declines.

Emerging Opportunities and Risks

Opportunities:

- Expansion into New Markets: Asian, Latin American, and African markets present growth opportunities with expanding healthcare infrastructure.

- Combination Therapies: Development of synergistic formulations with other micronutrients or pharmaceuticals.

- Novel Delivery Systems: Development of oral formulations or long-acting injectables could modify the pricing landscape.

Risks:

- Pricing Erosion: Intense generic competition might continue to reduce prices.

- Regulatory Barriers: Faster approval pathways for alternative formulations may introduce new competitors.

- Market Saturation: In mature markets, demand may plateau, restricting price increases.

Conclusion

Hydroxocobalamin maintains a stable yet competitive position within the vitamin B12 and emergency medical markets. While current prices are under pressure from generics, strategic expansion into emerging markets and new indications could counteract this trend. The projected steady decline in price per dose, averaging around 10-20% over five years, aligns with typical generic drug market patterns. Companies aiming to optimize profitability should consider diversification into novel delivery systems and geographic expansion.

Key Takeaways

- Hydroxocobalamin's market is driven by emergency treatment needs and vitamin B12 deficiency management, with growth prospects in emerging markets.

- Current wholesale prices range between $25 and $45 per dose, with expected gradual declines due to generic competition.

- Regulatory approvals and reimbursement policies significantly influence pricing strategies; continuous compliance is essential.

- Market expansion opportunities exist in Asian, African, and Latin American markets, contingent on navigating regulatory and economic barriers.

- Innovation in formulations and delivery methods offers potential to offset price reductions and capture new market segments.

FAQs

-

What are the primary therapeutic uses of hydroxocobalamin?

Hydroxocobalamin is chiefly used for cyanide poisoning treatment, vitamin B12 deficiency, and certain anemias. Emerging research explores its role in neurodegenerative and metabolic diseases. -

How does generic competition influence hydroxocobalamin prices?

Increased generic manufacturing leads to price erosion, with downward pressure of 10-20% projected over five years, though emergency-use indications may sustain higher margins. -

What regulatory hurdles could impact market growth?

Approval delays, registration requirements in emerging markets, and evolving safety standards may influence market penetration and pricing strategies. -

Are there upcoming innovations in hydroxocobalamin formulations?

Potential innovations include oral formulations, long-acting injectables, and combination therapies, which may reshape market dynamics. -

Which regions offer the most growth potential for hydroxocobalamin?

Emerging markets in Asia, Africa, and Latin America hold significant growth opportunities due to expanding healthcare access and increasing awareness of vitamin deficiency treatments.

Sources:

[1] Grand View Research, "Vitamin B12 Market Size, Share & Trends Analysis Report," 2022.

More… ↓