Last updated: July 27, 2025

Introduction

Hydrocortisone, a potent synthetic corticosteroid, has long been a foundational agent in managing inflammatory, allergic, and autoimmune conditions. Its broad therapeutic profile, coupled with extensive patent and formulation history, has cemented its presence in both prescription and over-the-counter (OTC) markets globally. This article provides an in-depth market analysis and price projection outlook for hydrocortisone, factoring in manufacturing trends, regulatory environments, competitive dynamics, and emerging market forces.

Market Overview

Global Market Size and Growth Dynamics

The global hydrocortisone market was valued at approximately USD 1.2 billion in 2022, with forecasts indicating a compound annual growth rate (CAGR) of around 4.5% through 2030 [1]. This growth trajectory hinges on several intertwined factors:

- Expanding incidence of inflammatory skin conditions, allergies, and autoimmune diseases.

- Increasing prescription of corticosteroid therapies.

- Growing availability of OTC hydrocortisone formulations, especially in emerging markets.

- Rising healthcare access and awareness.

Regional Market Breakdown

- North America: Dominates with over 40% market share, driven by robust healthcare infrastructure, high prevalence of dermatological and inflammatory disorders, and favorable regulatory policies for OTC products.

- Europe: Accounts for approximately 25%, benefiting from advanced healthcare systems and increasing use of topical corticosteroids.

- Asia-Pacific: Demonstrates the highest CAGR (around 6%), fueled by expanding consumer healthcare markets, urbanization, and rising autoimmune disorder prevalence.

- Rest of World: Latin America, Middle East, and Africa collectively represent growing segments with increasing market penetration.

Key Drivers and Constraints

Drivers

- Expanding Therapeutic Applications: Hydrocortisone's versatile use in topical, oral, and injectable formulations keeps demand stable and growing.

- Increased OTC Availability: Many jurisdictions permit OTC sales for low-potency hydrocortisone creams, elevating accessibility.

- Generic Market Expansion: Patent expirations have fostered generic competition, reducing prices and broadening market reach.

- Aging Population and Chronic Conditions: The prevalence of conditions like eczema, psoriasis, and arthritis increases overall consumption.

Constraints

- Regulatory Hurdles: Stringent approval processes, especially for new formulations or delivery systems.

- Pricing Pressures: Price competition among generics and market saturation limit pricing power.

- Alternative Therapies: Development of non-steroidal anti-inflammatory agents and biologics could curtail hydrocortisone demand in certain indications.

- Safety Concerns: Potential side effects associated with systemic corticosteroid use necessitate cautious prescription, impacting therapeutic expansion.

Competitive Landscape

The hydrocortisone market is highly fragmented, with numerous global and regional players. Key players include:

- Pfizer Inc. – Offers prescribed formulations with strong brand recognition.

- Teva Pharmaceutical Industries Ltd. – Prominent in generic hydrocortisone products.

- Mylan (now part of Viatris) – Large-scale producer of OTC and prescription forms.

- Sandoz (Novartis) – Focused on dermatology formulations.

- Local manufacturers: Especially in emerging markets, significantly contribute to market volume.

Patent expirations in recent years have amplified generic prevalence, exerting downward pressure on prices but increasing volume sales.

Pricing Dynamics

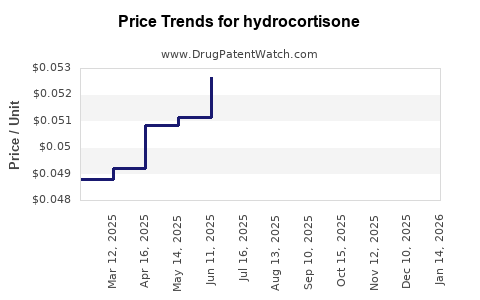

Historical Pricing Trends

Hydrocortisone prices have experienced a marked decline over the past decade due to generic competition. According to pharmacy price indices, topical hydrocortisone creams (1%) have fallen by approximately 60% globally since 2012 [2].

Current Price Range

- OTC Topical Hydrocortisone (1%): USD 0.10 – 0.25 per gram in mature markets.

- Prescription Formulations: USD 2 – 10 per dose, depending on strength, formulation, and packaging distribution channels.

- Injectable Hydrocortisone: USD 0.50 – 2.00 per vial, with pricing varying by region.

