Last updated: July 27, 2025

Introduction

Glipizide, a second-generation sulfonylurea, remains an integral component in managing Type 2 diabetes mellitus (T2DM). Approved by the U.S. Food and Drug Administration (FDA) in 1984, glipizide works by stimulating pancreatic beta-cell insulin secretion, thereby reducing blood glucose levels. Despite the advent of newer antidiabetic agents, glipizide maintains a significant presence in global pharmaceutical markets, attributed to its cost-effectiveness and established efficacy. This analysis dissects current market dynamics, assesses potential growth factors, and develops price projections over the next five years.

Market Overview

Global Market Size and Growth Drivers

The global antidiabetic drug market was valued at approximately USD 62.84 billion in 2021 and is projected to expand at a Compound Annual Growth Rate (CAGR) of around 7% through 2028 [1]. Glipizide's market share remains substantial within the sulfonylurea class, primarily driven by its affordability, generic availability, and widespread prescribing habits, especially in emerging markets where healthcare affordability is paramount.

The increasing prevalence of T2DM, projected to reach 700 million globally by 2045 [2], sustains demand for cost-effective medications like glipizide. Additionally, healthcare systems in low- and middle-income countries favor older, established medications, bolstering glipizide’s market presence.

Regional Market Dynamics

-

North America: Regulatory scrutiny and the shift towards newer agents with lower hypoglycemia risk have slightly tempered glipizide's growth. Nevertheless, its affordability sustains a stable market share, especially among uninsured or underinsured populations.

-

Europe: Similar trends as North America; however, stricter guidelines for sulfonylureas' usage limit market penetration.

-

Asia-Pacific: Rapid economic growth, increasing T2DM incidence, and healthcare infrastructure development drive considerable demand for affordable therapies like glipizide.

-

Latin America and Africa: Heavy reliance on generics sustains high consumption levels. Price sensitivity is high in these regions, favoring continuation of glipizide use.

Competitive Landscape

The competitive landscape features generic pharmaceutical manufacturers dominating the market, with brand-name drugs like Amaryl (glimepiride) serving as upscale options. Key players producing glipizide include Teva Pharmaceuticals, Mylan, and Sun Pharmaceutical Industries, among others. The entry barriers are low due to the availability of manufacturing processes, reinforcing price competition and commoditization.

Market Challenges

-

Safety Concerns: Sulfonylureas, including glipizide, are associated with hypoglycemia and weight gain, prompting clinicians to consider alternative therapies.

-

Regulatory Shifts: Evolving guidelines favor newer medications with improved safety profiles (e.g., GLP-1 receptor agonists, SGLT2 inhibitors), potentially constraining long-term growth.

-

Patent Landscape: As patents expire, significant price erosion is anticipated; however, since glipizide's patents long expired (since the late 1980s to early 1990s), generic competition maintains a depressed price trend.

Market Trends and Future Outlook

Therapeutic Evolution

While newer agents are gaining traction, glipizide remains relevant due to:

- Its proven efficacy.

- Cost considerations in resource-limited settings.

- Existing infrastructure for generic production.

The transition towards personalized medicine and combination therapies might influence its usage but will not eliminate the demand in lower-income regions.

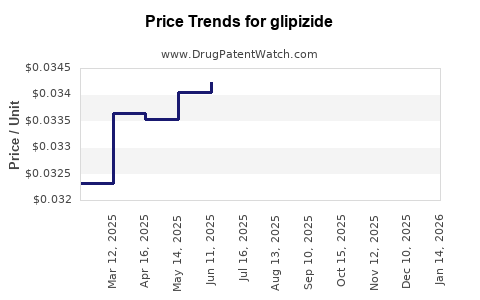

Pricing Trends

Historical data reflects a steady decline in per-unit prices as patents expired and generics entered markets. In the US, a standard 30-count 5mg tablet of glipizide costs approximately USD 4-8 at retail pharmacies, equating to roughly USD 0.13-0.27 per tablet [3].

In emerging markets, prices are significantly lower, often below USD 0.05 per tablet. The primary price drivers are manufacturing costs, regulatory barriers, and market competition.

Price Projections (2023-2028)

Based on current trends, the following projections consider factors such as generic market saturation, regulatory influences, and regional demand gradients:

| Year |

Estimated Average Price per Tablet (USD) |

Rationale |

| 2023 |

USD 0.05 - 0.07 |

Continued generic competition and manufacturing efficiencies. |

| 2024 |

USD 0.045 - 0.065 |

Potential price pressures from increased competition. |

| 2025 |

USD 0.04 - 0.06 |

Market saturation; slight consolidation among manufacturers. |

| 2026 |

USD 0.035 - 0.055 |

Regulatory pressures and economies of scale reduce prices further. |

| 2027 |

USD 0.03 - 0.05 |

Ongoing commoditization, especially in emerging markets. |

| 2028 |

USD 0.025 - 0.045 |

Possible regional price reductions; global generic trends persist. |

Note: Prices are projected for a standard 5mg tablet in USD and may vary by region.

Implications for Stakeholders

- Manufacturers: Cost advantages are critical. Focus on scaling production to capitalize on declining price margins.

- Payers and Healthcare Systems: Favor affordability; policies promoting generic use can drive savings.

- Pharmaceutical Distributors: High-volume, low-margin sales are expected; efficient logistics optimize profitability.

- Patients: Cost reductions improve access, especially in underserved regions, supporting adherence.

Conclusion

Despite evolving therapeutic landscapes, glipizide remains a cost-effective alternative within the T2DM treatment paradigm, particularly in resource-constrained settings. The prevailing market trends suggest a continued decrease in unit prices driven by generic manufacturing, with minimal risk of obsolescence. However, long-term demand may be moderated by shifts toward newer, safer agents, particularly in high-income regions.

Strategic emphasis on low-cost manufacturing, regional market expansion, and regulatory navigation will be essential for stakeholders seeking to optimize market share and profitability in the coming years.

Key Takeaways

- The global glipizide market is characterized by robust generic production and declining prices, especially outside the U.S. and Europe.

- The predominant demand stems from emerging markets where affordability is crucial.

- Price projections indicate a continued downward trend, reaching approximately USD 0.025-0.045 per tablet by 2028.

- Market growth remains steady driven by increasing T2DM prevalence, though growth rates may be tempered by safety and safety concerns.

- Stakeholders must adapt to competitive pressures and evolving clinical guidelines to sustain relevance.

FAQs

1. How does the patent landscape influence glipizide prices?

Since glipizide's patents expired decades ago, it faces intense generic competition, leading to significant price erosion and market saturation.

2. Are there safety concerns that could impact glipizide demand?

Yes. Risks of hypoglycemia and weight gain have prompted clinicians to consider newer agents, especially in high-income countries, potentially limiting future growth.

3. In which regions is glipizide most widely used?

It is most prevalent in low- and middle-income regions, including parts of Asia, Africa, and Latin America, where affordability is prioritized.

4. How does the lower cost of glipizide compare to newer antidiabetic drugs?

While newer agents often cost several times more, glipizide maintains a fraction of these costs, making it a preferred choice in resource-limited settings.

5. What factors could disrupt the current price trend?

Introduction of new safety or efficacy data, regulatory changes, or significant innovations in alternative therapies could alter market dynamics and pricing patterns.

Sources:

[1] Grand View Research. (2022). Diabetes Drugs Market Size & Trends.

[2] International Diabetes Federation. (2019). IDF Diabetes Atlas 9th Edition.

[3] GoodRx. (2023). Average Prices for Glipizide.