Last updated: July 27, 2025

Introduction

Guaifenesin, a widely used expectorant, is foundational in managing cough and mucus expectoration. It is incorporated into many over-the-counter (OTC) formulations globally, often combined with other respiratory agents. The sustained demand for cough remedies, combined with its status as a generic compound, influences both market dynamics and pricing strategies. This report provides a comprehensive analysis of the current market landscape and offers price projections grounded in industry trends, competitive positioning, regulatory factors, and macroeconomic considerations.

Market Landscape Overview

Global Market Size and Growth Trajectory

The global expectorants market, driven chiefly by Guaifenesin, was valued at approximately USD 1.2 billion in 2022 and is projected to reach around USD 1.6 billion by 2030, registering a Compound Annual Growth Rate (CAGR) of approximately 4.2% (2023-2030) [1]. Factors propelling this expansion include the persistent prevalence of respiratory illnesses, increased health awareness, and rising demand for OTC cough suppressants.

Key Regional Markets

- North America: Dominates the market with an estimated share of 40%, supported by high healthcare expenditure, OTC sales proliferation, and well-established distribution networks.

- Europe: Accounts for roughly 25%, with growth driven by aging populations and regulatory support for OTC medicines.

- Asia-Pacific: Exhibits the fastest growth segment (CAGR ~5.8%), driven by increasing urbanization, rising income levels, and growing awareness of respiratory health.

- Latin America and MEA: Show moderate growth prospects, anchored by market expansion and evolving healthcare infrastructure.

Market Participants and Competitive Dynamics

Guaifenesin production is highly commoditized, with numerous generic manufacturers competing on price, quality, and supply reliability. Major players include:

- GSK (SmithKline Beecham)

- Sun Pharmaceutical Industries

- Pfizer

- Meda Pharmaceuticals (a subsidiary of Mylan)

- Local and regional manufacturers in emerging markets.

Innovations surrounding formulations — such as sustained-release tablets or combination products — influence competitive positioning but do not significantly alter the core in terms of API pricing due to widespread patent expirations.

Pricing Dynamics

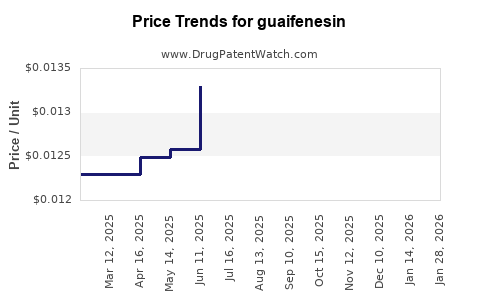

Current Pricing Trends

The cost of Guaifenesin API remains predominantly driven by production costs, raw material availability, and competitive intensity. As of 2023:

- API Price Range: US$ 15 – US$ 25 per kilogram for bulk Guaifenesin API.

- Finished Dosage Form Price: OTC tablet prices typically range from US$ 0.05 to US$ 0.20 per unit, depending on brand, packaging, and marketing.

Price sensitivity remains high in emerging markets, with governments and consumers favoring cost-effective generics.

Factors Influencing Pricing

- Raw Material Costs: Ephedrine and other precursor chemicals influence API prices and can fluctuate based on regulatory controls and supply chain shifts.

- Manufacturing Scale & Efficiency: Large-scale producers benefit from economies of scale, reducing unit costs and enabling competitive pricing.

- Regulatory & Quality Standards: Compliance with Good Manufacturing Practice (GMP) can elevate costs but ensures market acceptance, especially in jurisdictions with strict standards.

Regulatory Impact

While Guaifenesin is generally classified as aphanacid, regulatory agencies like the FDA and EMA impose stringent standards that can influence product pricing through compliance costs. The expiration of key patents has further driven market entry by generics, intensifying price competition.

Market Drivers and Challenges

Drivers:

- Rising Incidence of Respiratory Diseases: Common colds, bronchitis, and influenza sustain demand.

- OTC Accessibility: Ease of purchase supports sustained sales.

- Growing Awareness of OTC Options: Demographic shifts towards self-medication favor the product.

Challenges:

- Market Saturation: Especially in developed regions.

- Pricing Pressures: Increasing competition dampens margins.

- Regulatory Barriers: Stringent standards in some countries may hinder market entry or increase costs.

Price Projection Outlook (2024-2030)

Given industry trends, the following projections are reasonable:

- API Pricing: Slight downward pressure anticipated due to continuous generic manufacturing and raw material cost stabilization. API prices are forecasted to decrease marginally to the range of US$ 13 – US$ 22 per kilogram by 2030.

- Finished Product Pricing: Market saturation and couponing could lead to a slight decline or stabilization of tablet prices, remaining largely in the range of US$ 0.04 – US$ 0.18 per unit.

- Premium Formulations & Combinations: Potential premium pricing for combination drugs may maintain higher margins but will not significantly influence pure Guaifenesin pricing.

Impact of Emerging Markets and Supply Chain Dynamics

Emerging markets will likely see greater price competition, impacting overall pricing. Supply chain disruptions, such as those experienced during the COVID-19 pandemic, have caused temporary fluctuations but are expected to stabilize, with long-term effects minimal on core API prices.

Conclusion

The Guaifenesin market's outlook remains stable with moderate growth driven by global respiratory illness prevalence and OTC demand. Price sustainability and competitiveness hinge on manufacturing efficiencies and raw material costs. API prices are expected to trend marginally downward by 2030, reflecting ongoing generic competition, while finished product prices will remain sensitive to regional market dynamics.

Key Takeaways

- The global Guaifenesin market is projected to grow at a CAGR of approximately 4.2%, reaching USD 1.6 billion by 2030.

- API prices are anticipated to decline gradually, stabilizing around US$ 13–22 per kilogram by 2030.

- Market saturation in developed regions limits significant price escalation, with emerging markets offering growth opportunities at competitive prices.

- Competitive manufacturing costs, raw material supply, and regulatory compliance are primary determinants of API and formulation pricing.

- Strategic focus on supply chain resilience and formulation innovation can sustain profitability amid competitive pressures.

Frequently Asked Questions

1. What factors influence the price of Guaifenesin API?

Raw material costs, manufacturing scale, regulatory compliance, supply chain stability, and competitive pricing strategies primarily influence API prices.

2. How does patent expiration affect Guaifenesin market prices?

Patent expirations lead to increased generic manufacturing, intensifying competition and exerting downward pressure on prices.

3. Are there regional differences in Guaifenesin pricing?

Yes. Developed markets tend to have higher prices due to regulatory standards and branding, while emerging markets favor lower-cost generics.

4. What are the growth prospects for Guaifenesin in the coming years?

Moderate growth is expected, driven by rising respiratory illnesses, OTC availability, and expanding markets in Asia-Pacific and Latin America.

5. How might supply chain disruptions impact future Guaifenesin prices?

Short-term disruptions could temporarily increase costs, but long-term prices are expected to stabilize due to supply chain adaptations and diversified sourcing.

References

- Market Research Future. “Expectorants Market Report - Forecast to 2030,” 2023.

- Transparency Market Research. “Global Guaifenesin Market Analysis,” 2022.

- IQVIA. “Global OTC Medicine Trends,” 2022.