Price Influencing Factors

- Formulation and Strength: Higher potency formulations command premium prices.

- Packaging and Delivery Systems: Innovations in delivery (e.g., foam, gel, or patch) influence prices.

- Regulatory Approvals and Market Entry Barriers: Stringent approval processes may sustain higher prices initially.

- Market Penetration and Competition: Increased generic competition steadily drives prices downward.

Future Price Projections

Considering current trends, the following projections are anticipated for 2025 and 2030:

2025 Predictions

- OTC Topical Hydrocortisone (1%): Price decline of approximately 10–15% from 2022 levels, reaching USD 0.085 – 0.20 per gram.

- Prescription Hydrocortisone: Slight price decreases of 5–10%, averaging USD 1.80 – 9 per dose.

- Injectable Formulation: Marginal decrease, approximately 5%, due to limited generic competition.

2030 Predictions

- OTC Topical Formulations: Stabilization at near current levels, possibly declining marginally further (around 5%), thanks to saturation.

- Prescription Market: Prices likely to decrease by 10–15%, but potential premiumization of specialized formulations could sustain higher price points.

- Emerging Market Dynamics: Price reductions accelerated by increased local generic manufacturing and government policy interventions.

Influencing Factors on Projections

- The rate of generic market penetration.

- Adoption of biosimilar and novel formulations.

- Regulatory initiatives aimed at price controls.

- Healthcare reimbursement policies favoring affordability.

- Potential patent extensions or new formulation patents.

Regulatory and Patent Landscape

Hydrocortisone, being a centuries-old compound, resides largely in the public domain. However, formulation patents, delivery system innovations, and combination therapies confer strategic patent protections. Generic manufacturers escalating production capacity and filing for approval in emerging markets continue to shape the competitive environment, compelling core brand products to adapt pricing strategies.

Emerging Trends and Opportunities

- Novel Delivery Systems: Liposomal, nanoemulsion-based, or transdermal patches may command premium prices, potentially shifting the price landscape.

- Combination Products: Hydrocortisone combined with other agents may create niche markets with distinct pricing.

- Biosimilars and Biologics: Although less relevant for hydrocortisone itself, adjacent corticosteroid innovations could influence overall corticosteroid utilization patterns.

- Digital and Telehealth Integration: Improvements in formulary placement and dosing adherence may impact demand and, consequently, pricing strategies.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost-effective production, formulation innovation, and geographic expansion, especially in emerging markets.

- Investors: Monitor patent expiry timelines, regional regulatory changes, and emerging formulations to assess valuation and market entry risks.

- Healthcare Policymakers: Balance affordability with innovation incentives to sustain supply and access.

Key Takeaways

- The hydrocortisone market exhibits steady, moderate growth driven by broad therapeutic use and geographic expansion.

- Fierce generic competition has historically lowered prices, a trend expected to continue, with some stabilization due to formulation innovations.

- Emerging markets present significant growth opportunities, with prices predicted to decline further as local manufacturing scales.

- Regulatory and patent landscapes remain crucial in shaping future pricing, especially concerning novel delivery systems.

- Stakeholders should align strategies with technological trends and regional market dynamics to optimize value.

FAQs

1. How does patent expiration influence hydrocortisone pricing globally?

Patent expirations have increased generic entry, intensifying competition and driving prices downward, particularly in mature markets where regulatory approvals for generics are streamlined.

2. What are the primary factors impacting hydrocortisone price stability?

Market competition, formulation innovations, regulatory policies, and manufacturing costs are the main drivers influencing stability and trends in hydrocortisone pricing.

3. Are there risks of price surges in upcoming years?

Price surges are unlikely in saturated markets but may occur with the introduction of new formulations or delivery systems that can command premium pricing, especially in niche therapeutic areas.

4. How will emerging markets affect hydrocortisone price trends?

Increased local manufacturing, regulatory reforms, and higher acceptance of OTC products are likely to accelerate price reductions and expand access.

5. What role do clinical developments play in hydrocortisone market pricing?

Innovations that enhance efficacy or reduce side effects may allow for premium pricing and market differentiation, supporting higher price points for specialized formulations.

References

[1] MarketWatch, "Hydrocortisone Market Size, Share & Forecast," 2022.

[2] IQVIA, "Global Prescription Drug Price Trends," 2022.